The stock market is currently experiencing a lot of volatility due to the constant rate hikes that being implemented. This means that the value of stocks is fluctuating rapidly, making it difficult for investors to predict what will happen next. As a result, many investors are turning their attention to other investment options that are less affected by this volatility & gives increasing returns.

One such option is the Bond market, which has become increasingly attractive to investors in recent times as repo rates hiked day by day. Some NBFCs & Banks offering as high as 9 to 9.5 % return, and peer to peer lender offing at high of 12 % guaranteed return.

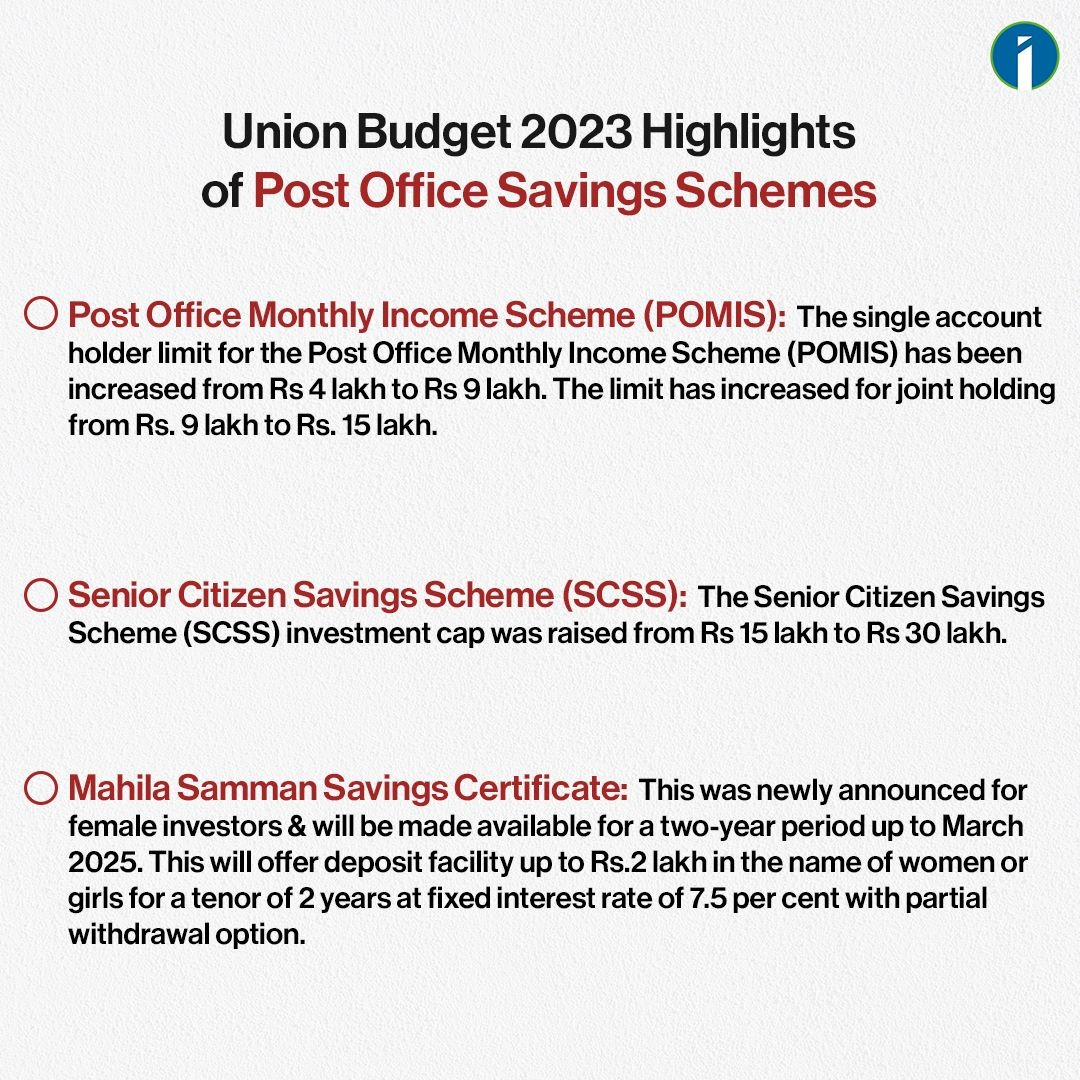

However, recent changes in tax regulations surrounding debt mutual funds have caused many investors to turn their attention to other fixed-income options, such as those provided by post offices. These options can offer attractive rates of return and stability in an uncertain market.

If you are looking for the best fixed-income options in this uncertain market, it is worth considering the post office schemes available. Post Office Savings Schemes offer a range of fixed-income options that are backed by the government and offer attractive rates of return. Today’s blog is about the best Post Office Savings Schemes for the low risk taking investors & especially for older citizens of our country.

Read this article to articulate your investment plans beforehand, taking the current scenario into consideration.

In this article, you’re going to explore:

- The concept of a Monthly Income Scheme or MIS.

- Whatis Post Office Monthly Income Scheme or POMIS, and how did it work over the years?

- Features &Benefits of POMIS

- Other Senior Citizen Savings Schemes or SCSS provided by the post office

- Comparison of POMIS with SCSS.

- Recent revised interest rate structure

- How can you start investing in it?

What are the MIS & its benefits?

Monthly Income Scheme (MIS) is a financial investment scheme offered by the Indian Post Office and banks that allow investors to earn a fixed and guaranteed rate of return on their investment. Under this scheme, investors can invest a lump sum and earn interest on a monthly basis, which is credited directly to their savings account by quarterly or monthly

The primary benefit of such a monthly income scheme is to provide a regular source of income for investors who are looking for a steady and guaranteed return on their investment. For that reason, these types of schemes are great opportunities for retirees, senior citizens, and those who are looking for a comparatively safer and more secure investment option rather than grinding over the other riskier and more volatile choices like equity market.

What are POMIS and its last five years’ interest rate assessments?

The Post Office Monthly Income Scheme (POMIS) is a highly lucrative investment option that guarantees a fixed monthly income in exchange for a certain amount of investment.

Compared to other schemes, POMIS stands out with its high-interest rate of 7.01%, making it one of the most profitable and lucrative investment options for investors. The interest earned through POMIS is disbursed every month, providing a steady and reliable source of income. One of the other plus points of POMIS is that, being backed by the government, it is always a safer option for the commoners.

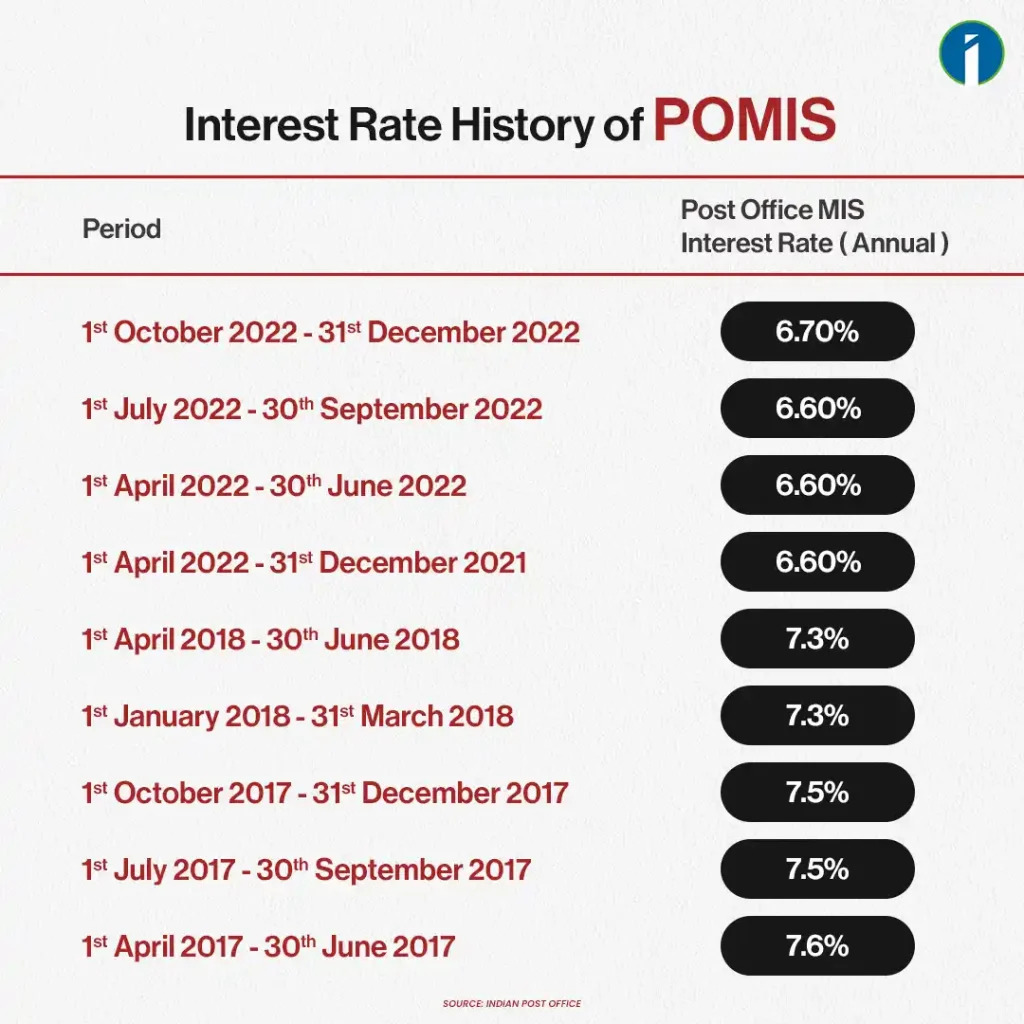

Before discussing the key features promised by POMIS, let’s have a look at its over-the-years-of-interest facilities first.

Interest Rate History of POMIS

Looking at the chart above, it is evidently visible that the interest rates of the Post Office Monthly Income Scheme have fallen straight from 7.6% to 6.7% over the span of the last 5 years, whereas the initial rate of interest was 8.4% on April 1, 2016.

Note: The POMIS interest rate for the 1st quarter of 2023, that is, from January to March, is 7.01%.

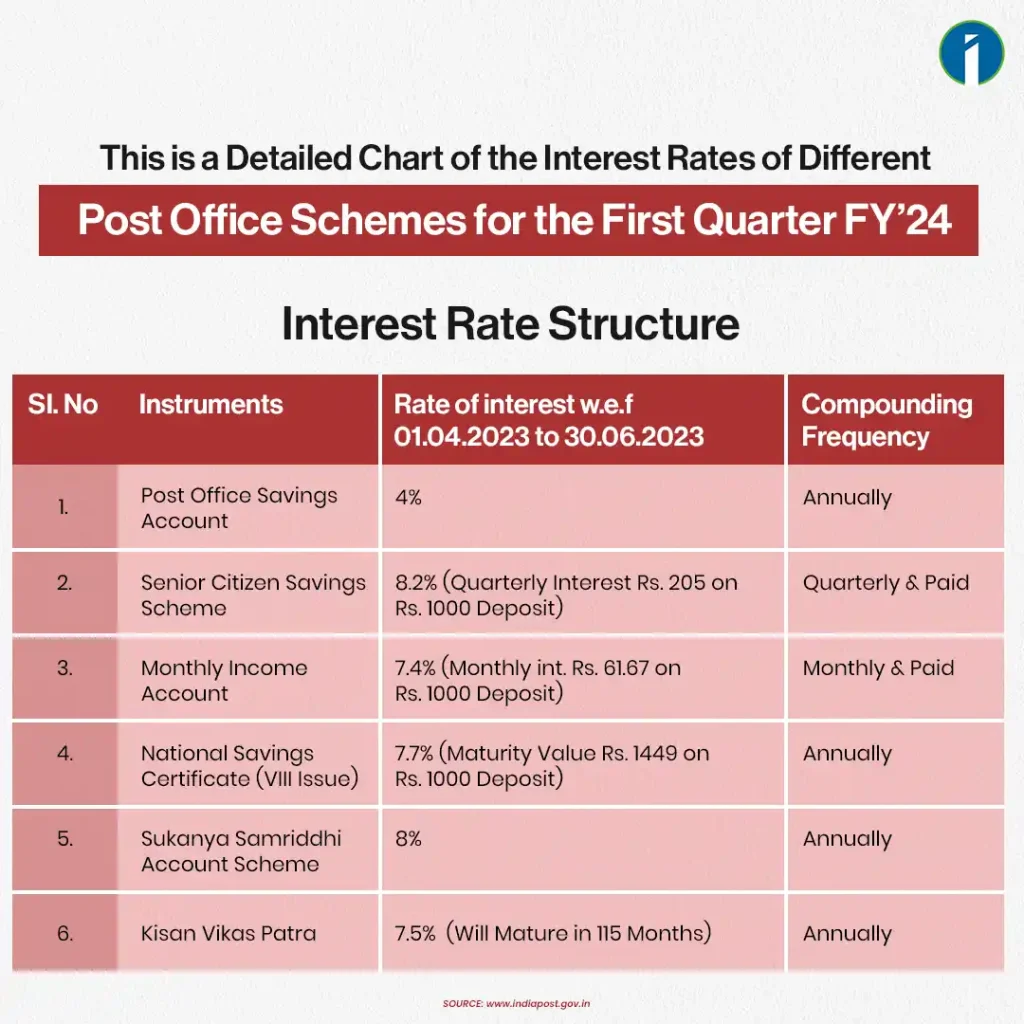

(There is a detailed chart of the interest rates of different post office schemes for the first quarter below.)

**Please keep in mind that the income generated by interest is taxable.

Features of POMIS

Lock-in period: POMIS allows its investors to hold the invested capital for a period of 5 years. The amount can only be withdrawn after it has matured or been reinvested. If, by chance, the person urgently needs the money in such a scenario, he should be obeying the penalty according to POMIS rules.

- Withdrawal within less than a year equals zero benefits.

- 1 to 3 years = the entire coupon amount will be granted to refund with the penalty amount of 2%.

- From the fourth to the fifth year: entire coupon refund minus 1% penalty.

- Hassle-free auto transactions: The investor can withdraw the interest directly from the PO to his savings account by utilizing the automatic withdrawal features of POMIS, either by PDC or ECS. But if the POMIS account is connected with a core banking solution, in such a case the withdrawal will be possible in only any CBS-centric savings account.

- Reinvestment, RD, and data changing: Post Office has recently added the recurring deposit feature to it, allowing investors to move their funds into it. Whereas they also can reinvest their funds under the same scheme for another 5 years, continuing to reap the benefits.

In case the investor intends to change their location within the country, the POMIS also allows them to change their details effortlessly while carrying forward their investments.

Benefits of POMIS

- Guaranteed capital safety: As we talked about earlier, being a government-backed institution, it always ensures the protection of investors’ money, giving it the upper hand over other banks and similar scheme providers.

- Low-risk & low-investment opportunity: POMIS provides its investor with a certain amount of income every month despite the market calamities, whereas an investor can start his financial planning with a minimum of Rs. 1000 with POMIS.

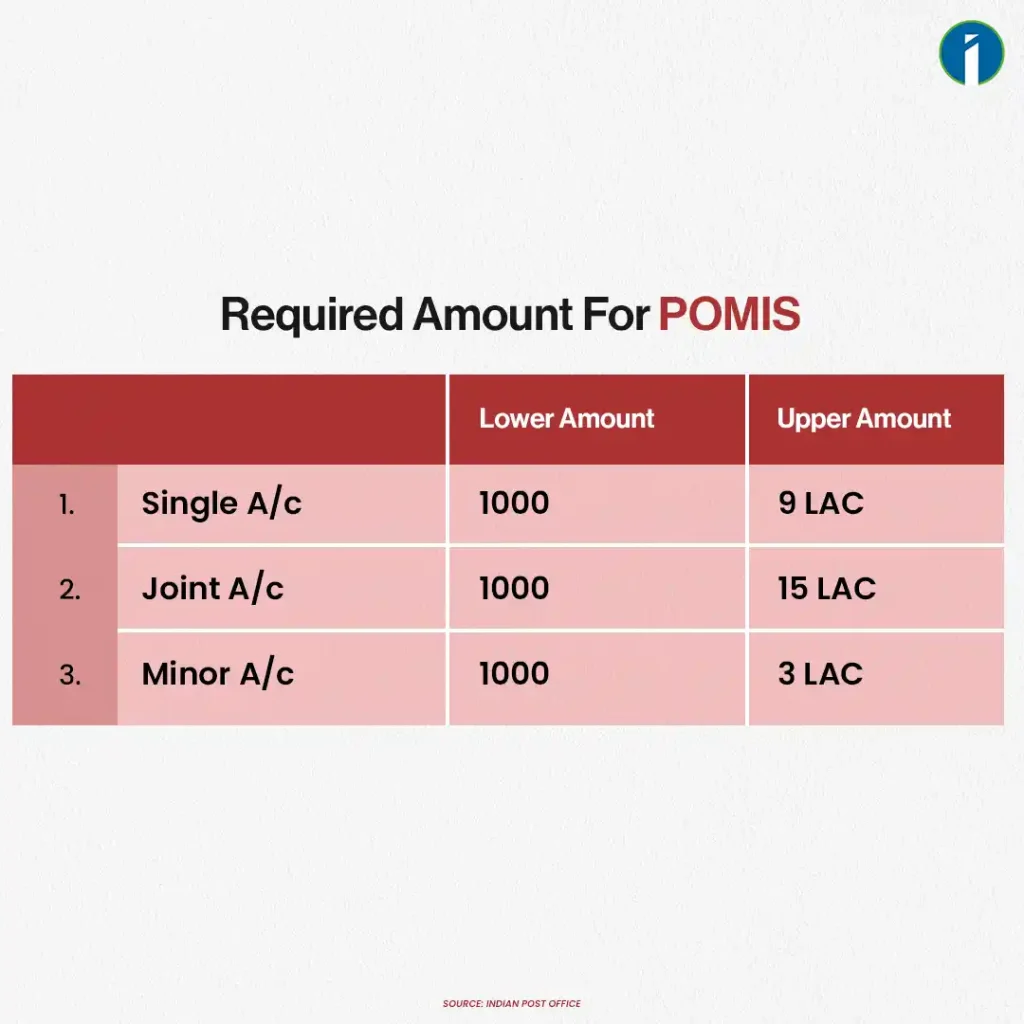

- Join account facilities: With POMIS, an investor can open a joint account with a maximum of three acquaintances. The only difference in such a case can be seen in the amount. An individual can open an account under the POMIS with only 4.5 lakhs, whereas for joint accounts, the amount will be 15 lakhs (as per the new regulations of Budget 2023).

The person will have the authority to change his account type from joint to single anytime he wants, and vice versa. - Nominee: Similarly, the person will get the nominee power to choose* any of his legal heirs or family members for them to claim the benefits in case anything unfortunate happens to him.

- Minor account benefits: POMIS allows citizens of India to open minor accounts for their children of or above the age of 10 with a maximum capital amount of Rs 3 lakh. The beneficiary will be allowed to withdraw in his name once he reaches the age of 18.

Other senior citizen saving schemes provided by the post office

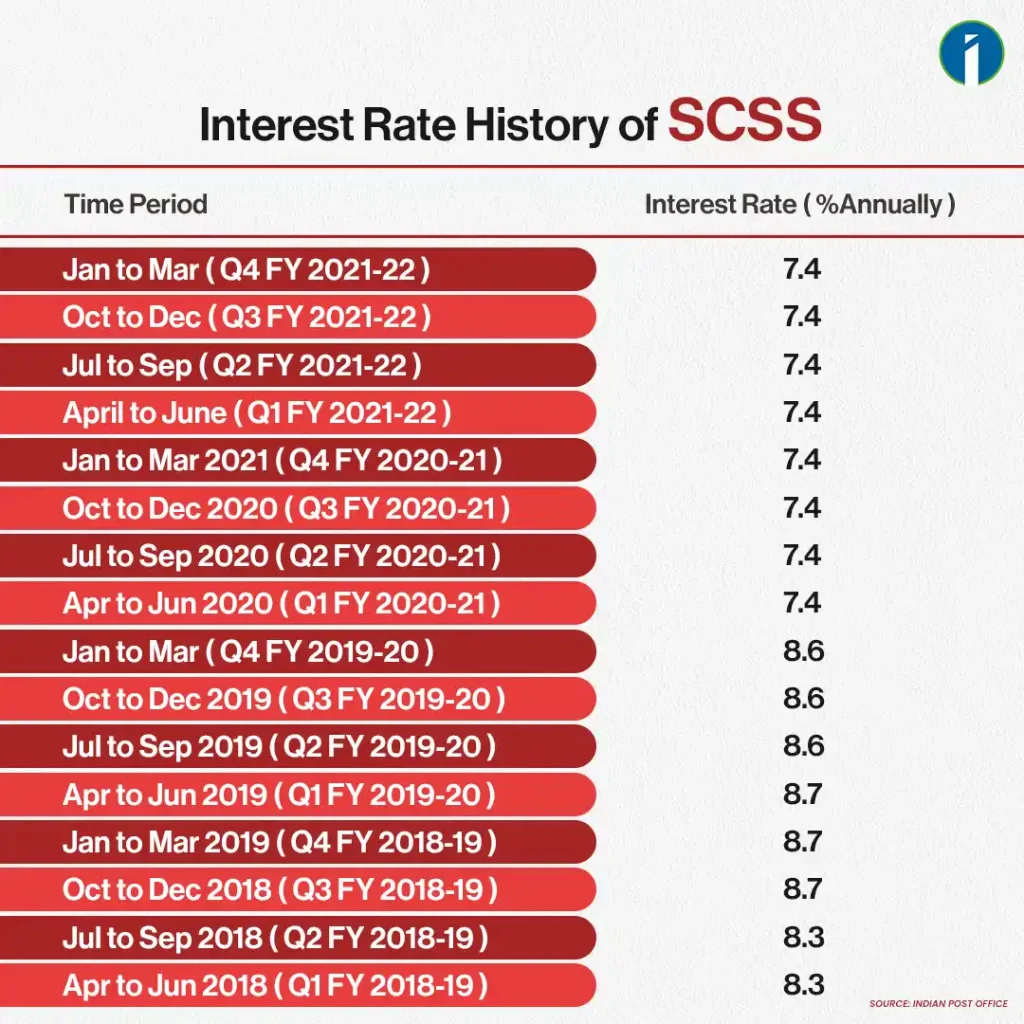

Besides POMIS, there’s another type of scheme available, named the Senior Citizen Savings Scheme (SCSS), suitable for any seniors or retirees above the age of 60 in our country.

Just like the post office monthly income scheme, SCSS’s maturity time period is 5 years, except upon maturity, the investor can opt for an extended holding for the next 3 years with the eligibility of tax breaks (we will be talking about this soon).

Below is the historical interest rate change data for SCSS over the years.

Interest Rate History of SCSS

Benefits of the Senior Citizen Savings Scheme

- Trustworthy and guaranteed returns: The Senior Citizen Savings Scheme is a trustworthy government-supported savings plan that offers a guaranteed return to senior citizens after their retirement.

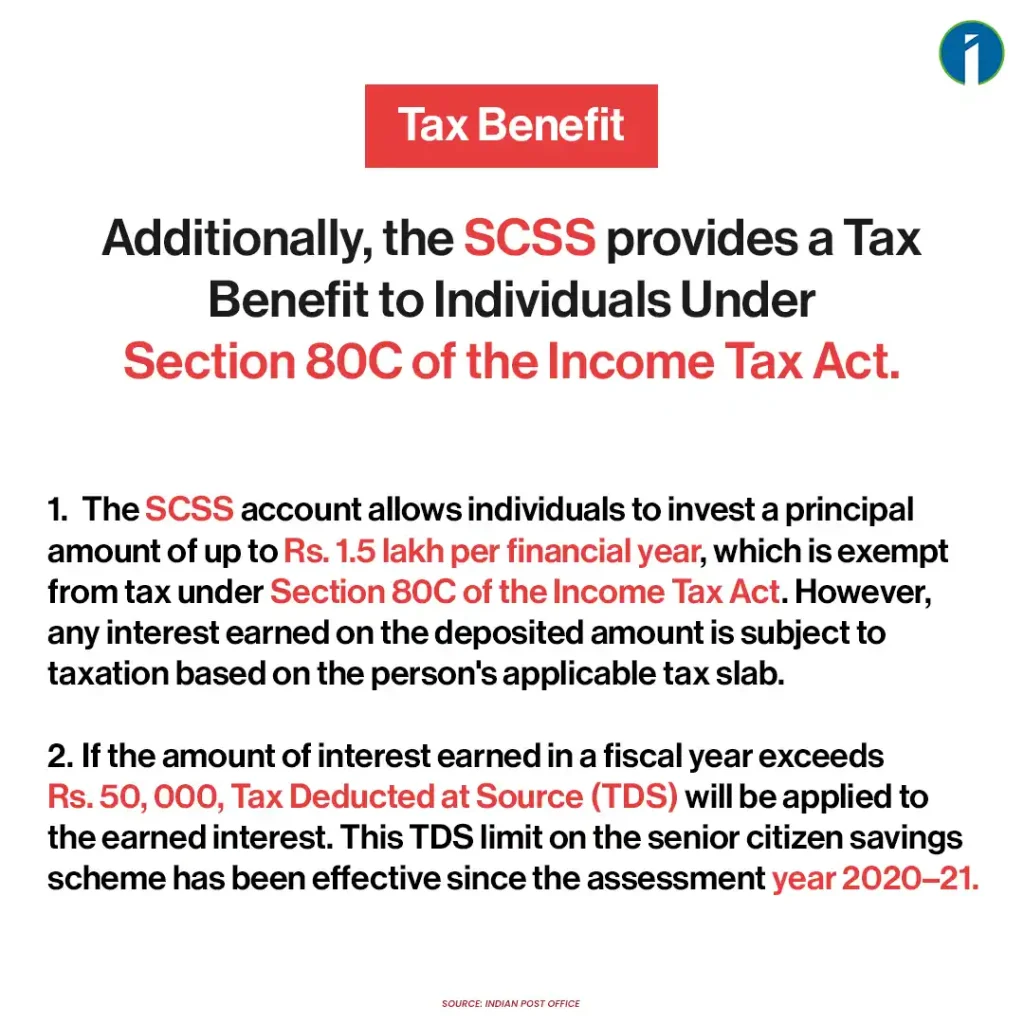

Tax benefit

Quarterly interest: The interest amount is paid out quarterly to the account holder, providing regular payouts that can be added to the investment.

- Lock-in period: In the event of a financial emergency, individuals may prematurely terminate their SCSS account and access their funds. Premature termination is applicable after completing one year from the date of account initiation, and a penalty of5% is charged if withdrawn before the completion of one year and 1% if withdrawn after two years.

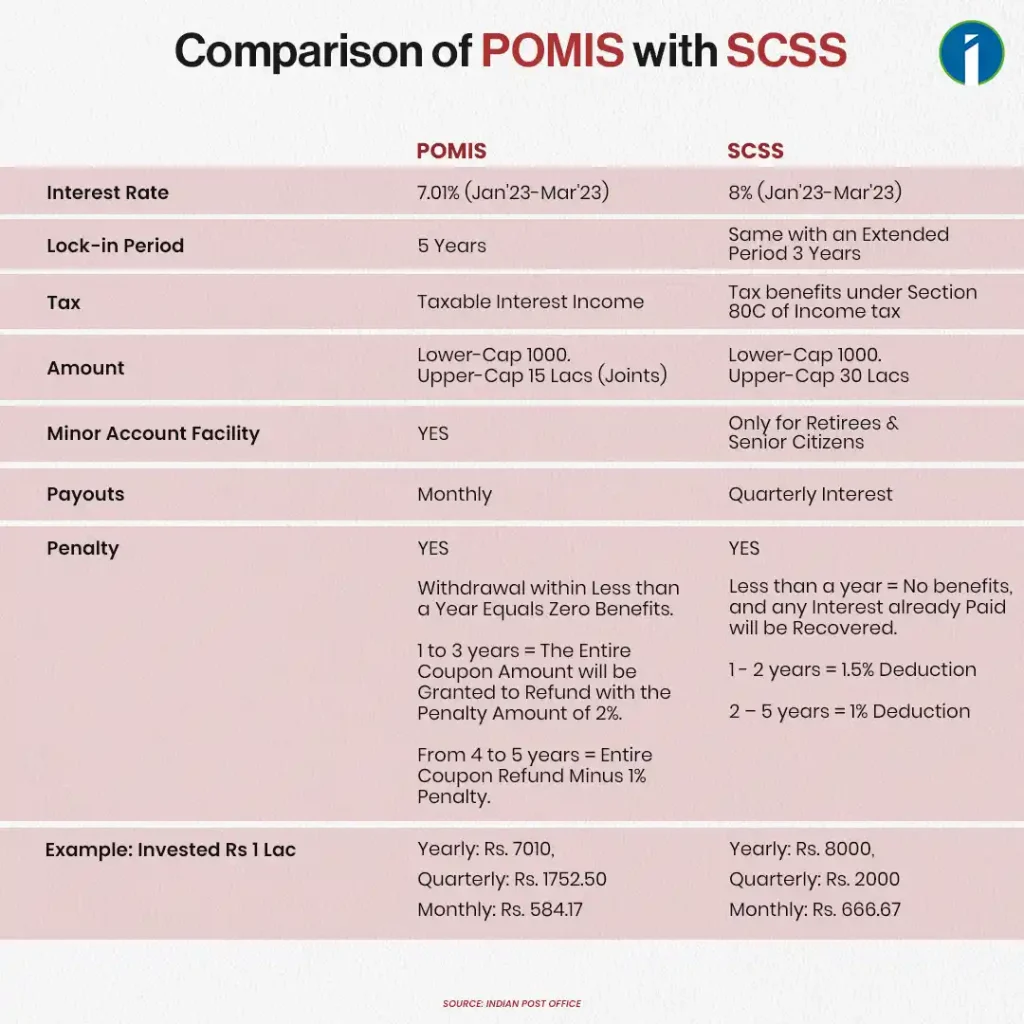

Comparison of POMIS with SCSS

This is a detailed chart of the interest rates of different post office schemes for the last quarter FY’23:

How can you start investing in POMIS?

Getting yourself enrolled in both the Monthly Income Scheme (MIS) of the Post Office and the Senior Citizens Savings Scheme of the Post Office is quite easy and uncomplicated. However, you must possess a savings account with the Post Office to invest in the scheme. If you don’t already have one, you can open a savings account with the Post Office and follow the below-mentioned steps to invest in the POMIS or SCSS account:

POMIS

- Submit the filled-up form along with a photocopy of your ID proof (PAN, passport, voter’s card, ration card, Adhaar), address proof (utility bills), and two passport-sized photographs.

- Produce the original copies of the documents mentioned above for verification purposes.

- Obtain the signatures of the beneficiaries or witnesses.

- Invest the capital amount via a dated cheque. The date specified on the cheque will be deemed the date of opening the account. The interest earned on your investment will be disbursed one month from the account opening date.

Criteria for POMIS

- The criteria for qualifying for the MIS scheme at a post office require that only individuals who are residents of India can open a POMIS account.

- This program is not available to non-resident Indians.

- Any person who has attained the age of 18 is eligible to create an account, and it is also possible to open an account on behalf of a minor who is at least 10 years old. Once a minor turns 18, they will be granted access to the funds held in the account.

- It is necessary for a minor who has reached the age of majority to request a conversion of the account into their name.

SCSS

- For SCSS, form A has to be submitted.

- Two passport-size photos.

- Identity proof

- Address proof

- Age proof (imp)

Age restrictions and conditions

✅ The account holder should be a citizen of India over 60 years old.

✅ Person with voluntary retirement or superannuation, age 55–60

✅ Retired personnel from Defence, age 50-60

✅ In SCSS, both spouses are eligible to open separate accounts at the same post office.❌ Not-eligible: HUFs and NRIs

Conclusion

As we started this article with the point of recent volatility and uncertainty in mind, it will be wise to start diversifying our investments under such governmental bodies. These are the two best schemes for the senior population of India, with the aim of providing them with the best recurring income from their savings. When two of the above-discussed schemes come with their own separate and respective pros and cons, INVESMATE is advising you to choose your best scheme thoughtfully, considering your needs and other factors.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Very informative and useful information. Thank you for such beautiful content.

Very much useful blog