Option trading might seem complex, but understanding the basic concepts can simplify your trading journey and significantly enhance your investment potential. Among the various methods of trading in the stock market, Call Option Trading and Put Option Trading are prominent techniques. We have already discussed detailed information about Call Option Trading in a previous blog- A beginners guide to call options trading blog by INVESMATE

In this blog, we’ll provide you with a comprehensive understanding of what a put Option is, how it works, and its potential benefits and risks. This knowledge will assist you in embarking on your trading journey.

Read : The Beginner’s Guide to Options Trading blog By INVESMATE

What is a Put Options?

A put option is a financial contract that grants the buyer the right, but not the obligation, to sell an underlying asset (Such as Stocks, Currencies, or Commodities) at a specified price (Known as the strike price) within a predetermined period.

How Do Put Options work?

When an investor buys a Put Option, they are speculating that the price of the underlying asset will fall below from the strike price before the option expires.

If the asset’s price falls below from the Strike Price, the investor can exercise the Option, sell the asset at the higher Strike Price, and potentially buy it back at the lower market price for a profit.

If the asset’s price does not fall below the Strike Price before expiration, the Option will expire worthless, and the investor will lose only the premium paid for the option.

Conversely, when an investor sells a put option, they expect the price of the asset to be above the strike price.

Put Options Example

There are two types of examples for Put options: Put option buying and Put option selling.

Scenario 1

Buying a Put Option

When buying a put option, the buyer acquires the right to sell the underlying asset at the strike price at any time before the option expires.

Example on put Option Buying

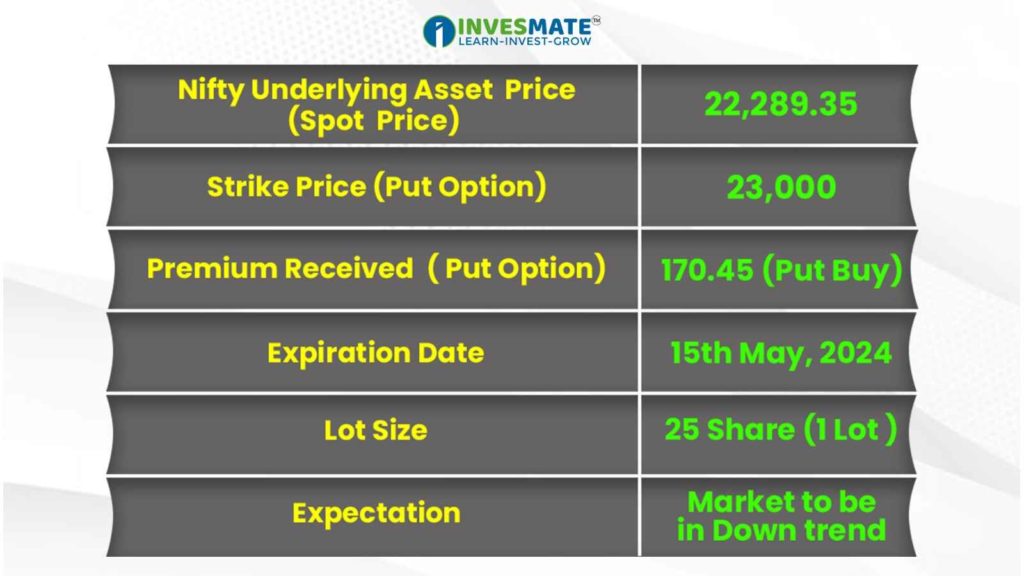

Below is an example for easy understanding of Put Option Buying.

* Spot Price,Strike Price,Premium,Expiration Date Explained The Beginner’s Guide to Options Trading blog By INVESMATE Please read this Blog

In anticipation of a decline in the Nifty Index price, a Put Option can be bought.

We have chosen the Nifty-50 index. On May 9th, 2024, the Nifty’s underlying asset price (Spot Price) was 22,289.35. Taking in consideration the Nifty put Option with a strike price of 23,000 was priced at 170.45. The expiration date for this option is 15th May, 2024. When the Nifty’s Underlying Price (Spot Price) fell to 21,968.15, the put Option price increased to 264 .

Potential Outcomes :

The premium of the put option has increased by Rs. 264. If we had bought the put option at Rs.170.45 then selling it at Rs 264 then we would have booked a profit of +2,338.75.

Profit & Loss Calculated =(Current Premium -Premium Paid) x Lot size

=(264 – 170.45)=93.55

=93.55 x 25 (Lot) = +2,338.75

But one thing to remember is that if the Nifty Underlying Asset Price (Spot Price) goes above to 22,289.35 , we will lose the Premium paid for the option. in this case-

- Let’s say Nifty reaches 23,350 on Expiry

= Now the Intrinsic Value of the option will be “0” , hence on Expiry we have to sell the option at “0” value.

** Note:Intrinsic value =( 23,000 -23,350)= -350 =0

= 0 -170.45 = -170.45 x 25 (1 Lot) = – 4,261.25

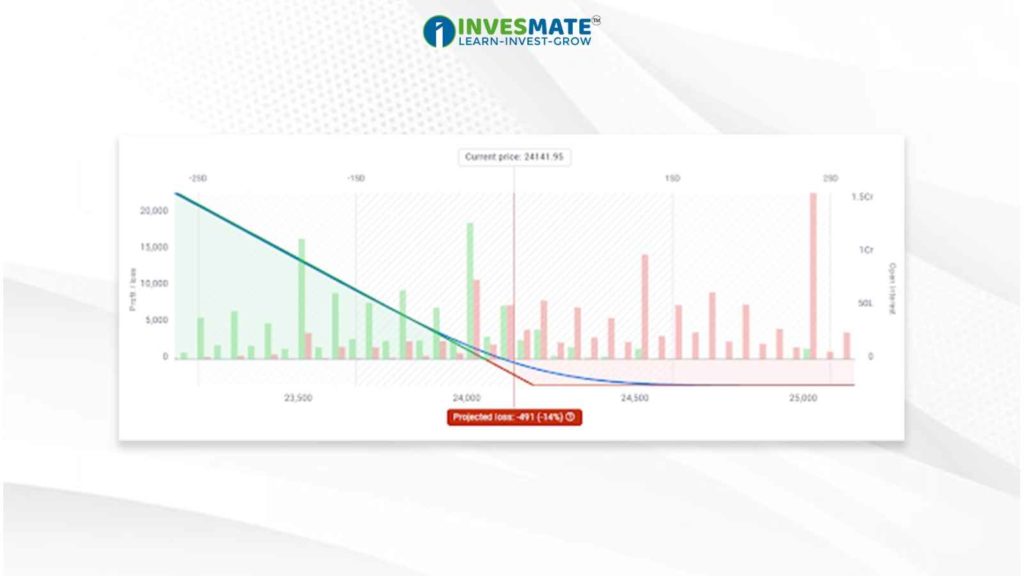

The Payoff Chart For Put Option Buy

- The payoff chart for a put option buying indicates that the profit potential is unlimited, as the profit increases with the fall in the underlying asset’s price.

- The maximum loss is limited to the initial premium paid for the put option. This means that regardless of how high the underlying asset’s price is , the most the option holder can lose is the amount paid for the option premium.

Scenario 2

Shorting a Put Option

When selling a put option, the seller assumes the obligation to buy the underlying asset at the strike price if the buyer exercises the option.

Example on Put Option Selling

Below is an example for easy understanding of Put Option Selling.

* Spot Price,Strike Price,Premium,Expiration Date Explained The Beginner’s Guide to Options Trading blog By INVESMATE Please read this Blog

In anticipation of a rise in the Nifty Index price, a Put Option can be sold.

We have chosen the Nifty-50 index. On May 23rd, 2024, the Nifty’s underlying asset price (Spot Price) was 22,600.85. Taking in consideration the Nifty put Option with a strike price of 23,000 was priced at 370.55. The expiration date for this option is 30th May, 2024. When the Nifty’s Underlying Price (Spot Price) rose to 22,972, the put Option price decreased to 191.20.

Potential Outcomes:

The premium of the put option has decreased by 191.20 rupees. If we sell the put option for Rs.370.55, then by executing the option, we would have booked a profit of Rs. +4,483.75

Profit & Loss Calculated =(Premium Received – Current Premium ) x Lot size

= (370.55– 191.20) =179.35

=(179.35 x 25)= +4,483.75

But one thing to remember is that if the Nifty’s Underlying Asset Price (Spot Price) goes below 22,600.85 at the time of expiry, we will lose the Premium paid for the option. In this case-

=Let’s say Nifty reaches 22,400 on Expiry

=370.55- Intrinsic value of option

** Note: Intrinsic value =(23,000 – 22,550)=450

=370.55 – 450= –279.45 x 25(1 Lot) = – 1,986.25

How to Calculate Put Sell Options?

Profit & Loss Calculated =(Premium Received — Intrinsic Value)x lot size

**Note: Intrinsic value =( Strike Price -Current Market Spot Price)

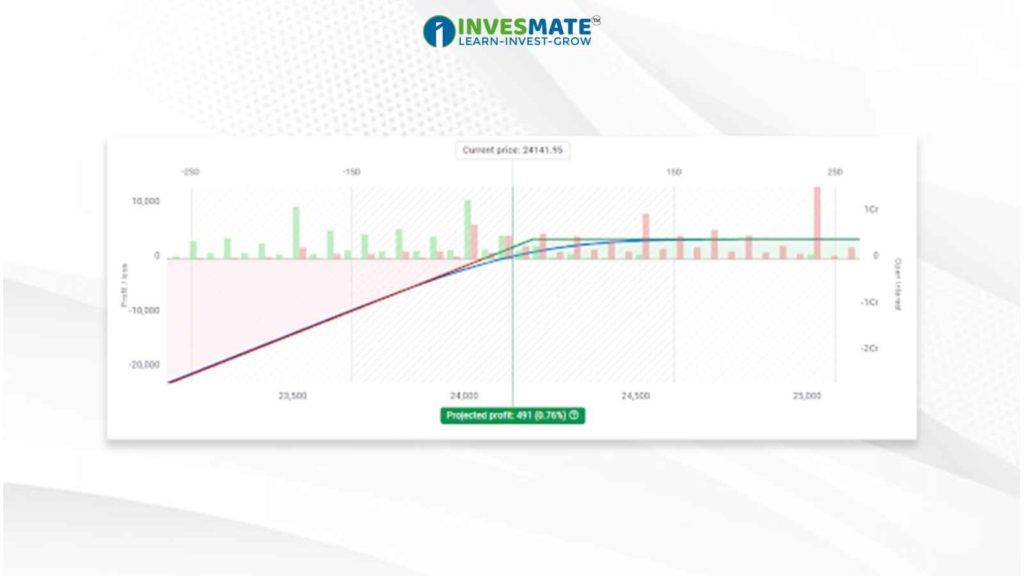

The Payoff Chart For Selling Put Option

- The payoff chart for selling a put option indicates that the profit is limited to the premium received,

- The potential loss is unlimited, as it increases with the fall in the underlying asset’s price.

Benefits of Put Options

- Hedging: Put options can be used to hedge against potential losses in a portfolio.

- Speculation: Traders can use put options to bet on the decline of an asset’s price.

- Limited Risk: The maximum loss is limited to the premium paid for the option.

Remember that options trading involves risks, and there’s no guarantee of profits. Take your time to learn and practice, and gradually build your skills and confidence as a trader.

FAQs

A put option gives you the right, but not the obligation, to sell a Underlying asset at a specific price by a particular expiration date.

Put options profit when the underlying asset’s price decreases. They act as insurance, allowing the holder to sell at a predetermined price, regardless of market fluctuations.

PE stands for “Put Option” and CE stands for “ Call Option”.

Call options allow the holder to buy the underlying asset at a specified price, while Put options allow them to sell it at a specified price.

Yes, you can sell your put option before its expiration date.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Leave a Reply