Table Of Contents

What is a Cyclical Stock?

#Cyclical Stock?

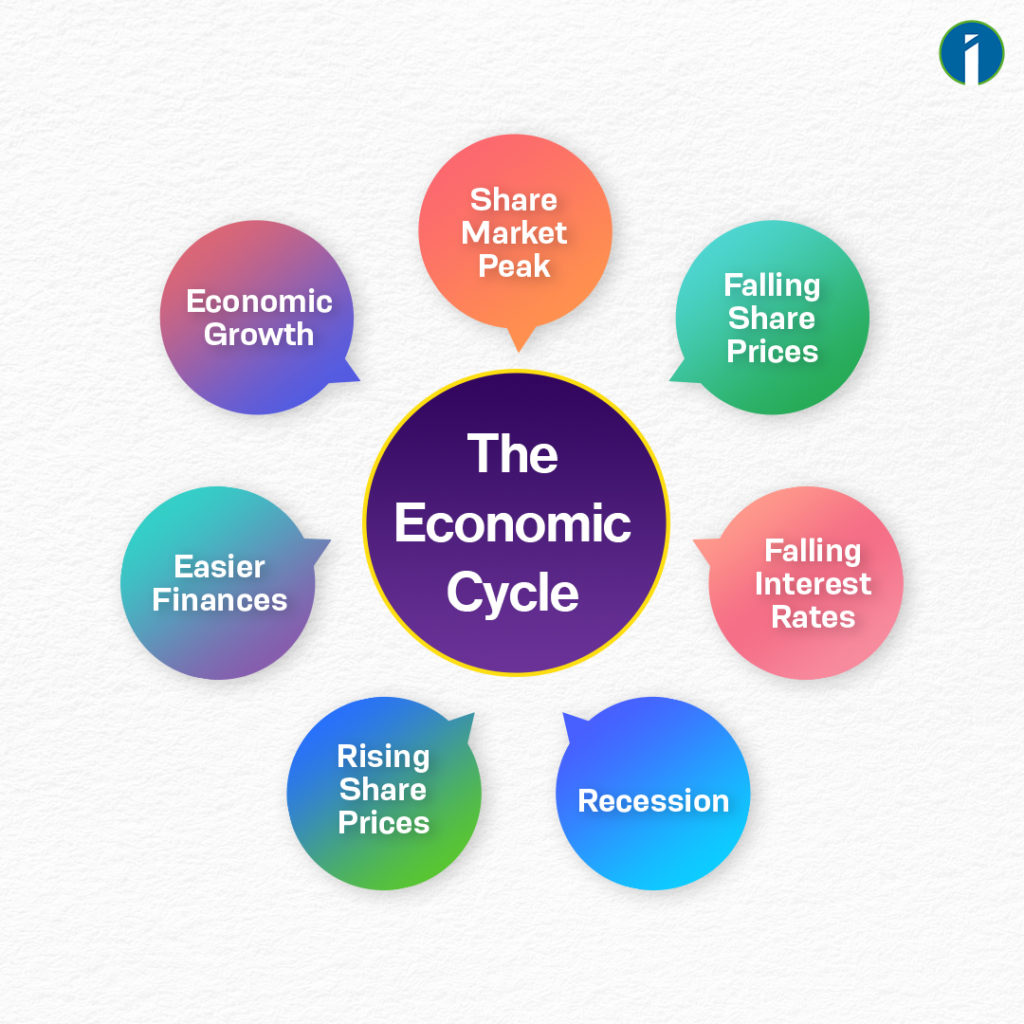

A cyclical stock is a stock that’s price is affected by macroeconomic or systematic changes in the overall economy. Cyclical stocks are known for following the cycles of an economy through expansion, peak, recession, and recovery.

Cyclical businesses perform well during economic expansions but typically experience significantly declining sales and profits during recessions and other challenging economic times.

Understanding Cyclical Stocks

#StockUnderstanding

There are quite a few sectors that are directly linked to economic growth. Cement, construction, steel, capital goods, automobile are all classic examples of cyclical stocks.

Some more cyclical are car manufacturers, luxury goods manufacturers, airlines, furniture retailers, clothing stores, hotels and restaurants etc

Let’s understand with some Examples

Metal Sector

During the corona virus period when raw material costs of the metal sector were low, the profits of those companies were seen to be positively affected. But as the raw material price increase we have seen a sharp correction in OPM % in recent quarter results.

OPM (Operating Profit Margin) of metal stocks like Tata Steel rose to 30% in Jun’21, but has now come down to 10% in Sep’22.

For more details about the steel sector, watch this video 👉Link: https://youtu.be/Ot0JYpojQFU

Automobile Sector

The corona virus lock-down had badly affected sales in the automobile industry, but car sales are also improving as the corona virus situation improves.

Sales of Tata Motors fell to Rs. 31,983 crore in Jun’20, but with the normalization of the situation its sales have increased to Rs. 79,611 crore in Sep’22.

Chemical Sector

Can two stocks of same sector be cyclical and noncyclical? : It is quite possible, for which we have to look into two chemical sectors– bulk chemicals & speciality chemicals.

Bulk Chemicals VS Speciality Chemicals

Bulk Chemicals : Bulk chemicals are raw materials needed to produce speciality chemicals, profit margin depends on raw materials cost fluctuation. Bulk chemicals are produced in huge quantities but are low in value and hence, these companies have low margins also.

Deepak Fertilizer, Gujarat Alkalies and Meghmani Organics are some of the bulk chemical companies. Operating profit margin of these companies always depend on raw materials costs.

Speciality Chemicals : Speciality chemicals are either a single chemical or a mixture designed for a specific application and not depends on raw materials’ cost fluctuation. Speciality chemicals have low volumes, but they have specialisation, which is why speciality chemical companies have higher margins.

Clean science & technology, Aarti Industries, Navin Fluorine, SRF are some of the speciality chemical companies. Operating profit margin of these companies rarely depend on raw materials costs. Specialty companies that are backward integrated can cushion themselves from spikes in bulk chemical prices.

How to identify Cyclical Stocks?

There are various indicators based on which one can judge a cyclical stock.

High Beta or Volatile-Stocks

- These companies have a direct relationship with economic growth. The first is the Beta value or systemic risk. Cyclical stocks tend to have high beta values, which are usually higher than 1. A beta of 1.5 means if the market falls 10 per cent, the stock is likely to fall 15 per cent.

- Secondly, cyclical stocks tend to have volatile earnings per share or EPS, as their earnings keep on fluctuating in relation to the sentiment in the economy.

- The third aspect is price-earnings ratio, which compares the price of a stock in relation to its EPS. Cyclical stocks generally tend to have low PE ratios, making them cheaper in comparison to defensive stocks.

- Low PE and PB ratio because of there cyclicality stock are very volatile and investor not like to invest this kind of stocks.

Cyclical vs. Noncyclical Stocks

Cyclical Stocks

Noncyclical Stocks

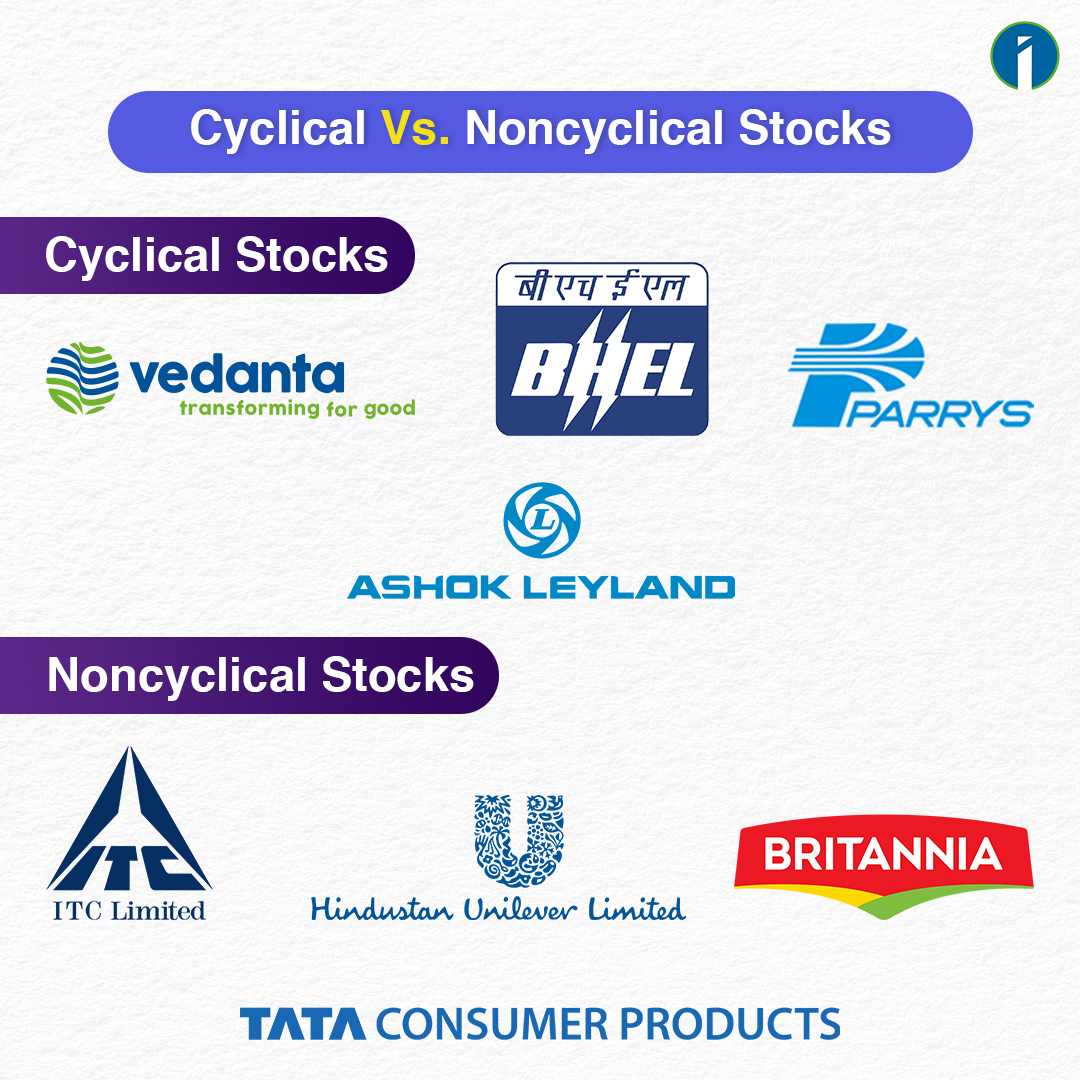

The performance of cyclical stocks tends to correlate with the economy.

Noncyclical stocks tend to beat the market regardless of the economic trend, even when there’s a slowdown in the economy.

The performance of cyclical stocks tends to correlate with the economy. Companies that deal with cement, construction, steel, capital goods, automobile are examples of those that have noncyclical stocks.

Noncyclical stocks are also called defensive stocks. These stocks encompass the consumer staples category, with goods and services that people continue to buy through all types of business cycles, even economic downturns. Companies that deal with food, gas, water and other FMCS products are examples of those that have noncyclical stocks.

Adding noncyclical stocks to a portfolio can’t be a great strategy for investors as these stocks are known for following the cycles of an economy

Adding noncyclical stocks to a portfolio can be a great strategy for investors as it helps hedge against losses sustained from cyclical companies during an economic slowdown.

Cyclical Stocks

The performance of cyclical stocks tends to correlate with the economy.

The performance of cyclical stocks tends to correlate with the economy. Companies that deal with cement, construction, steel, capital goods, automobile are examples of those that have noncyclical stocks.

Adding noncyclical stocks to a portfolio can’t be a great strategy for investors as these stocks are known for following the cycles of an economy

Noncyclical Stocks

Noncyclical stocks tend to beat the market regardless of the economic trend, even when there’s a slowdown in the economy.

Noncyclical stocks are also called defensive stocks. These stocks encompass the consumer staples category, with goods and services that people continue to buy through all types of business cycles, even economic downturns. Companies that deal with food, gas, water and other FMCS products are examples of those that have noncyclical stocks.

Adding noncyclical stocks to a portfolio can be a great strategy for investors as it helps hedge against losses sustained from cyclical companies during an economic slowdown.

When should one invest in Cyclical Stocks?

When the government is undertaking a major capital spending thrust : Back in 2003, the Indian government’s Golden Quadrilateral project that had far-reaching implications in subsequent years on economic growth and the capital cycle In fact the lag benefits of this move were felt all the way till 2011 when the capital investment cycle finally turned around. During the period, we have seen stocks like Crompton Greaves, L&T, BHEL, Reliance Energy and Tata Power become absolute multi-baggers. Hence the first mantra is to invest in cyclical stocks at the base of a major capital investment cycle.

When there is frantic capacity expansion in the economy : Between 2005 and 2008, India saw tremendous investments in sectors like steel, power, telecom, infrastructure etc and all these factors put together created a major demand push for cyclical stocks.

In recent, JSW Steel revises their capex to ₹15,000 crore for FY23 and Tata Steel to invest Rs 12,000 crore in FY23.

When government changes policy that can help the industries : Following government policies help to those respective industries. Some of those policies are Retrospective tax repeal, Telecom package, PLI Schemes, National asset monetisation pipeline, Power reforms, A New Bad Bank, Amendments to laws, Air India disinvestment, A new development financial institution, Scrappage policy for vehicles, Drone policy, Approval to make military transport aircraft in India.

- For investing in cyclical stocks, price-to-book multiplesare better to use than the P/E. Prices at a discount to the book value offers an encouraging sign of future recovery.

In this article, we have discussed all the possible aspects of cyclical sectors and its stocks. Which cyclical sector’s turn is about to come next? What do you think? Write us in the comment box.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Very good

Very interesting 🙏🙏