Investors often use technical indicators as part of technical analysis for stock trading, which helps analyze and predict stock prices and volumes. These indicators are essential for Intraday and swing traders, as well as other types of traders.

Lagging and leading indicators are utilized in various fields, including management, economics, and finance. In this context, they refer to technical indicators. Most technical indicators fall into either the lagging or leading category.

Despite their different purposes, both types are crucial for informed trading decisions.

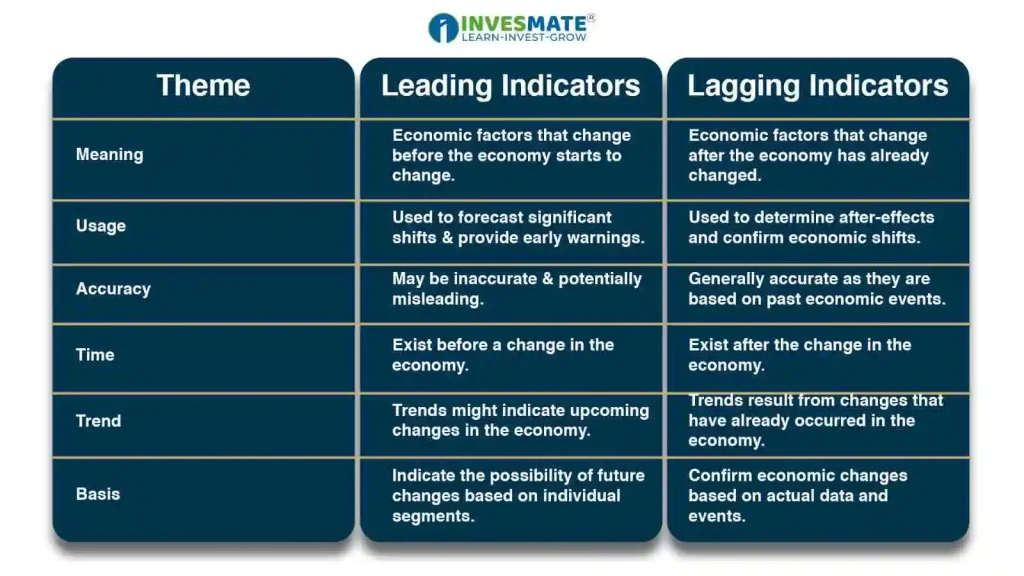

Leading Vs Lagging Indicators – Comparative Table

How Lagging Indicators are Used?

Lagging indicators typically reflect the actions of the current price. Traders use these types of indicators to confirm trends by comparing them with moving averages and stock prices.

Traders who follow trends often use lagging indicators. They analyze data using these indicators to identify the strength of stocks and to make decisions on whether to buy or sell stocks. Typically, if a moving average or another lagging indicator shows an uptrend, traders might take a long position. Conversely, if it indicates a downtrend, traders might exit their position.

However, while lagging indicators help with guidance, trading decisions depend on individual strategies.

Examples of Leading Indicators:

I. Relative Strength Index (RSI)

The RSI Oscillator measures price movements of stocks and other assets. It is considered a leading indicator because it provides early trade signals. RSI helps identify overbought and oversold conditions.

II. Stochastic Oscillator

The Stochastic Oscillator is considered one of the most accurate indicators. It compares the current closing price to its range over a specific period. It identifies overbought and oversold areas and provides early signals for trend reversals.

III. Commodity Channel Index (CCI)

The Commodity Channel Index (CCI) measures the current price level relative to the average price level over a specified period. It helps identify early trend reversals and is also used to spot bullish and bearish divergences.

Examples of Lagging Indicators

I. Moving Averages

Moving averages are lagging indicators used to determine trend direction and identify support and resistance levels. They continuously update the average price based on historical data.

II. Moving Average Convergence Divergence (MACD)

The MACD indicator shows the relationship between two moving averages of stock prices, indicating whether an uptrend or downtrend is gaining or losing strength.

III. Bollinger Bands

Bollinger Bands, which measure volatility, are created using a 20-day simple moving average. They provide bullish and bearish signals and indicate potential breakouts.

Both lagging and leading indicators are crucial in trading, each with strengths and weaknesses. Relying only on leading indicators risks false signals; focusing solely on lagging indicators may miss profit opportunities.

FAQs

Examples of lagging economic indicators include measurements like unemployment rates, corporate profitability, and Consumer price index (CPI).

Lagging indicators assess past performance, while leading indicators guide future actions. Lagging indicators provide a straightforward measurement but are hard to alter, whereas leading indicators offer dynamic insights but are challenging to quantify.

Lagging indicators confirm trends that have already occurred but don’t anticipate future ones which results the leading indicators often experience volatility, where short-term fluctuations can generate misleading signals.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Leave a Reply