Often we see a lots of interest in the market for “Monopoly Stocks” among the Investors, many of them wants to hold Monopoly Stock in their portfolios. There is also a craze in the market in the name of Monopoly Stock and many of them choose the wrong One.

SO, What is a Monopoly Stock?

Why investors chase for Monopoly Companies?

What Makes a Company Monopoly?

You can Read this Blog & clear all you doubts and also get a clear idea about Monopoly Stock with simple examples below.

A Monopoly refers to an economic situation where a specific company and its product offerings dominate a sector or industry.

Monopolies usually result from the free-market capitalism and the absence of any restriction or restraints on that company.

A single company or conglomerate grows large enough to become the owner of all or nearly all of the market for a particular type of product or service.

A market for the product would include supplies, infrastructure, materials or services.

Therefore the term monopoly signifies an entity that has complete or close to complete control of a market.

Such companies usually have high barriers to entry, making it difficult for new players to enter the market and challenge their position.

Monopoly businesses often have significant pricing power, means they can charge higher prices for their products & services.

How could A company can achieve a monopoly position?

A company can achieve a monopoly position in several ways. One common method is by acquiring its competitors and consolidating its market position. Another way is by leveraging its technological advantage or patents to maintain its position in the market.

You can visit our INSIGNIA program where INESMATE explains Monopoly Stocks quite easily to their students.

Let’s take a brief look on Top Four Monopoly Companies:

- Indian Railway Catering and Tourism Corporation Ltd (IRCTC)

- Coal India

- Hindustan Zinc Ltd (HZL)

- Hindustan Aeronautics Ltd (HAL)

Don’t’ worry, Read this BLOG & know all about Government Loan Schemes in Details:

1. Indian Railway Catering and Tourism Corporation Ltd (IRCTC):

There are around 40 million registered and unregistered Micro Small and Medium Enterprises (MSMEs) in India. MSMEs can be classified as belonging to either the organized or unorganized sectors. These MSMEs continue to be an important source of employment and generate around 40% of India’s overall GDP. Critical national problems including poverty, unemployment, income inequality, regional imbalances, etc. are addressed by MSMEs. The government has introduced a number of programs to provide loans to MSMEs in order to strengthen their businesses and economies. A loan can be obtained by the business owners of these MSMEs through any of the programs that best meet their needs.

Growth Factors:

a) Investment in railways is increasedby 27.5 % in the Union Budget of 22-23

b) 400 plus Vande Bharat trains to be introduced in coming years

c) Growth prospects in tourism and travel sector including religious and pilgrimage tourism

d) Digitalization of payment system

Important Developments:

a) Company is planning to build a chain of hotels.

b) Company is entering into an e-marketplace with services like bill payment,recharges, and other third-party services like online insurance purchases, etc. in partnership with brands like Amazon, Flipkart, HDFC Life, etc.

c) Diversification of IRCTC as a Fintech company through company’s online payment gateway iPay

d) Plans to enter into segments like Helicopter Travel, medical tourism, etc.

e) Plans to expand Non-Rail based tourism viz. corporate travel business, cruise, river packages, air tickets etc.

2. Coal India Limited:

Coal India Limited is a state-owned coal mining company. It is mainly engaged in mining and production of Coal and also operates Coal washeries. The major consumers of the company are power and steel sectors. Consumers from other sectors include cement, fertilizers, brick kilns etc. It is one of the largest coal-producing companies in the world and has a dominant market position in the Indian coal industry.

Coal India Ltd leads the country’s coal production contributing to around 80% of the Nation’s entire coal output. Its supplies to the power sector exceed 80% of its entire despatch.

Major Consumers:

Coal India’s major consumers are the Power sector (82% of the total output) and Steel sectors and others include cement, fertilizer, brick, kilns, and a host of other industries.

The Co. incorporated two wholly owned subsidiaries viz. CIL Solar PV Limited for manufacturing of solar value chain (Ingot-wafer-Cell Module) and CIL Navikarniya Urja Limited for renewable energy.

Important Developments:

It is aiming at installing 3,000 MW Solar Projects by FY24. Work orders for 240 MW have been awarded in FY22. Additionally, it is focusing on fully automated and environment-friendly coal loading by setting up Coal Handling Plants and Silos.

3. Hindustan Zinc Ltd (HZL):

Incorporated in 1966, Hindustan Zinc has a rich experience of more than five decades in Zinc- lead mining and smelting.It is an Indian mining and metals company that produces zinc, lead, and silver. It has a dominant market position in India’s zinc and lead industries and is one of the world’s largest integrated zinc producers.

Company is a subsidiary of Vedanta Limited which owns 64.9% stake in it and balance 29.5% stake is owned by Government of India.

Manufacturing Capabilities:

The co. has 1.2 MTPA mined metal capacity, of 800 tonnes silver refining capacity & 1.123 MTPA Zinc-lead smelting capacity.Company has long mine life of 25 years with 448MT reserves .

Strategic divestment by GOI:

Government is selling its entire shareholding (29.5%) in the co. This decision was approved by the cabinet on 22 May 2022.

4. Hindustan Aeronautics Ltd (HAL):

Hindustan Aeronautics Limited is a state-owned aerospace and defence company in India. Hindustan Aeronautics is engaged in the business of Manufacture of Aircraft and Helicopters and Repair, Maintenance of Aircraft and Helicopters.

HAL plays a strategic role in India’s defense program being the only Indian company having specialization in aircraft manufacturing and providing its Maintenance and related services.

Company spends6% to 7% of the total revenue into the research and development activity annually and increased R&D reserve from 10% to 15% of PAT last year to build a sufficient R&D reserve.

HAL has signed an MoU with Safran to set up a joint venture intended for development, production, sales and support of helicopter engines

MoU with the IAI, Israel Aerospace Industries on 4 March 2022 to convert the civil passenger aircraft to multi-mission tanker aircraft.

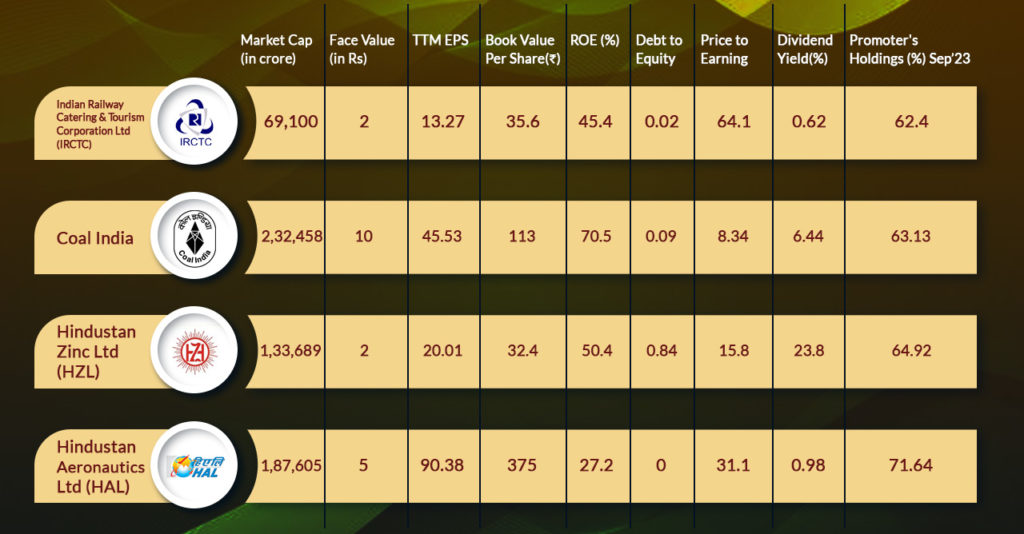

Comparison of these 4 Monopoly Stocks:

Please SHARE the BLOG and let us know your opinion about Monopoly Stock by COMMENTING.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Leave a Reply