Technical analysis is one of the most vital terms in the world of the stock market. Whereby a trader or an investor employs charting tools such as rates of past performances, volume, and other techniques to predict the market price of shares. In this regard, technical analysis is a notable aspect of trading in the Indian stock market (or any instrument, in general), as it provides suggestions for the investment decision-making process and the identification of probable opportunities for enhancing performance. So, it’s good to go with the Best Technical Analysis Trading Course for mastering this important analytical skill.

The Key Concepts of Technical Analysis:

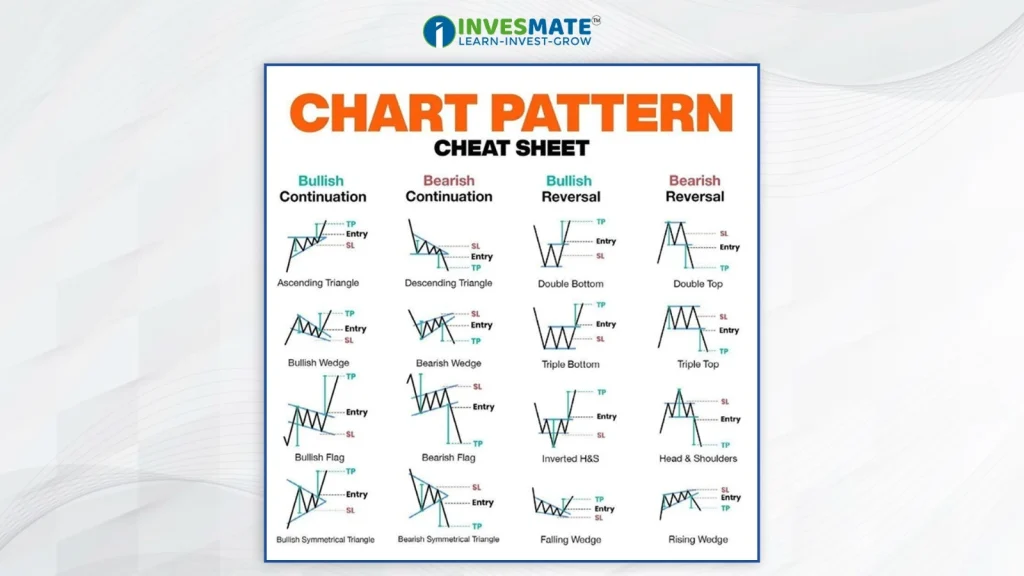

1. Chart Patterns: Among various technical concepts like head and shoulders, double tops, and flags, chart patterns are at the top of the list. Chart patterns are used by traders to detect trend reversal or its continuation.

2. Moving Averages: Trading averages such as 51 days or two hundred, etc., help traders know the overall trend direction of a stock.

3. Relative Strength Index (RSI): The RSI indicator can assist traders in assessing the velocity, rate, and even reversal of price trends, especially when they show signs of being overbought or oversold.

4. Support and Resistance Levels: To plan beforehand and be able to trade in the Indian share market more effectively, one has to identify key support and resistance levels through the price analysis of previous trends.

The Implementation of Technical Analysis:

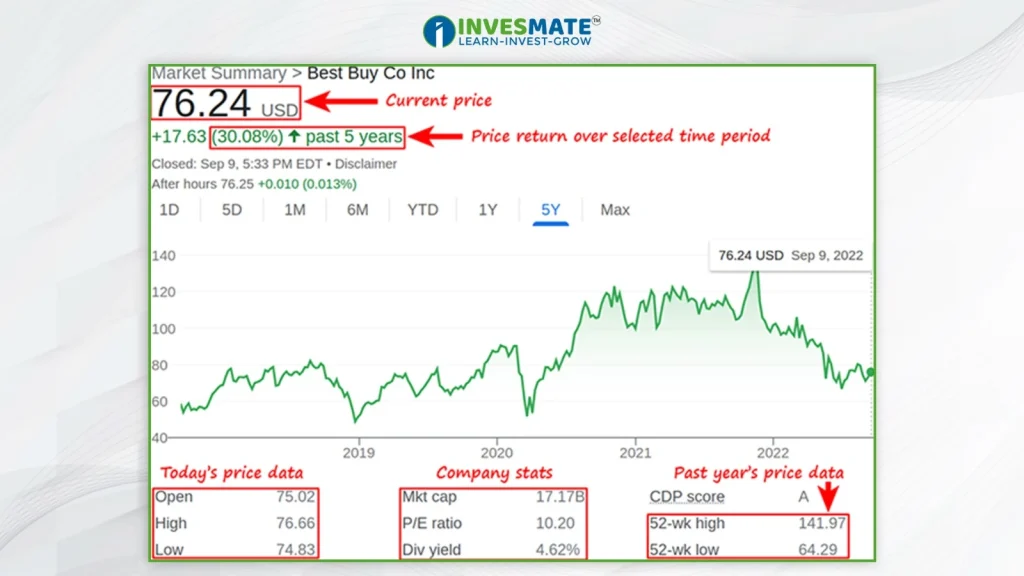

With reference to the above discussion, suppose an investor in India wishes to trade in Company X under the NSE. By employing technical analysis strategies, the investor can:

- Study Price Charts: Categorize Company X’s daily, weekly, and monthly price chart patterns using moving averages, candlestick formations, and trendlines in order to enter and exit his positions.

- Utilize Moving Averages: He needs to closely track how moving averages, such as 20-day and 50-day crossovers, happen to identify bullish or bearish signals regarding Company X’s share price.

- Apply Indicators: MACD can be used alongside an indicator, such as RSI, to validate whether to buy or sell and predict the momentum of a particular stock.

- Identify Support and Resistance Levels: Such vital technical indicators as support and resistance levels should be established for Company X stocks to set the stop-loss levels and the levels at which the profit will be targeted based on previous price trends.

With the incorporation of these tools and the concept of technical analysis, any investor and trader can make better decisions and hedge the fluctuating tendencies of the stock price.

In the same way, technical analysis can be useful to market participants on the Indian Stock Exchange because it helps give an understanding of price movements, direction, and possible trade opportunities. The one who is successfully able to analyze technical signals can make a better trading decision and try to get closer to their goals set for short-term and long-term actions. A fully curated technical analysis trading course online can provide you with a detailed idea.

The Relevance of Technical Analysis Trading Course in the Indian Trading Market

Technical analysis is very important for traders and investors in any market due to the following reasons:

- Decision Making: While entering a particular stock for buying or selling, charting the stocks, indicators, and pattern formations are most useful to predict the price variation to enhance operations.

- Risk Management: Initiating stop-loss orders Considering several technical analysis parameters of trends translates the risk into a safe trade.

- Timing Entry and Exit Points: Through technical analysis, it is easier to establish the important support and resistance levels, which are essential when defining points of entry and exit to ensure that traders achieve large profits and, where necessary, minimize losses in specific trades.

- Market Sentiment Analysis: Thus, analyzing the volumes and other oscillatory indicators, such as RSI, in terms of their magnitude and dynamics can help Indian traders identify the prevailing sentiment on the market and the psychology of investors.

- Confirmation of Fundamental Analysis: Through the use of technical analysis, one can affirm or deny the validity of a particular investment. Here, decisions about the investment can be made on various aspects. The aspects are mainly earnings reports, economic indicators, and other industry news.

- Adapting to Market Dynamics: Technical analysis serves as an effective set of tools. It is like active bartering in the rapidly evolving Indian stock market. And it can also be an efficient recommendation for timely market adjustments and corresponding reactions.

How Technical Analysis Can Be Useful in Investment & Portfolio Management?

Again, consider an Indian investor interested in trading stocks within the IT sector, particularly Company Y. Through his technical analysis and learning, the investor can:

- Analyze Price Patterns: Analyzing price graphs of Company Y, the investor can notice that on the same level, certain formations appear from time to time, similar to a triangle pattern or head and shoulders.

- Utilize Moving Averages: Fixed averages such as the fifty-day moving average and the two hundred-day moving average can assist the investor in identifying long-term movements of Company Y share prices for making proper investment decisions.

- Incorporate Indicators: The use of technical tools, such as the MACD or Bollinger Bands, provides confidence in signals and trends detected in the price of Company Y shares, making the investor’s strategies more accurate.

- Manage Risk: The investor can set the stop-loss levels and overall target for the effective management of risks for Company Y.

The Significance of a Proper Trading Analysis Course

Trading analysis courses can be considered a significant segment of traders’ and investors’ assistance, providing them with the necessary knowledge and skills in financial trading. Here are several reasons why enrolling in trading analysis courses is essential:

- Build the Foundation: A good trading analysis course helps shape a fundamental understanding of trading across several technical indicators, stock charts, and trading methods. It is crucial to have a concrete understanding of these concepts so that the right decisions can be made in the financial markets.

- Skill Development: A good, full-fledged technical trading course seeks to train participants in better analysis and critical thinking. Traders are readily able to acquire knowledge on how best to read the signals in the market, analyze trends, and generally look at price action.

- Risk Management: Failure to manage risk appropriately is one of the more severe vices of trading. Here, good mentors educate students on ways of managing risks; some of them include setting up stop orders, determining the size of each position, and using leverage properly.

- Market Psychology: Technical analysis is a good tool for assessing market psychology since it focuses on market action. The patterns and trends shown by this analysis can provide important insights into the underlying psychological causes of market behavior. For example, if a stock has regularly trended upward, it may imply that investors are bullish on the company’s prospects.

- Hands-On Experience: Some technical trading analysis classes provide opportunities for practice in scenarios that mimic the real incidents of the market. Such experiences enable the student to intertwine practical situations with the theories learned in class and gain confidence in their abilities.

- Continuous Learning: Compared to other markets, the sphere of stock markets is quite liquid and actively undergoes changes in terms of new trends and technologies. Technical trading analysis courses can be helpful to cover recent changes in the marketplace and learn new and appropriate approaches to stay up-to-date and engage in professional development.

Benefits of Technical Analysis Trading Courses:

- Improved Decision-Making: Many people who attend technical analysis trading courses improve their ability to analyze information related to the markets, understand trends, and invest in stocks effectively.

- Enhanced Performance: By enhancing their abilities and gaining experience in a practical manner, learners throughout the course learn to enhance their capacities for trading while executing better results in the real financial markets.

- Career Advancement: A proper knowledge of technical analysis will help the students apply to companies dealing with asset management or become members of proprietary trading firms.

- Confidence Building: Education from trading analysis courses leaves traders equipped with an understanding of market problems, and prepares them to tackle the markets in an informed manner with a proper plan and perseverance to deal with any problem that could come across.

With the help of technical analysis trading courses that are focused on the education and improvement of the trader, people can think about long-term success and the possibility of developing the trading activity in a stable manner in the future.

The Best Technical Analysis Trading Course in India

INVESMATE, an ISO 9001:2015-certified e-learning platform, offers premium financial education courses in vernacular languages for the general public. INVESMATE provides an all-inclusive approach to stock market education, utilizing an interactive and personalized learning method to assist students in developing the necessary analytical skills and concepts. Digitally enabled practices with experienced trainers assist them in successfully working in the financial industry.

Though they started their classes with just 30 students in a small, convenient classroom, after the pandemic, they launched their best technical analysis trading course online. Their major vision is to spread financial literacy in every corner of the world. There are so many people in our society who are least bothered by financial freedom. To fulfill their long-term financial goals, trading becomes one of their sharpest weapons. Therefore, INVESMATE started their technical analysis trading course in vernacular language.

Why INVESMATE Will Be Everyone’s First Choice?

In the world of social media, one can find several options for stock market platforms where they can learn to trade. But INVESMATE has some unique value in it.

- INVESMATE is one of the leading platforms for stock market education that has the advantage of online trading classes in vernacular language.

- They have a panel of experienced and efficient stock market professionals. All the mentors are NISM-certified and are always ready to provide hands-on guidance and attention to each student.

- They have both theoretical and practical classes. Through LIVE MARKET HOUR, the students can gain practical experience.

- They have special doubt-clearing sessions in both offline and online classes.

- They have a NSE Smart Stimulator system through which each student can avail of the NSE Smart Platform for their trading strategies.

- They have INVESMENTOR. Here you can get live chat support from the market analysts, one-to-one guidance, and upgrade your model portfolio with analysis assistance.

- Every week, stock enthusiasts can get INVESLETTER to prepare themselves for the next day.

- There is a premium program on the stock market called INSIGNIA, through which one can become a professional trader.

- Students get certificates after completing the course.

Conclusion

In conclusion, technical analysis skills prove to be helpful to traders and investors in their trading, particularly in stock trading. This technique means assessing past stock prices and the occurrence of patterns as a way to make future predictions about the prices. The achievement of this objective enables individuals to epitomize technical analysis in that it facilitates effective decision-making by analyzing technical indicators and chart patterns that, in one way or another, are presumed market trends and patterns. Hopefully, you like today’s blog. Let us know which subject you want to learn from us on our next blog.

Leave a Reply