Momentum trading is a powerful strategy in the trading world that allows traders to profit from the strength of the current price trend. By leveraging momentum trading, traders can ride upward or downward trends to achieve significant returns.

Through this blog, we will discuss the key aspects of Momentum Trading and highlight the best strategies for success. How can you effectively apply this strategy to your trading approach? Let’s find out

What is Momentum Trading?

Momentum Trading Strategy refers to a strategy that aims to profit from significant upward or downward trends in a stock’s momentum.

In simple terms, it involves following the current trend. The momentum trading strategy is designed to capitalise on short-term uptrends or downtrends.

This means that in momentum trading, we try to buy stocks or securities that are showing bullish momentum and sell those that are showing bearish momentum.

How Does Momentum Trading Work ?

Momentum trading doesn’t wait for the “buy low and sell high” approach. Instead, it takes advantage of trends by buying at high prices and selling at even higher prices. Rising prices attract more buyers, which drives the price up further and strengthens the trend.

It continues until selling pressure surpasses buying pressure. To maximise profit, it is essential to evaluate the strength of the trend, as a weak trend may not be profitable in the long term. A strong trend always provides the best opportunity for momentum trading.”

Elements of Momentum Trading

Security Selection: Focus on assets with recent strong price movements and high liquidity.

Trading Volume: High trading volume indicates strong interest and potential for sustained momentum.

Price Volatility: Assets with high volatility offer more profit opportunities, but they also come with increased risk. To maximise potential profits, you should select volatile assets and manage the associated risks.

Timing the Entry and Exit: Enter trades during a strong momentum phase and exit before the trend reverses. Technical analysis tools can be used to determine the precise timing for entries and exits.

Risk Control: Manage risk through stop-loss orders, appropriate position sizing, and diversification.

Momentum Trading Strategy

Breakout Trading Strategy

Breakout trading is a strategy where you initiate a trade when an asset’s price breaks through a key support or resistance level. This approach is particularly effective if you believe these breakout points signal the start of a new trend, allowing you to potentially profit from the trend’s continuation.

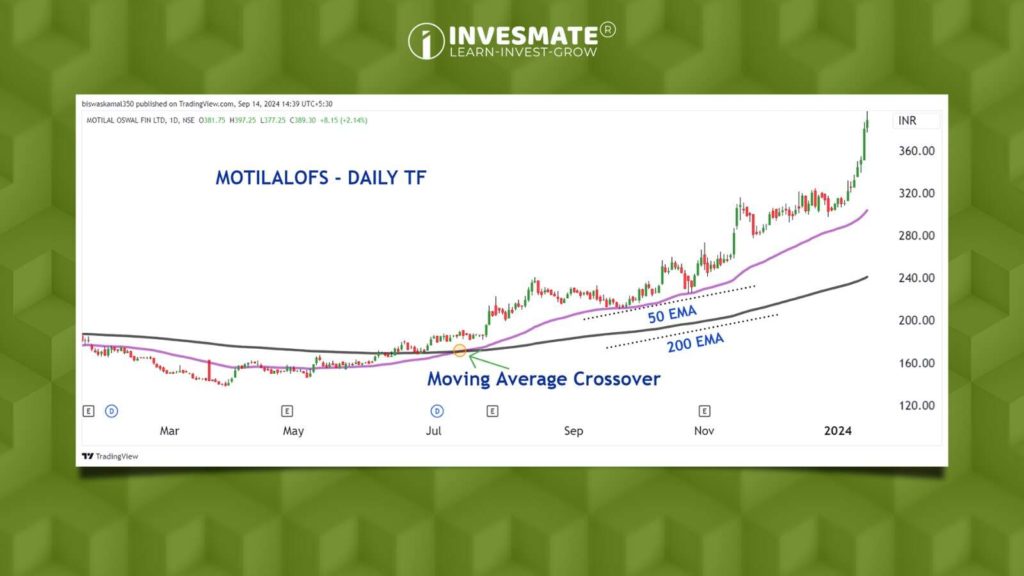

Moving Average Crossover Strategy

This strategy relies on the crossover of two moving averages (50 EMA and 200 EMA) to generate trade signals. An uptrend is likely when the shorter-term moving average (50 EMA) crosses above the longer-term moving average (200 EMA), while a downtrend is suggested when the opposite occurs.

Conversely, if the shorter-term moving average falls below the longer-term moving average, it may indicate a downward shift in the market.

Relative Strength Index (RSI)

We can use RSI to measure strength, meaning if it goes above 60, there is a possibility it will go up, while if RSI falls below 40, there is a possibility it will go down.

Buying Signals: Traders use RSI to spot buying opportunities. A buy signal is generated when the RSI moves up from below and crosses above 60, indicating that the asset might begin to rise in the short term.

Selling Signals: Traders use RSI to spot selling opportunities. A sell signal is generated when the RSI moves down from above and crosses below 40, indicating that the asset might begin to decline in the short term.

Momentum Trading Key Takeaways

Here are some essential tips for implementing a momentum trading strategy.

- Understand the Strategy: Get a solid grasp of momentum trading fundamentals and key technical indicators.

- Set Clear Rules: Define your entry and exit signals, position sizing, and risk management criteria.

- Utilize Technical Tools: Different indicators should be used to confirm signals, but you should not rely on just one indicator.

- Manage Risk: Implement stop-loss orders, diversify your portfolio, and avoid excessive leverage.

- Maintain Discipline: Follow your trading plan strictly and steer clear of emotional decisions.

- Backtest Your Strategy: Test your approach thoroughly with historical data before trading live.

Conclusion

Momentum trading can be a powerful strategy if executed with discipline and a solid understanding of market dynamics. Remember, successful momentum trading requires ongoing learning and adaptation to the ever-changing market conditions.

FAQs

Momentum in trading is measured using indicators like RSI, MACD, and ATR. These tools assess price movements, trend strength, and market volatility.

To engage in momentum trading, identify strong trends using indicators, set clear entry and exit points, and manage risks effectively.

Momentum trading can be effective in trending markets but may struggle in choppy or sideways markets. Success depends on the correct application of indicators and market conditions.

Yes, momentum trading is a legitimate strategy used by many traders to capitalise on market trends. However, it requires careful analysis and risk management.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Leave a Reply