Options trading is a type of financial derivative instrument that can be an excellent way to generate revenue in the stock market. However, it’s essential to understand how it works.

In options trading, the option premium is a crucial factor. It is the price an option buyer pays to an option seller for the right to buy or sell an underlying asset at a specific price and time.

We have already discussed detailed information about Call Options Trading & Put-Options Trading in a previous blog.

Through this blog, we are going to provide a complete understanding of what option premium is, how it is calculated, and its importance in the trading world. This will strengthen your trading journey.

Also Read : Beginner’s Guide to Options Trading

What is Option Premium?

An option premium is the price that traders pay for a call or put option contract. When we buy an option, we acquire the right to trade the underlying asset at a predetermined price for a certain period of time. The price we pay for this right is called the option premium.

Components of Option Premium

The option premium consists of two main components:

- Intrinsic Value

- Time Value

1. Intrinsic Value

The intrinsic value of an option is the difference between the underlying asset’s current price and the option’s strike price.

For a call option, intrinsic value is calculated as:

Intrinsic Value = (Current Price − Strike Price)

Intrinsic Value = (Strike Price − Current Price)

But remember, When the calculation shows a negative number, the intrinsic value is considered zero because in such cases, the option wouldn’t be exercised.

2. Time Value

Time value is an option’s premium representing the probability that the buyer’s price may rise before expiration. It’s the difference between the option’s entire premium and intrinsic value.The time value can increase due to various reasons such as-

- Time to Expiration: Options that have more time until they expire typically have higher time value because there’s more chance for the underlying asset to move in a favourable direction.

- Volatility: Higher volatility increases time value because greater price swings in the underlying asset make profitable moves more likely.

- Risk-Free Interest Rate: Higher interest rates can also increase time value, especially for call options where there’s potential for the underlying asset’s price to rise above the strike price.

Formula for Time Value is:

Time Value = Option Premium − Intrinsic Value

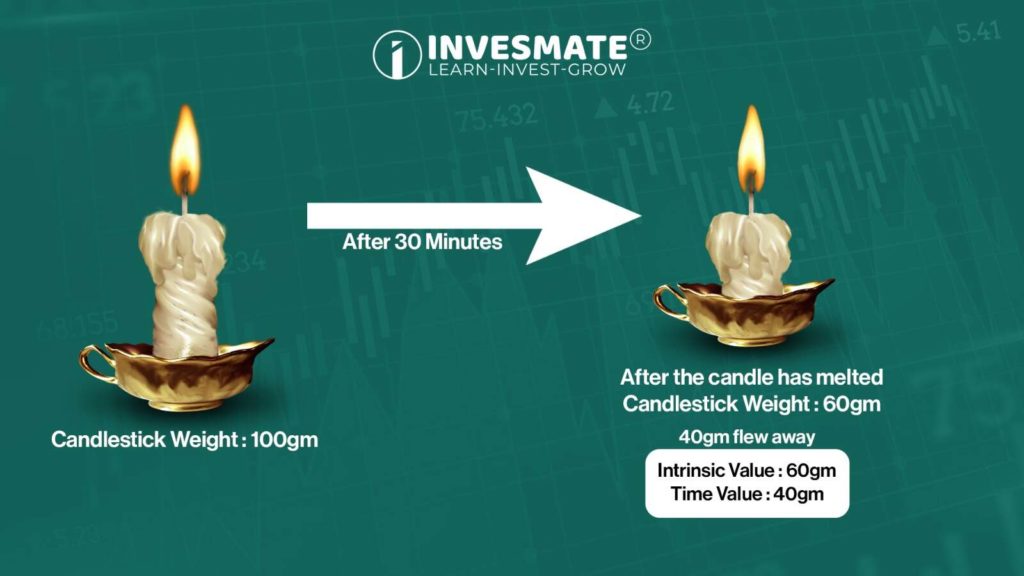

Let’s take an example to see how Intrinsic Value and Time Value work.

Looking at the Image above, you can see that we have taken a candle that weighed 100 grams. After 30 minutes, we found that the candle had melted. We weighed it again and found that the weight of the candle was 60 grams, and the amount that melted away was 40 grams. So, the remaining 60 grams is my intrinsic value, and the 40 grams that melted away is my time value.

How is Option Premium Calculated?

Option premiums are calculated by adding an option’s intrinsic value to its time value.

Option Premium = Intrinsic Value + Time Value

Option Premium Example

Let’s consider two practical examples to illustrate how option premiums work.

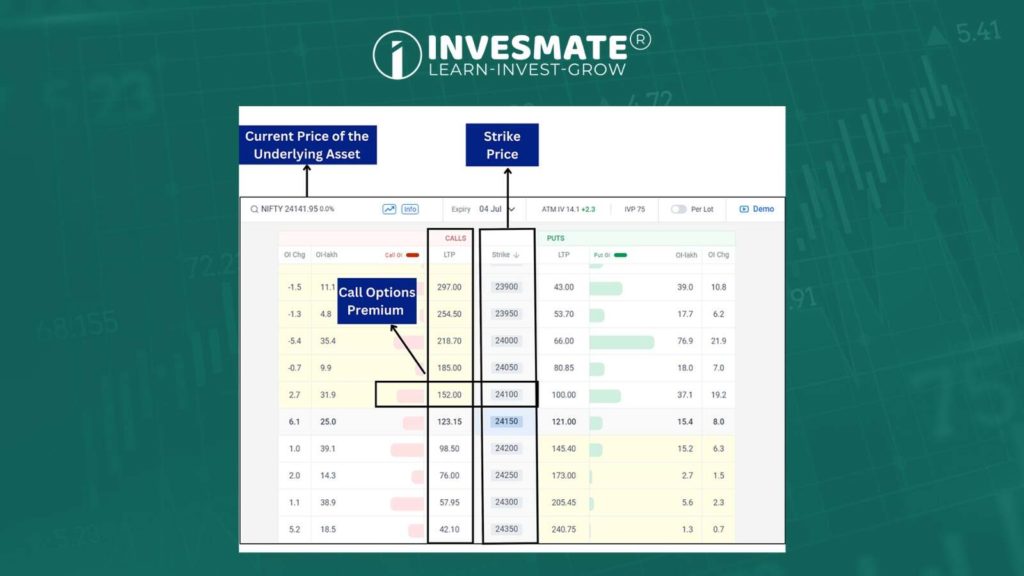

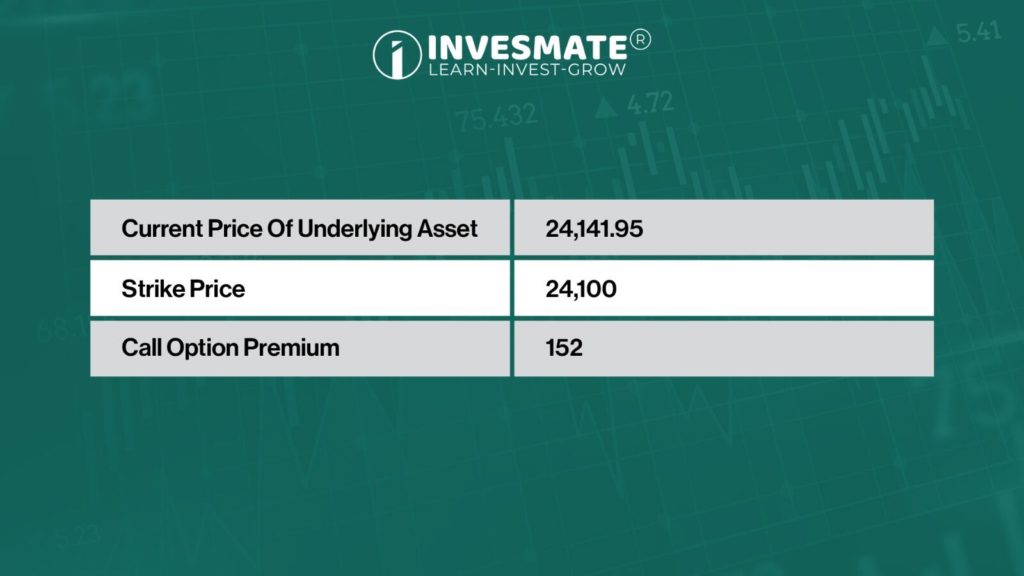

Example 1: Call Option

Let’s imagine that the Nifty 50 Underlying Asset is currently trading at 24,141.95 You have decided to Buy a Call Option with a Strike Price of 24,100, expiring on 04th, July, 2024. Premium of this option is Rs.152.

In this case, the intrinsic value of the call option is:

Intrinsic Value = 24,141.95 − 24,100 = 41.95

Since the option premium is 152, the Time Value is:

Time Value = 152 − 41.95 = 110.05

Thus, the Rs. 152 premium is composed of Rs. 41.95 “Intrinsic Value” and Rs. 110.05 “Time Value”.

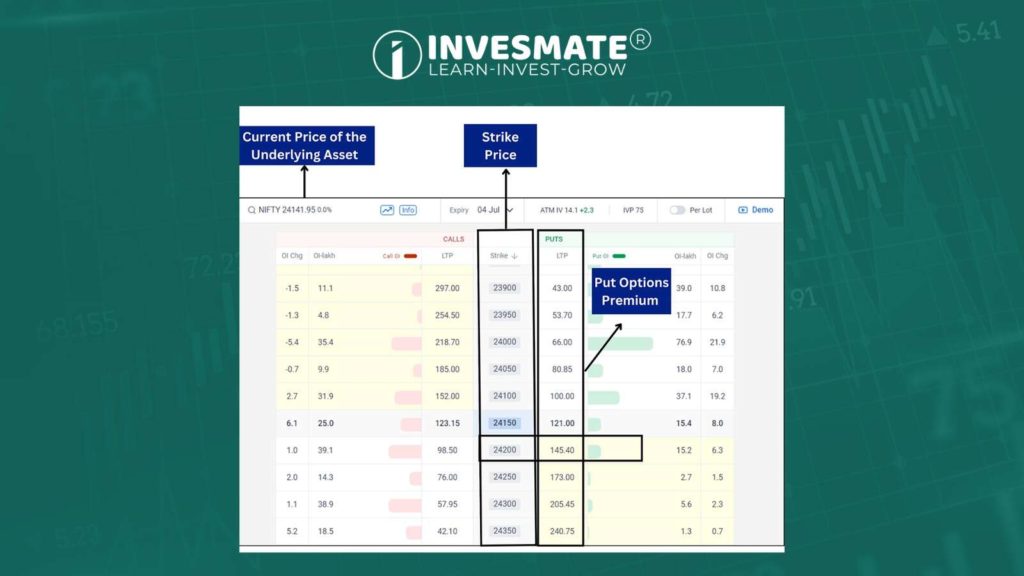

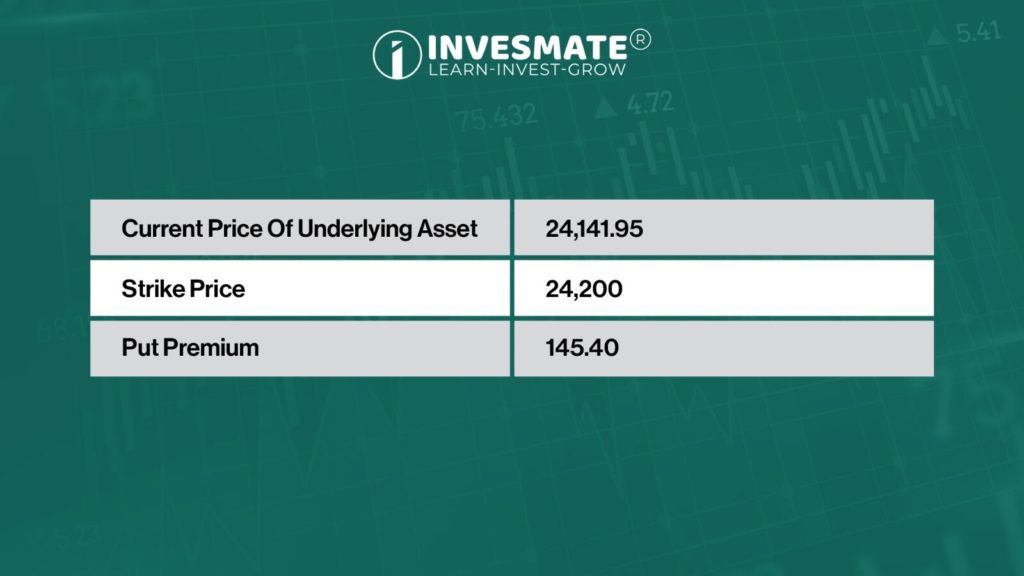

Example 2: Put Option

Let’s imagine that the Nifty 50 Underlying Asset is currently trading at 24,141.95 You have decided to Buy a Put Option with a Strike Price of 24,200, expiring on 04th, July, 2024. Premium of this option is Rs. 145.40.

In this scenario, the intrinsic value of the put option is:

Intrinsic Value = 24,200 − 24,141.95 = 58.05

The Time Value is:

Time Value = 145.40 − 58.05 = 87.35

Therefore, the Rs. 87.35 premium consists of Rs.58.05 “Intrinsic value” and Rs.87.35 “Time Value”.

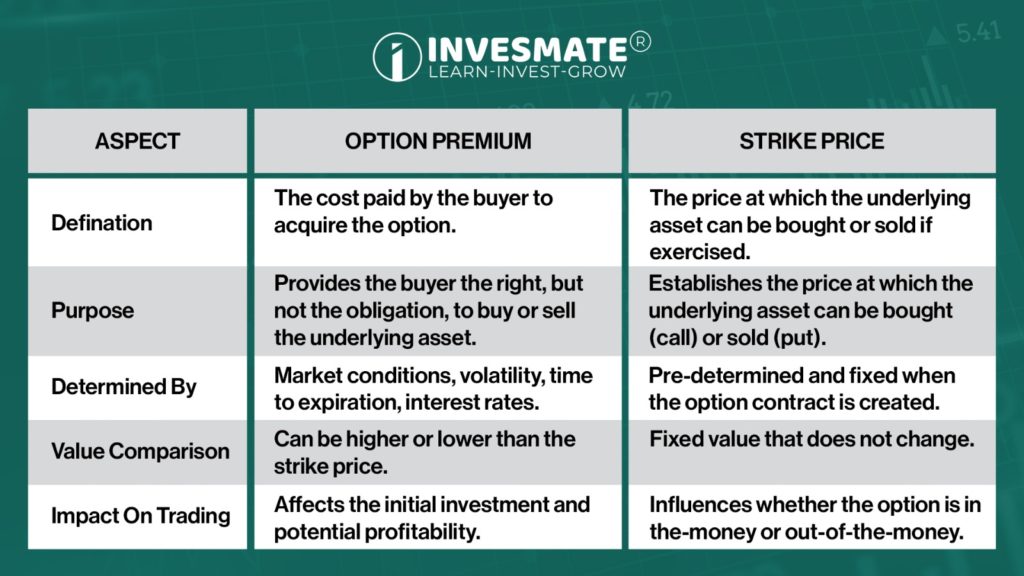

Option Premium vs Strike Price

The strike price is the price at which the underlying asset can be bought (for a call option) or sold (for a put option) if the option is exercised. Conversely, The option premium is what you pay to acquire the option.

The premium can be higher or lower than the strike price, depending on market conditions and the time remaining until expiration.

Learn stock market through Invesmate completely in Bengali language

Remember that options trading involves risks, and there’s no guarantee of profits. Take your time to learn and practice, and gradually build your skills and confidence as a trader.

FAQs

The option premium is the price paid by the buyer to the seller for the rights provided by the option contract.

The option premium is calculated using the formula: Option Premium = Intrinsic Value + Time Value.

When an option premium becomes zero, the option is considered worthless. This typically happens at expiration if the option is out of the money.

As an option writer (seller), you receive the premium when you sell the option contract. The buyer of the option cannot sell the premium but can sell the option itself if it is tradable.

The option premium is determined by the market, based on factors such as the underlying asset’s price, strike price, time to expiration, volatility, and risk-free interest rate.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Leave a Reply