Learn Advanced Option Trading strategies Training Course

In this highly tech-savvy era, trading has become the hot cake in every community. Especially the derivatives segment. Not only experienced investors or traders, but an 18+ youngster is now keenly interested in trading. Therefore, Options Trading is gaining more prevalence day by day.

But why only option trading?

Here, one of the reasons could be that an investor or a trader can expand their portfolios with less capital, and on the other hand, there is a high possibility of grabbing maximum returns.

N.B.: Regarding option trading propaganda, our respected Securities and Exchange Board of India published a detailed observation.

With the blooming of options trading, it is pivotal to prepare oneself with the fundamental information and aptitudes to explore this vast and dynamic field. The best options trading course in India can help you, in this case, dive deep into this field by providing the proper knowledge and immense guidance.

Features of the best Advanced options trading course in India

When choosing an options trading course in India, one should consider multiple factors. With the breakthrough of social media platforms, you can get several of the best option trading courses in India. But all are not your cup of tea. Let’s share the key attributes that should be preferred by beginners.

- Extensive Course Content: The ideal options trading course in India will have a thorough curriculum that addresses important subjects like option fundamentals, complex strategies, risk control, time concepts,spread making etc. A balanced program should lay strong groundwork for novices and introduce more advanced ideas for seasoned traders.

- Skilled Teachers: Seek out courses led by skilled instructors who have a successful history in options trading. Instructors who have practical trading experience can provide valuable insights, useful tips, and guidance based on their firsthand experience in the markets.

- Engaging Education: Choose the best options trading course in India that offers interactive learning resources, live trading demonstrations, case studies, and simulations. Getting hands-on experience can help solidify theoretical concepts and improve comprehension, enabling students to put their knowledge into practice in real-life trading situations.

- Availability of Tools and Resources: Top courses on options trading provide access to platforms for trading, analytical tools, sources for research, and communities for trading. These resources can improve the learning process, help with simulated trading, and allow students to stay informed about market trends and potential opportunities.

- Assistance and Guidance: Opt for a course that offers continuous support, mentoring, and guidance for students. Having access to mentors, forums for discussions, Q&A sessions, and personalized feedback can enrich the learning experience and assist students in conquering obstacles and enhancing their trading abilities.

- Popularity: Before enrolling in an options trading course, it is important to carefully examine its reputation and reviews. Courses with positive testimonials, endorsements from industry experts, and a history of successfully educating traders should be prioritized.

INVESMATE: The #1 Advanced Options Trading Training Course in India 2025

INVESMATE, India’s No. 1 E-Learning Platform, is one of the finest stock market learning platforms in 2025 that offers advanced options trading training courses in India in your own regional language.

what you’ll get to learn from this option trading course…

Something interesting…

1. The concept of Option Pricing (Value of Option)

2. In-depth knowledge of Time Decay

3. Nitty-gritty of Implied volatility (IV)

4. Mastering A-Z Option Chain Analysis

5. Complete Option Buying Strategy

6. Learn to create different spreads based on market sentiment

7. LIVE trade with Option Buying Strategy

8. Risk Management factors

9. Option buying Psychology… and many more.

Let’s see what is in the box!

Welcome Session

This is the introductory portion of the course. In the welcome session, the students will become familiar with the complete concept of options, like the vital contract between the buyer and the seller, option payoff diagrams, in-the-money (ITM), out-of-the-money (OTM), or at-the-money (ATM), etc.

...Proceed to the Advance!

Now the entire session is divided into 8 Modules.

In module 1, a student will learn different concepts about call and put buyers, the nitty-gritty of payoff charts, a detailed overview of the master option chain analysis, etc. This will help students build the right foundation for their successful derivatives journey in the stock market. In the 2nd Module, a student will get detailed insights about how a buyer manages to buy a stock at a specific price; the premium paid, the worth of specific assets, the strike price, etc. are explained. These are helpful for both buyers and sellers. In a word, the P&L for a put buyer and put seller will be clear here. How to measure the major characteristics of the Greek contract’s price, the concepts of Delta, Gamma, Theta, and Vega, and the brief analysis of Delta will be taught in 3rd Module. Apart from these, Long Build Up & Short Covering, and Short Build Up & Long Unwinding are also explained.

In session 4, one will learn: what are Gamma, Theta, Vega, and Rho, and how to calculate an option’s price that will vary with the price of the underlying asset; whether the option is associated with risk or not; and what’s the movement also taught here. In the 5th Module, you can see there is a huge number of options, which are listed together under the name of the option chain. Puts, calls, strike price, etc. are all explained in brief here. How you will be efficient in your option buying strategy by using OI data is also explained.

The concepts of bull call spread, bear call spread, short Straddle, long Stradle, bull put, and bear put spread help understand how the spread can be created as per any market conditions and also what is out-of-the-money put, out-of-the-money call, profit potential, etc. Such concepts will be portrayed in Module 6 in detail.

The 7th Module teaches how to earn money with options using the Iron Condor and Butterfly strategies, as well as how to deal with risk and set your mind to win in the stock market. One of the best parts of options trading in INVESMATE is the live market hour practice. Not only theoretically, a beginner can learn options trading practically through the hands-on guidance of NISM Certified Mentors in the Live Market Hour. Even all the queries and questions regarding options trading will be clear at the session of Module 8. That’s why the best option trading course in India is only possible for INVESMATE.

Why INVESMATE is the Best Choice for Online Option Trading Classes in 2025?

The best option trading course in India is progressing at an alarming proportion. By 2025, this market is expected to generate INR 456.42 billion in revenue. With this growth predicted to continue at a 23.44% annual growth rate (CAGR 2024–2028), the market is estimated to reach INR 1059.72 billion by 2028. Furthermore, it is anticipated that by 2028, there will be 263.6 million users in the online learning platforms industry.

Now, to learn options trading course India through online classes, INVESMATE has no alternative. Why?

- Study from Your Comfort Zone: For Option Trading online courses, anyone can attend their classes from their comfort zone. Whether they’re at home or they’re outside, they can join their classes comfortably.

- 1:1 LIVE Interactive Mentorship: Interaction with mentors is also possible in online mode. The mentors can also clarify your doubts and queries regarding Option Trading individually.

- Access to Recorded Classes: The best thing is that you can get the full recorded class of Option Trading Course later. If you skip any stock market courses online on time, you don’t have to miss the lessons.

- Better Time Management: Whether you’re running a business or you’re doing a job, you don’t have to be bothered to manage the online stock market courses.

- Study from Anywhere in India: Online classes for Option Trading offer everyone to attend classes from every hook and nook of India. No restrictions on location exist.

- Real Experience through Whiteboard Learning: With growing time, everyone has to be technically aware. Online classes make anyone cognizant of whiteboard learning.

Who is eligible for these Stock Market courses?

Housewives: Housewives can take INVESMATE courses from the comfort of their own homes because the company offers online classes.

Student: Because the courses are flexible, every student can study beyond their studies and start gaining real financial knowledge at an early age.

Businessman: A businessman can also take stock market courses to increase their capital.

Job holders: Job holders can also enroll in the courses to supplement their income.

Others Top Options Trading Courses in India

Apart from INVESMATE, some other best option trading courses in India are also available for learning options trading.

1. Mastering Futures & Options by BSE Varsity

BSE Varsity is one of the most popular learning platforms for financial education in India. BSE Varsity offers a super-exciting course on Futures & Options. The course is entirely conducted in English, and the duration is 12 hours. The Mastering Futures and Options course is divided into four sessions.

In the first session, introduction to derivatives, proper data, and strategies for derivatives are taught. In the second session, a vast lesson is taught about the future. In the third session, options are introduced along with the future. And in the fourth or final session, the secret strategies of futures and options trading are shown. BSE Varsity always wants to provide a deep insight into Futures & Options trading. And how and when the market can be led by all derivatives tools are also taught.

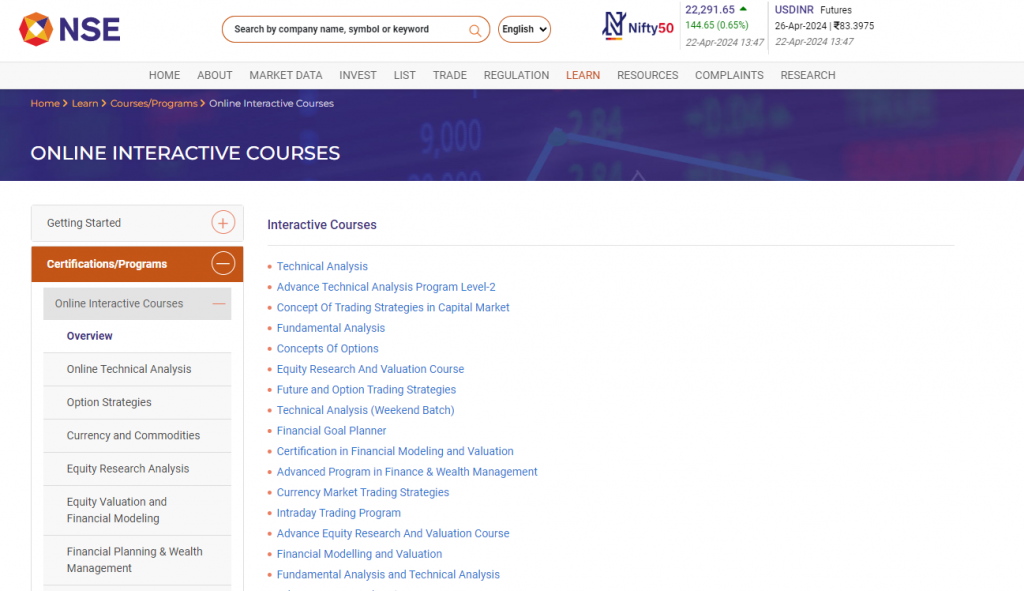

2. Future And Option Trading Strategies By NSE India

Today’s world is stuck with various financial perils. To remove all these types of economic obstacles, NSE Academy, a subsidiary of the National Stock Exchange of India (NSE), is a major platform that provides a variety of training programs and certifications in the financial markets. Collaborating with Empirical F&M Academy, NSE Academy has launched a course on Future & Options Trading. The course duration is 10 hours. It’s conducted online by experienced mentors.

After the course is completed, everyone can get a certificate. In this course, one can learn hedging, calculation, Greeks, and many option strategies. The major aim of this course is to shine a spotlight on getting the maximum profits from option traders. In the entire course, the first lesson consists of a basic conception of futures and options. The second one consists of the facts behind Future & Options Trading and their explanation. The third one is the entire chapter of strategies and formulas for futures and options trading.

3. Options Theory for Professional Trading by Zerodha Varsity

Zerodha Varsity is the best source of stock market education where beginners can start their stock market journey freely. This is the most influential platform where everyone can get free access to go through the lessons regarding the stock market, investing, and trading.

Option Trading is a 25-varieties text-oriented options trading course in India launched by Zerodha varsity. From the first few lessons, you can learn about options buying, options selling, put, option, call, etc. All the basic things related to options are clear in the first chapters. In the next chapters, options trading strategies, formulas, how to calculate the price, etc. are discussed. Even you can be knowledgeable about the profit and loss regarding options trading.

Though the above-mentioned institutions offer the best options trading courses in India, INVESMATE can be your only companion if you want to advance your option trading journey in your regional language. We’re the only ones in India who provide stock market solutions in students own language, making financial learning accessible and easy for all races in the country. With that, we are now more than 77,482+ successful students’ trusted platform in West-Bengal. The best part is that INVESMATE provides you with a free demo class facility so that you can admit yourself to the advanced options trading course in India only after you’re satisfied with the insights provided by our NISM certified instructors.

So, don't be late. Book your FREE DEMO CLASS NOW!

I thoroughly gone through the bloc prepared and found very helpful to new beginners like me in option market.Keep posting this type of blog. which increases our confidence.

I found great pleasure in reading your thoughtful blog article. The views and concepts you expressed were tremendously useful.

I thoroughly enjoyed reading your insightful blog post. Your perspectives and ideas were incredibly helpful.