Present Scenario of Iran-Israel Conflict

The exchange of drone and missile attacks between Israel and Iran over three weeks in April has taken West Asia to new levels of insecurity. On April 13, Iran launched over 300 drones and missiles at Israel after an Israeli strike on its embassy in Syria.

The Iran-Israel conflict is influencing the Indian stock market. Despite India’s stability, these international issues carry significant weight.

Origin of Iran-Israel Conflict

After the 1979 Islamic Revolution in Iran, the new government severed diplomatic and commercial ties with Israel, refusing to recognize its legitimacy as a state. This marked the beginning of open hostility between the two nations.

Iran’s increased support for proxy groups like Hezbollah and Hamas has led Israel to perceive Iran as a significant threat to its security.

How Can the Iran-Israel Conflict Affect India?

India imports over 80% of its oil requirements, India’s heavy dependency on oil imports makes it vulnerable to fluctuations in global crude oil prices. Any disruption in oil supplies from the Middle East due to the Iran-Israel conflict could lead to increased crude oil prices.

Geopolitical tensions have already driven a 6% rise in Brent crude oil prices over the past two weeks, now surpassing $90 per barrel.

The Impact of the Iran-Israel Conflict on Sectors and Stocks :

Although the overall economy may remain stable, specific industries and stocks could feel the impact.

Let’s explore how this situation might affect different sectors in India.

Oil and Gas Sector :

- India heavily relies on oil imports, primarily from Iran. Iran is the third largest importer of India.

- in Iran’s oil supply could raise global oil prices, impacting Indian companies and consumers.

- Stocks like Bharat Petroleum, Indraprastha Gas, and Hindustan Petroleum may suffer from supply disruptions.

Defense Sector :

- Geopolitical tensions could lead to increased defense spending in India.

- Hindustan Aeronautics Limited (HAL) and Bharat Dynamics (BDL) may see heightened demand.

- Import challenges from Iran may boost opportunities for Indian defense manufacturers.

Pharma Sector :

- Conflict-related disruptions may lead to raw material shortages, affecting medicine production.

- Export-dependent firms like Sun Pharma, Dr. Reddy, and Cipla could face delays and revenue impacts.

Infrastructure Sector :

Geopolitical uncertainties may dampen investor confidence, delaying projects.

L&T, IRB Infrastructure, and GMR Infrastructure may face project delays and funding challenges, impacting stock prices.

Aviation Sector :

- Oil price spikes could raise operational costs for Indian airlines like IndiGo.

- Reduced travel to the Middle East may further strain operations.

Commodities Sector :

- Geopolitical uncertainties may drive investors towards safe-haven assets like gold and silver.

- Companies like Hindustan Zinc Limited and Vedanta Limited may benefit from increased demand.

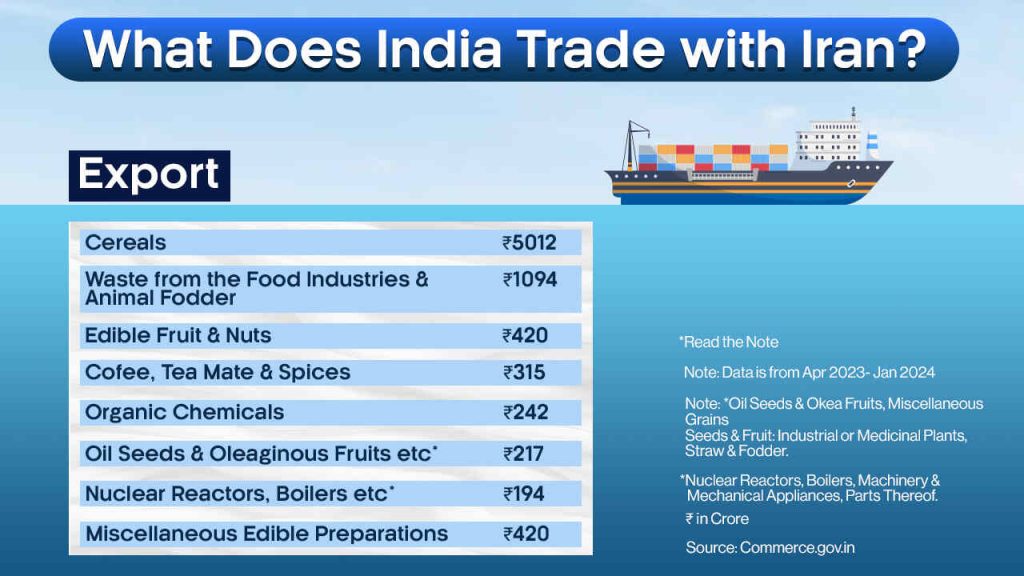

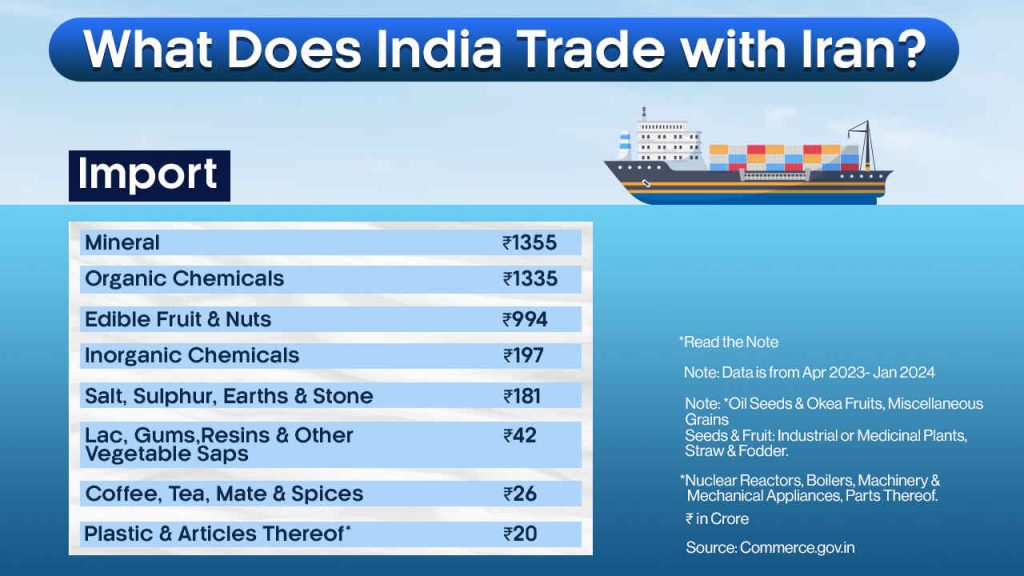

India's Trade with Iran and Israel :

- Bilateral trade with Israel has doubled from $5.56 billion to $10.7 billion in the last five years, including imports of space equipment and diamonds.

Investments in Iran, like the Shahid Beheshti Port development, aim to boost connectivity and trade ties with the Middle East and Central Asia.

Imports from Iran include items like methyl alcohol, petroleum bitumen, liquefied butanes, apples, liquefied propane, dates, and almonds.

Conclusion

The Iran-Israel conflict may cause short-term disruptions in selected sectors and stocks in India. Vigilance and adaptive strategies are vital for mitigating risks. While the broader economy may see limited impact due to India’s Make-in-India focus, sector-specific interests require careful attention.

FAQs

India imports over 80% of its oil requirements, mainly from the Middle East, including Iran. Disruptions could lead to higher oil prices.

Geopolitical tensions led to a 6% rise in Brent crude prices in two weeks, now exceeding $90 per barrel.

Oil and Gas, Defense, Pharma, Infrastructure, Aviation, and Commodities due to supply disruptions and geopolitical uncertainties.

Bilateral trade with Israel doubled, including imports of space equipment and diamonds. With Iran, trade focuses on agriculture and petroleum products.

The Indian stocks with an Israeli connection include Adani Ports, Sun Pharmaceutical, Dr. Reddy’s and Lupin, NMDC, Kalyan Jewellers and Titan.

The market could be disrupted by the war-related risk but hopefully, the supply-demand oil dynamics would continue to be unfettered.

Leave a Reply