Recently we have seen Market has made its 52 week high and then a stiff correction seen in the market. Now, there is a buzz in the market that the market could crash in upcoming 2023 year.

What could happen in the market in the next 2023 year?

This blog will help you to understand actual facts of the stock market in the next 2023 year.

Table Of Contents

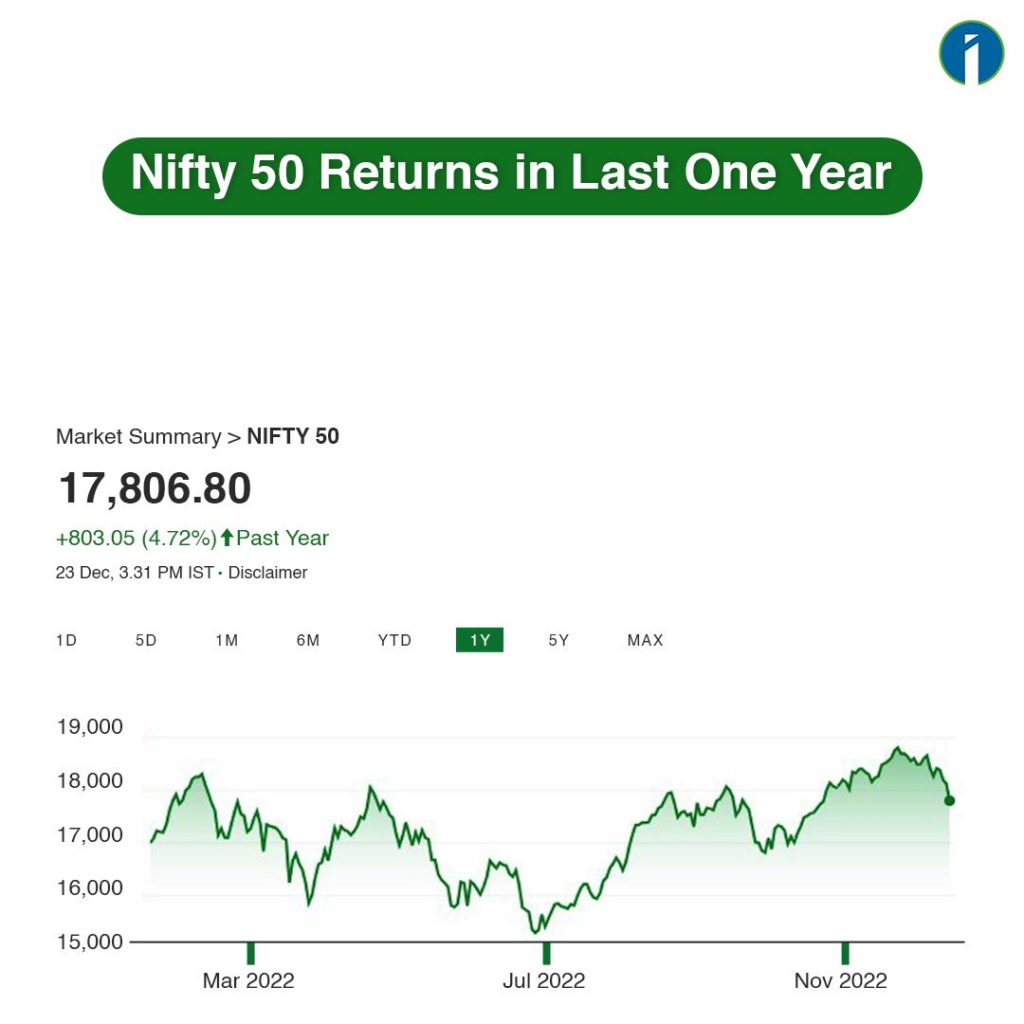

WHAT HAPPENED IN LAST ONE YEAR

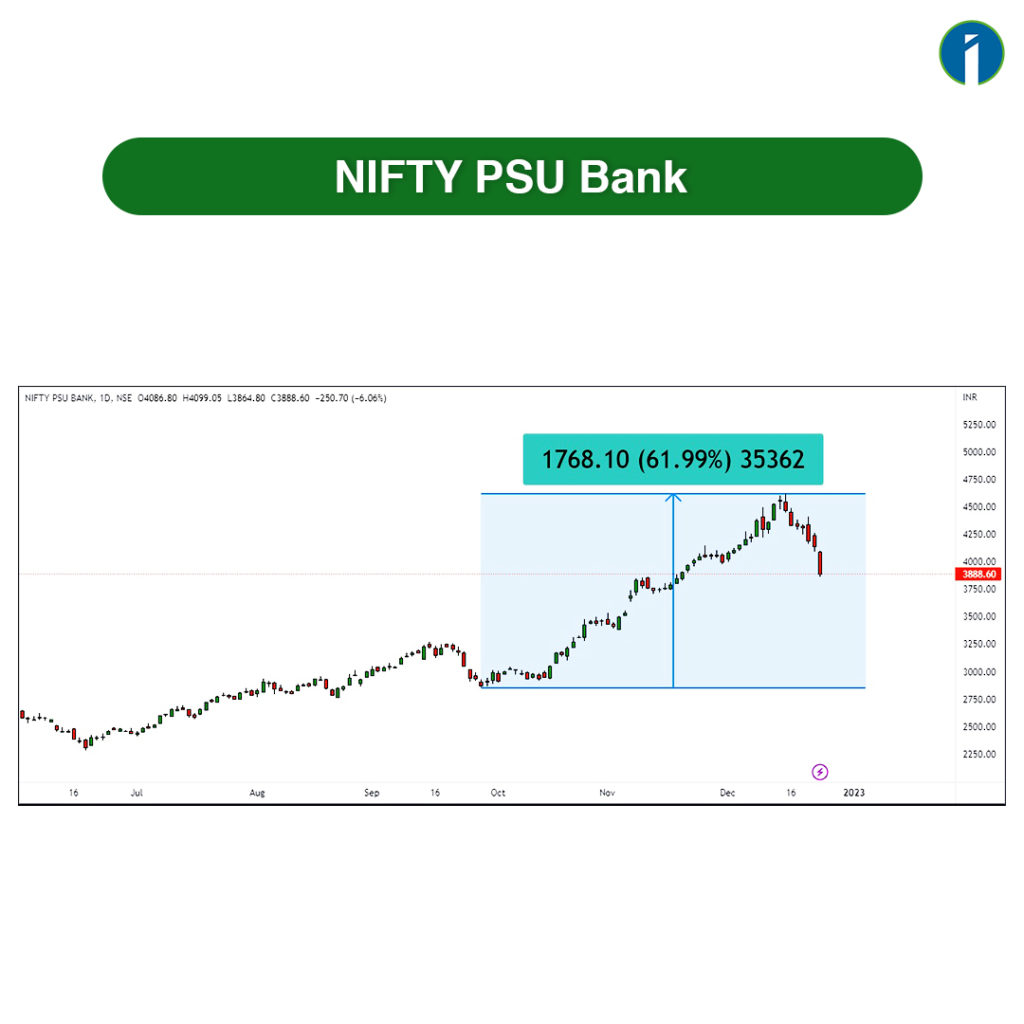

NIFTY 50 gives around 4.72% return in the last one year. But in this period only PSU Bank, FMCG etc. sector gives positive return.

Only few percentage of NSE listed stocks rallied in this last one year, even many of the NIFTY 50 quality stocks like Asian Paints, Bajaj Finance did not participate in that rally.

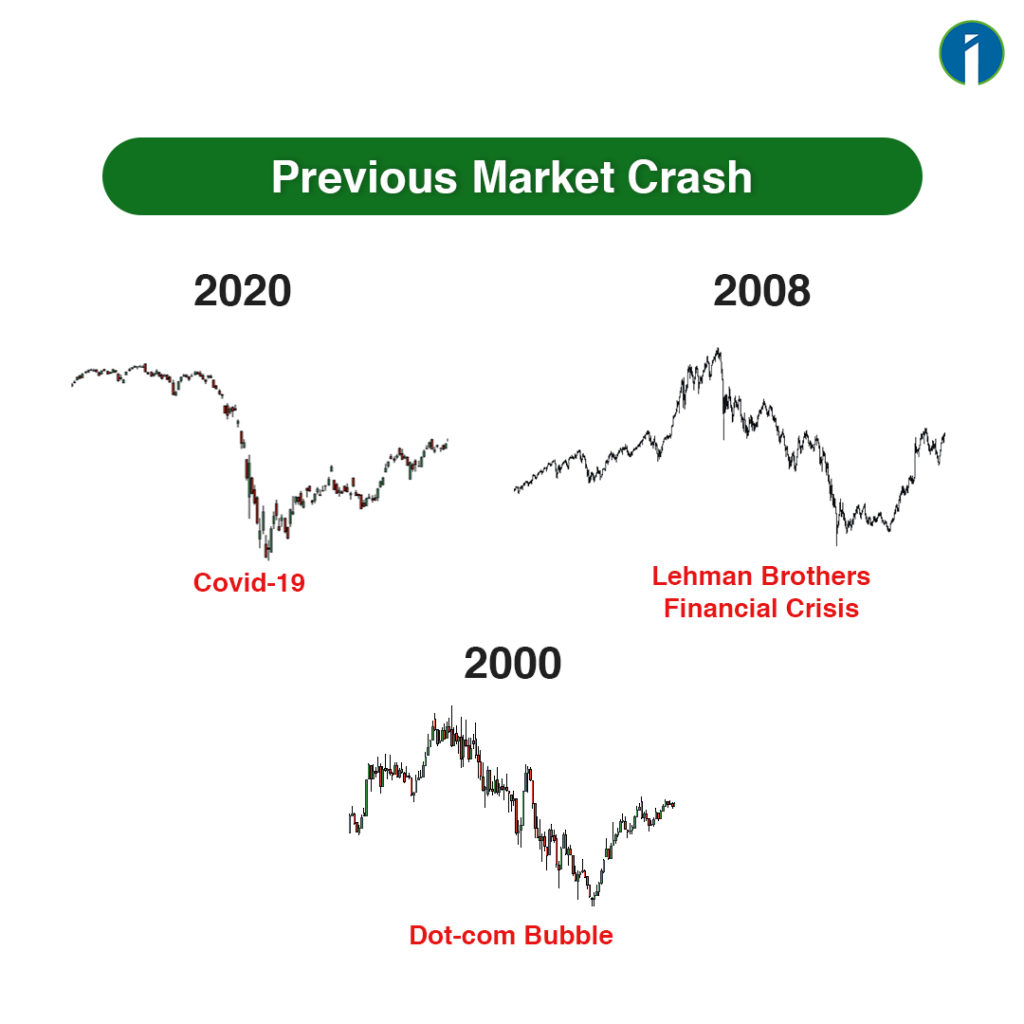

There is a thin difference between Market Fall and Market Crash. It needs a specific reason for heavy fall or market crash like Corona virus pandemic situation, Lehman brother’s crisis or Y2K.

In general, it refers to a very fast and significant decline. Investors lose their money as prices start to fall. It causes them to sell their assets for fear of losing more money, which drives stock prices down even further in a self-perpetuating cycle. It can be clearly understandable, when we look at NIFTY 50 chart of 2020(Corona virus), 2008(Lehman bros.) or 2000(Y2K). It needs a specific reason for market crash.

PRESENT FACTS & FIGURES

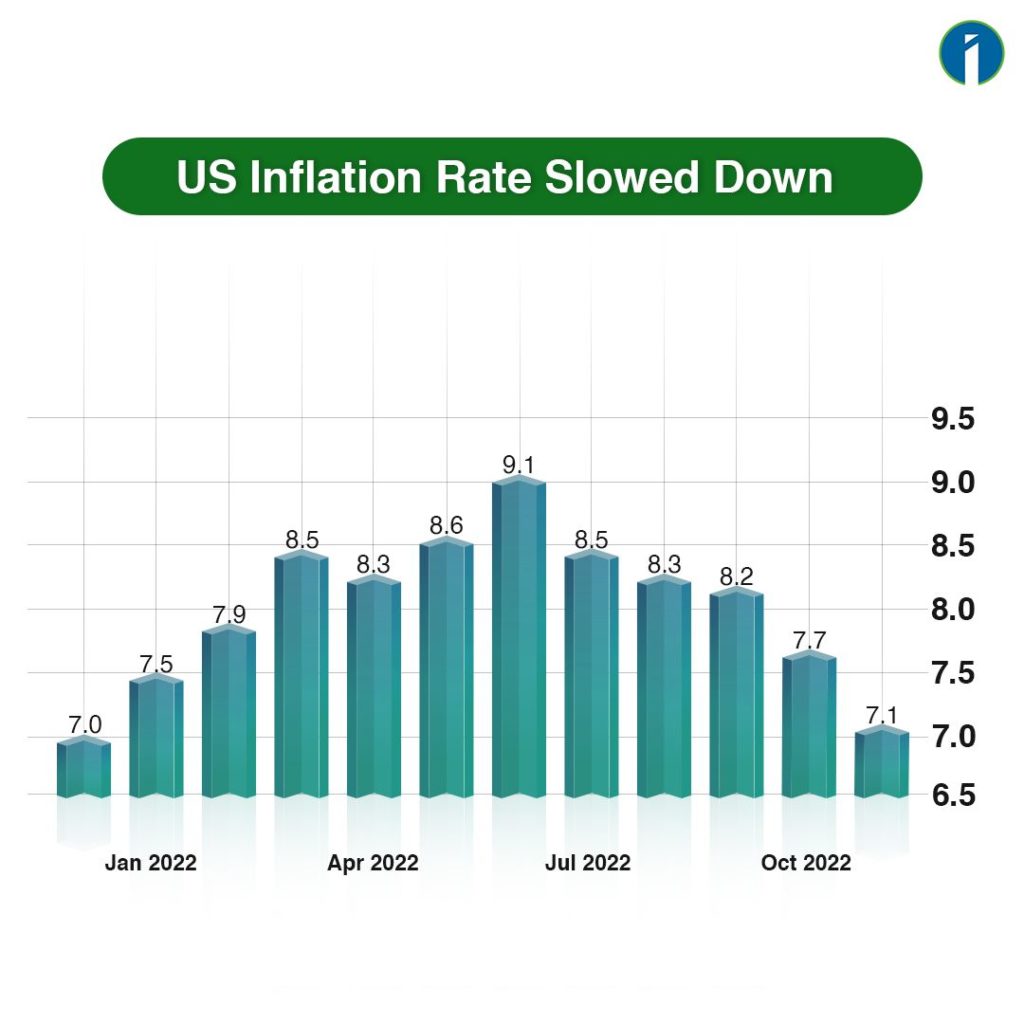

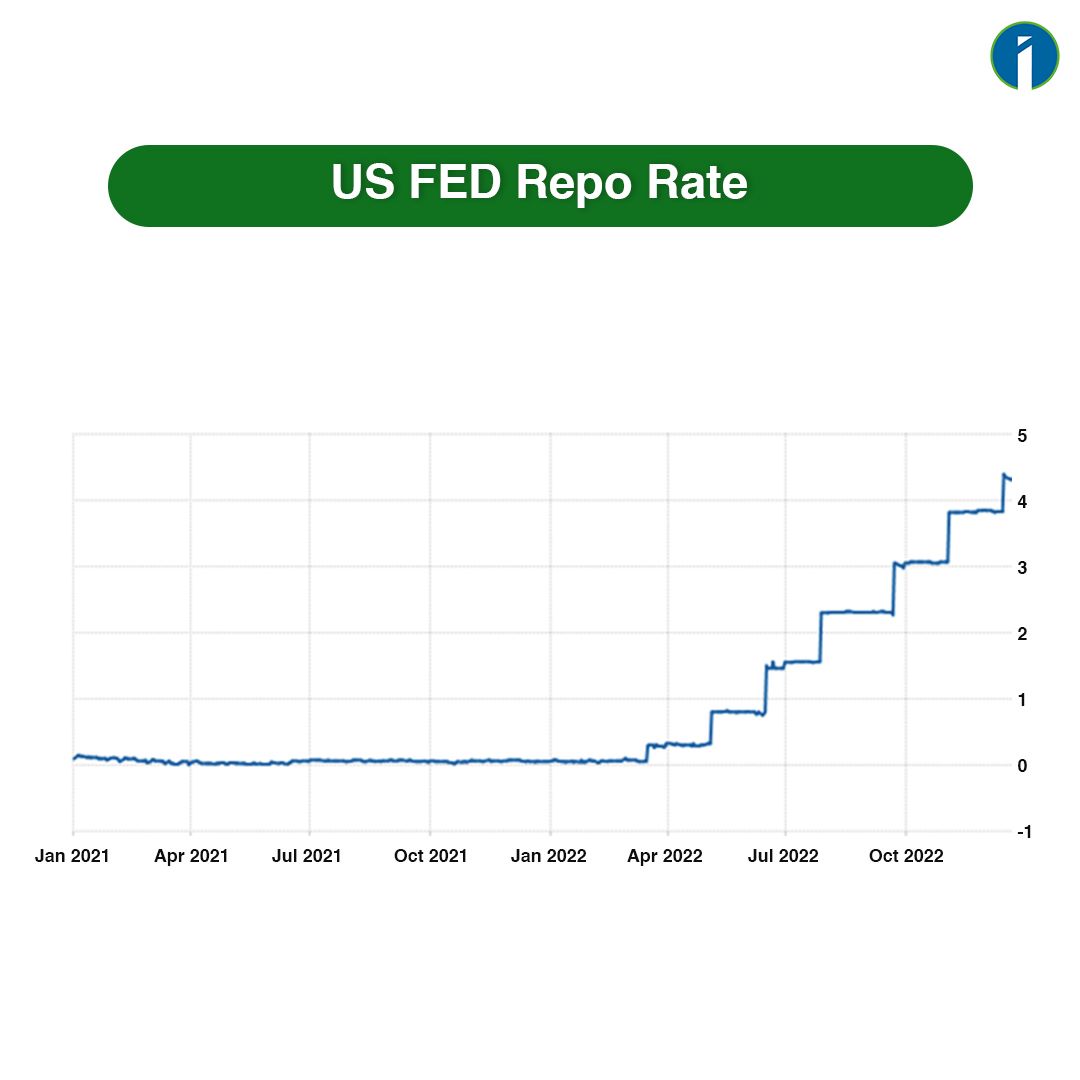

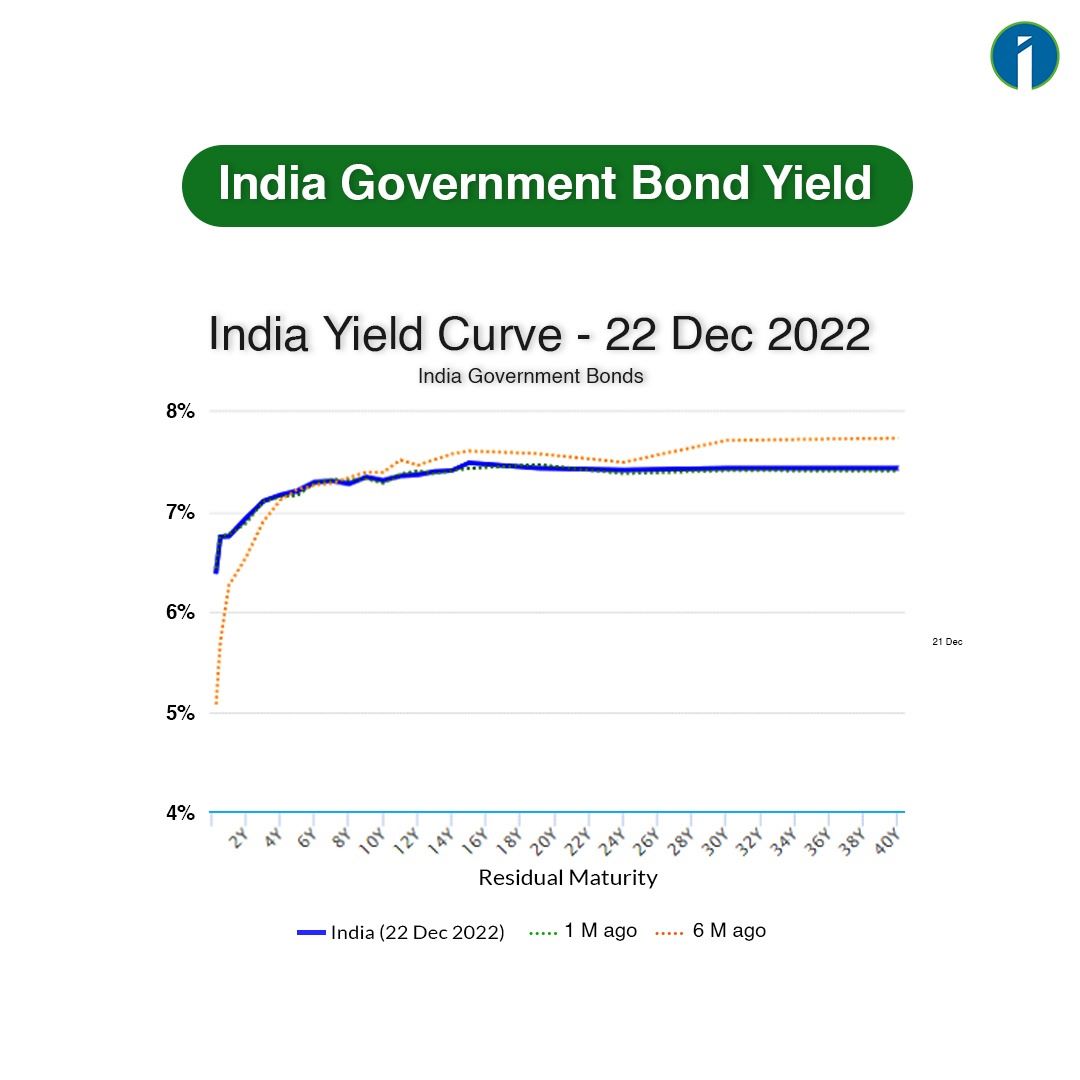

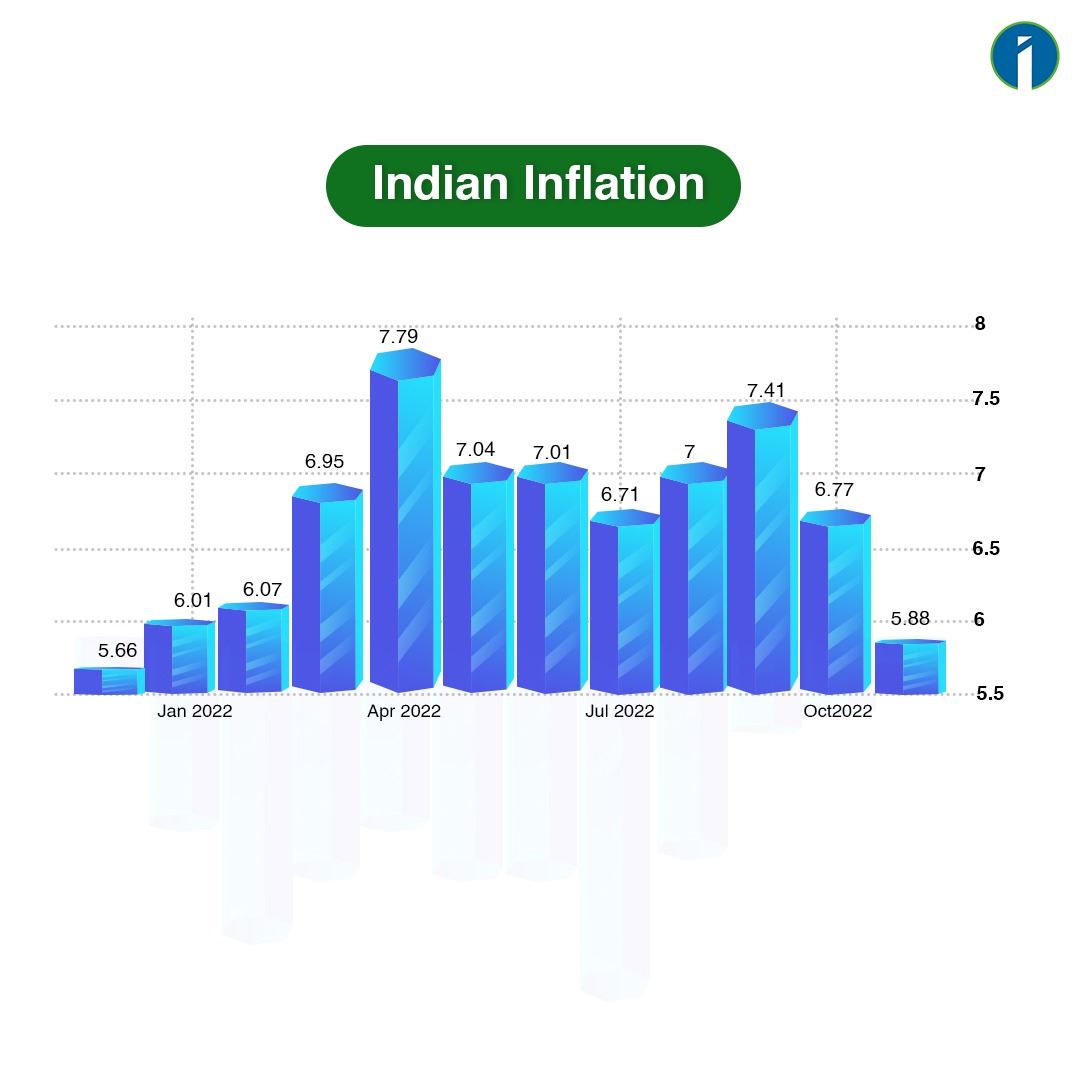

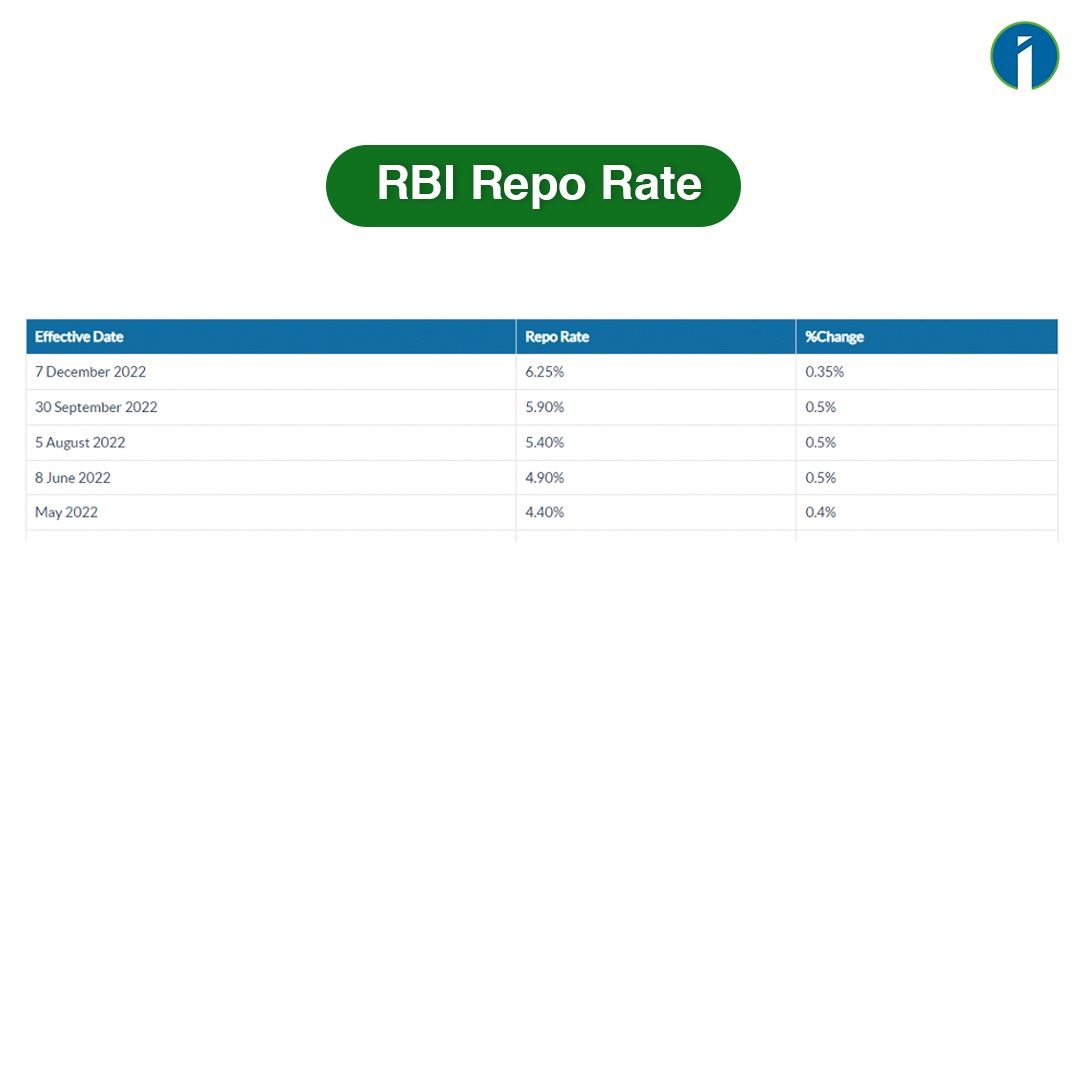

Global economic data

Although our Indian stock market shows a great retail investor’s strength in recent times, but economic factors always to be keep in mind.

Lets try to analysis this situation with marco economic data.

Our Domestic Factors

#Layoffs

- The technology sector in US is witnessing a wave of layoffs including some of the biggest brands in the world which include Amazon, Meta, Twitter and more.

- According to a survey by staffing and recruitment services firm Randstad, hiring activity in the Indian information technology industry is likely to pick up in the first quarter of 2023 despite of a hiring freeze and big tech layoffs.

- As per that survey, seven in 10 IT companies are likely to increase their headcount during January-March 2023.

- Factors like cost optimization and India’s stable geographical, political & economic foundation are contributing to firms looking to invest in the country.

#Fii_Diis

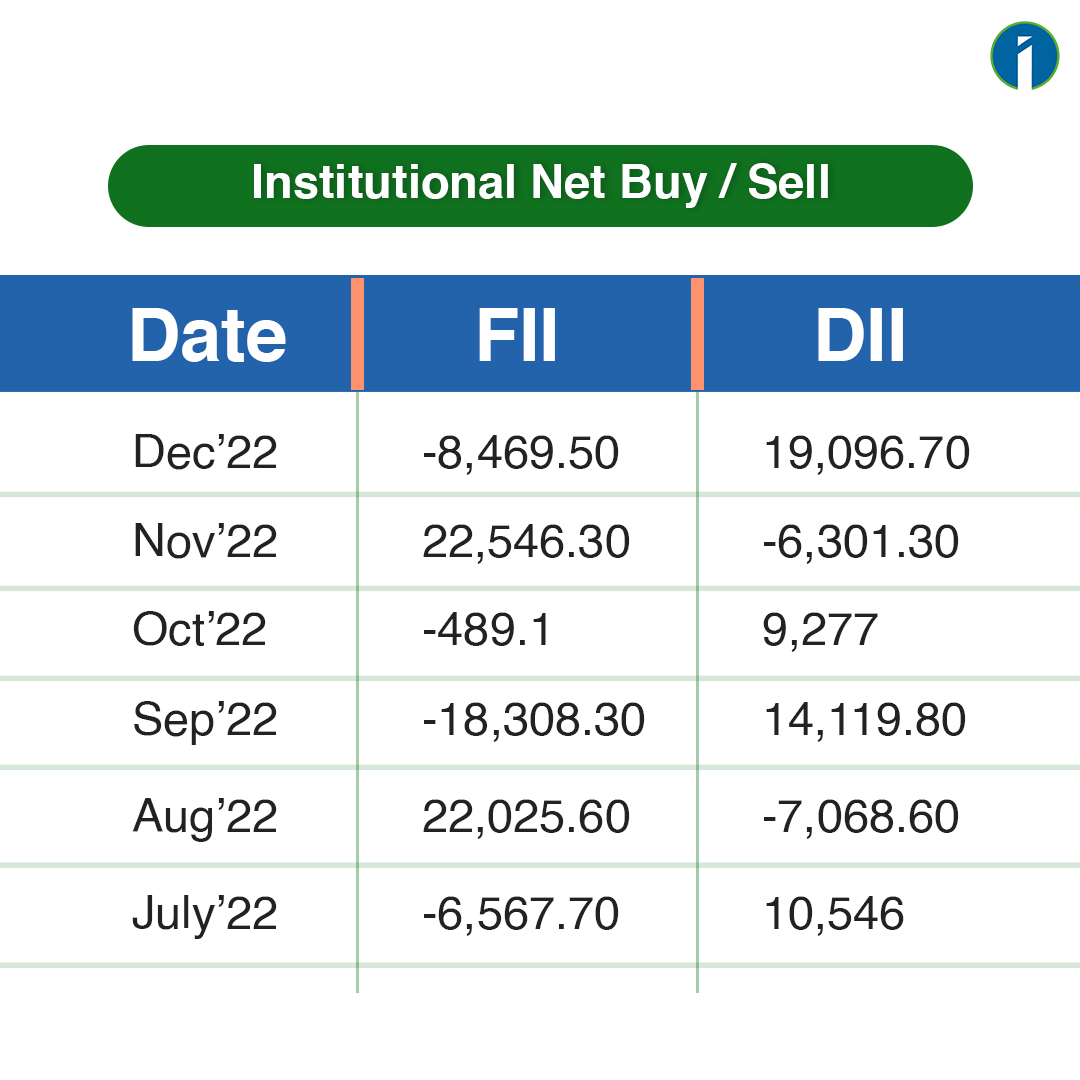

- We have seen a huge sell off from Foreign Institutional Investors (FIIs) starting from October 2021 and they have continued this sell off till July 2022.

- Earlier, at the time of corona virus pandemic recovery period FIIs were aggressively investing in the Indian market till March 2021. After that they started withdrawing their money slowly.

- On the other side Domestic Institutional Investors (DIIs) are showing their strength from that same period of March 2021 and started buying gradually.

- Indian retail investors are also now showing their strength through several Mutual Fund houses, which is also consider as DIIs. Investment in MF in the Indian market crossed Rs 13000 Cr. mark on October 2022 for the first time in history.

Present Covid Scenario

- In view of the sudden surge of COVID cases in different countries, Indian Medical Association (IMA) alerts and appeals the public to follow COVID appropriate behavior with immediate effect.

- As per the available reports, nearly 5.37 lakhs new cases have been reported in last 24 hours from major countries like USA, Japan, South Korea, France and Brazil.

- India has reported 145 new cases in last 24 hours out of which four cases are the new China variant – BF.7.

- These sudden spikes of corona virus create some volatility in the market. Because of this, panic selling is now seen in the market.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Thank you so much

Very Informative Data

Very Informative Content .

Great post! I really enjoyed reading it. The information was well-researched and presented in a clear and concise manner. I also appreciated the personal touches you added, as they made the post feel more relatable and engaging. Keep up the excellent work!

It’s just fantastic informative.

Kudos….👍👍

Very informative blog article. Everything is explained in detail.

360 degree analysis and top notch presentation, as usual from invesmate…👍

Nice Blog thanks for those informative knowledge.

360 degree analysis .top notch premium material from invesmate…..

Too informative..keep it up ☺️

Very much informative, Thanks for sharing this knowledge .

Informative

Excellent! Thank you for this

in-depth analysis.

Very informative

Super informative and helpful content. Thank you for sharing.

Very much informative , Thanks for sharing.

Very informative. Thank you.

Lots of new things here.

Thank you for this blog

Wow explanation 💕

Very helpful data. Thanks Invesmate!

Very much impressive. Thanks for sharing.

Very Informative

Thanks For The Information…..

Very nice information