A lock-in period is intended to prevent early investors and insiders from selling their shares for a predetermined amount of time after a company’s Initial Public Offering (IPO).

Existing shareholders are consequently prohibited from selling their shares for a predetermined period of time after the IPO, typically 90 to 180 days.

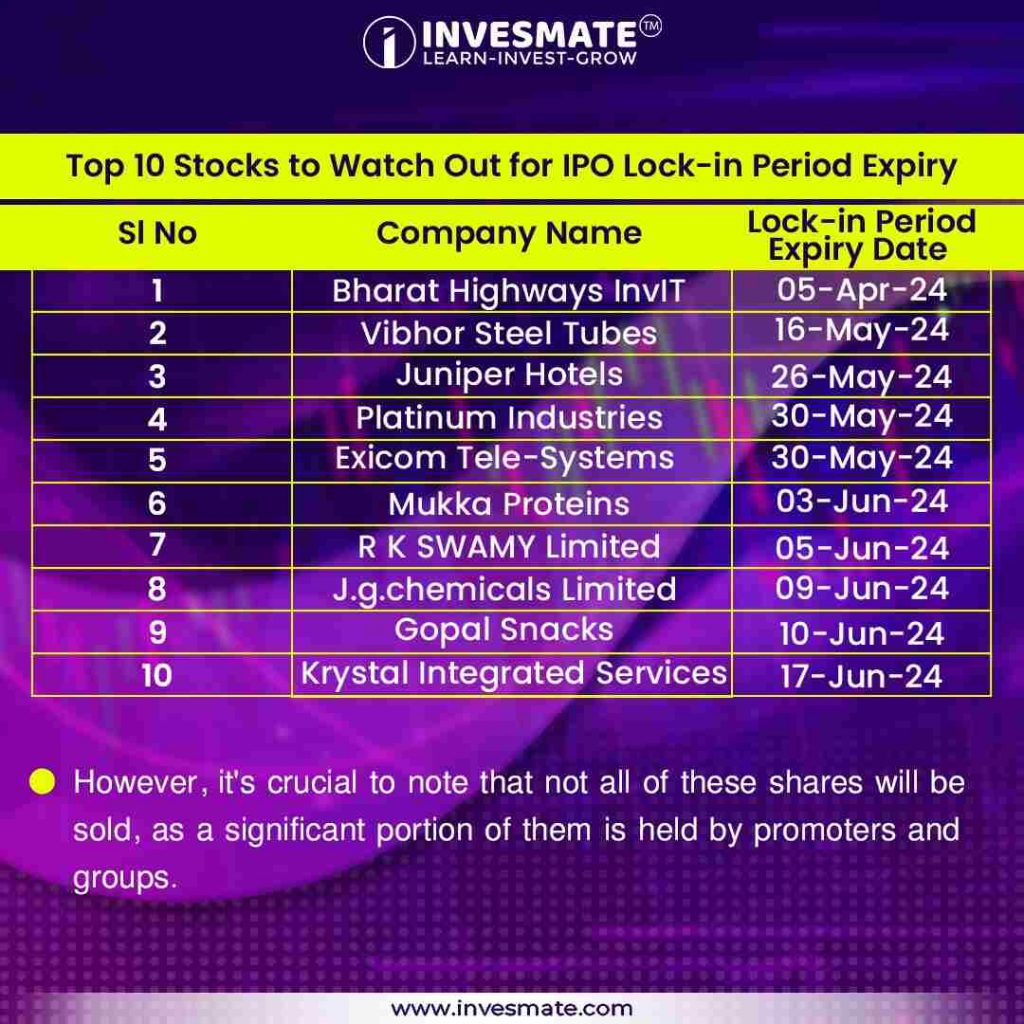

What is IPO Lock In Period and for whom is it Applicable? Could the Lock-In Period have any impact on the market?

To learn more, read our detailed post

Get all the new Blogs Updates

Leave a Reply