Basic Of Options Trading

Options trading is a fascinating and potentially lucrative way to participate in the financial markets. Before diving in, it’s crucial to understand the basics of options trading to make informed decisions and manage risks effectively.

In this blog, we’ll cover the fundamental concepts of options trading to help you get started on your trading journey.

What Is Options Trading ?

Option trading is a type of trading strategy where investors have the right to buy or sell an underlying asset at a predetermined price within a certain time frame, but these contracts do not provide any obligation to buy or sell. These contracts are called options.

How Options Trading Works?

Options trading involves buying and selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (called the strike price) on or before a certain date (called the expiration date).

Learn Stock Market through Invesmate in complete Bengali language.

Types of Options :

There are two main types of options: Call options and Put options

Call Option:

Call Options give the buyer the right to buy the Underlying Asset at the Strike Price before the Expiration Date. Traders typically buy call options when they expect the price of the underlying asset to rise.

Example: Below is a scenario as an example to understand Call Option easily

Scenario:

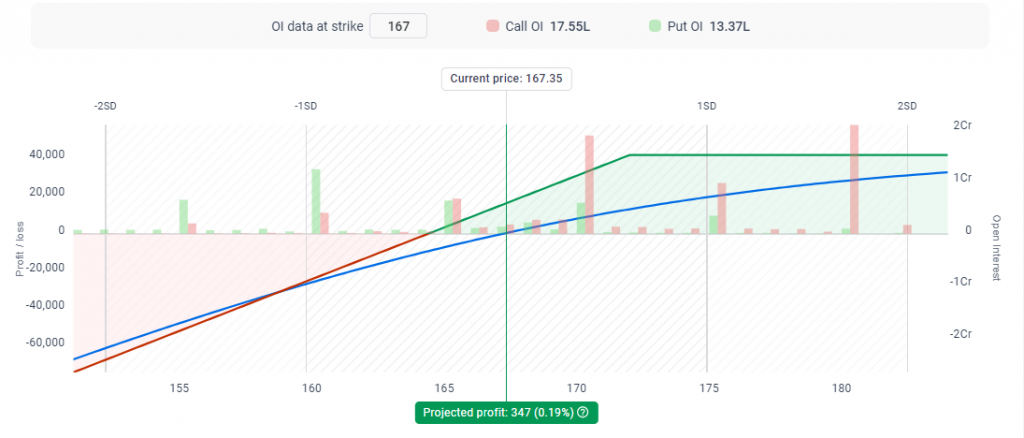

Nifty Spot Price = 22,604

Strike Price = 22,650 (Call Option Buy)

Premium Pay = 162

Expiration Date = 2nd May,2024

Imagine that the current spot price of Nifty is 22,604, and you predict a possible rise in its price. You have bought a call option at the strike price of Nifty 22,650 with a premium of Rs 162. This option gives you the right to buy but not the obligation. The contract will Expire on 2nd May,2024.

If the spot price of Nifty is 22,640 and the call option premium increases to 225 rupees, then by selling the option, you will book a profit of 1,575 rupees (25 shares × 65 rupees).

But one thing to remember is that if the Nifty Spot Price is below 22,604 or falls, you will lose the Premium paid for the option, in this case, Rs.4,050.

Put Option:

Put options give the buyer the right to sell the Underlying Asset at the strike price before the expiration date. Traders usually buy put options when they anticipate the price of the underlying asset to fall.

Example: Similarly, a scenario is shown below as an example to understand Put Option easily

Scenario:

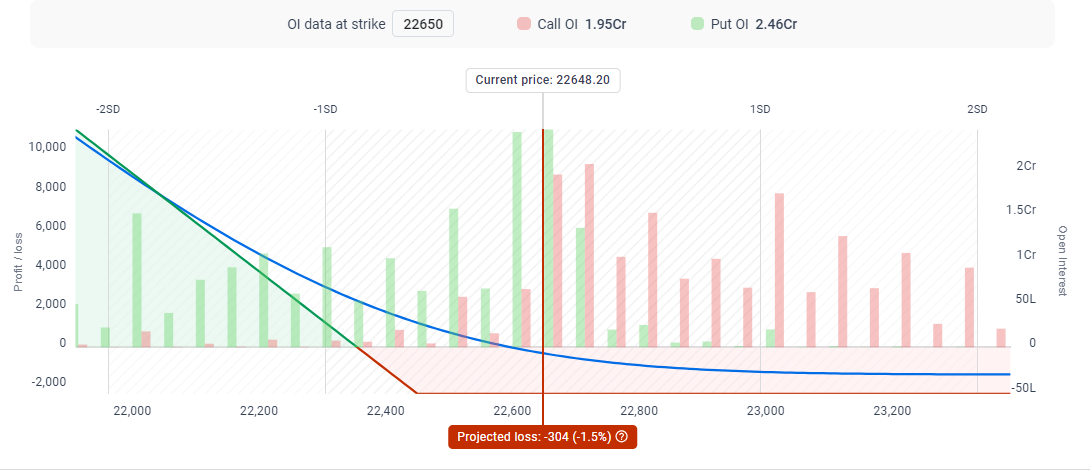

Nifty Spot Price = 22,604

Strike Price = 22,650 (Put Option Buy)

Premium Pay = 150

Expiration Date= 2nd May,2024

Imagine that the current spot price of Nifty is 22,604, and you predict a possible fall in its price. You buy a put option with a premium of Rs 150 on the strike price of Nifty 22,650. The contract will expire on 2nd May.

If Nifty falls between Expiry Date and Spot Price of Nifty falls below 22,604 then your option premium will increase. In this case, let’s say the premium of the Put option has increased to 210 rupees, then by selling the option you will book a profit of 1500 rupees (25 shares × 60 rupees).

But one thing to remember if the Nifty Spot Price stays above 22,604 or rises to 160, you will lose the Premium paid for the option, in this case, Rs.3,750.

Concepts of Options Trading:

Underlying Price:

A derivative contract’s value is tied to an underlying asset. This asset’s current market price is known as the underlying price.

Option Premium:

An option premium refers to the current market price of an option contract.

Intrinsic Value:

The difference between the current market price of the Underlying Asset and the strike price of the option.

Time Decay (Theta):

Theta measures how much an option’s price decreases with the passage of one day. Options lose value over time due to time decay, especially as they approach expiration.

Expiration Date:

This is the date on which an option contract expires and becomes worthless if not exercised. It signifies the termination date of the option contract.

Strike Price:

The strike price, also known as the exercise price, is the price at which the holder of an option can buy or sell the underlying asset when exercising the option.

Implied Volatility:

The strike price, also known as the exercise price, is the price at which the holder of an option can buy or sell the underlying asset when exercising the option.

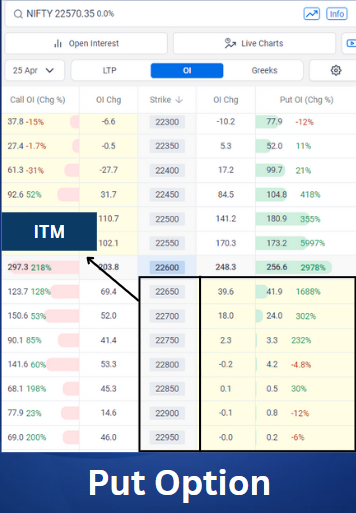

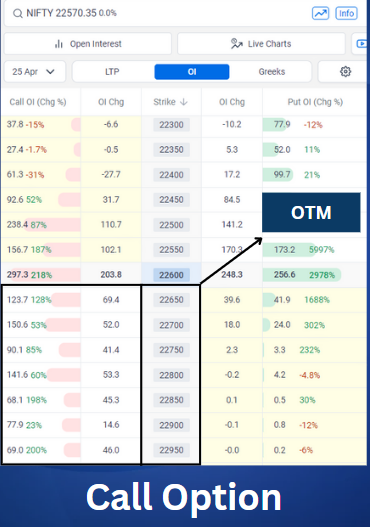

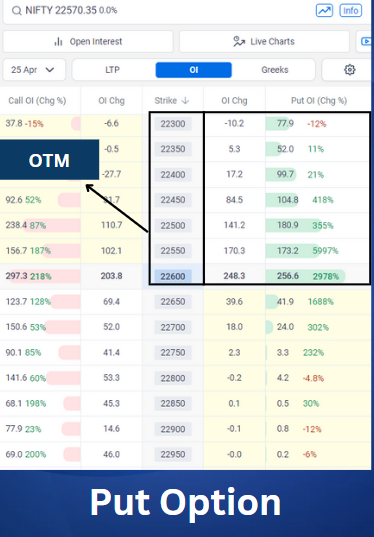

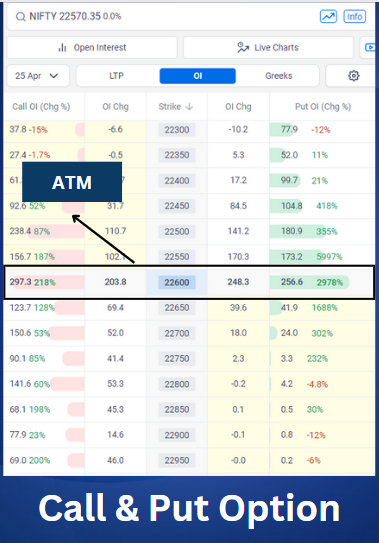

What Is ITM, OTM, ATM ?

Call Option: ITM when the Strike Price is Below the current Underlying Asset Price.

Put Option: ITM when the Strike Price is Above the current Underlying Asset Price.

Out of the Money (OTM):

Call Option: OTM when the Strike Price is Above the current Underlying Asset Price.

Put Option: OTM when the Strike Price is Below the current Underlying Asset Price.

At the Money (ATM):

Benefits of Options Trading

• Leverage:

Options allow you to control a larger position with less capital.

• Flexibility:

Options provide a variety of strategies for different market conditions.

Traders can be benefited in bullish, bearish, or neutral markets.

Options can be used for speculation, income generation, or risk protection.

• Risk Management:

Options can serve as an effective tool for hedging against potential loss in a portfolio or reducing downside risk in volatile markets.

Learn stock market through Invesmate in complete Bengali language.

Options Trading Strategies

▸Covered Call:

A Covered Call is an Options Trading Strategy where an Investor sells call options on a stock that they already own.

This strategy generates income from the premiums received from selling the call options, but it also limits the potential upside gains if the stock price rises significantly.

▸Protective Put:

A Protective Put is when an Investor buys put options on a stock they own, acting as insurance against potential losses.

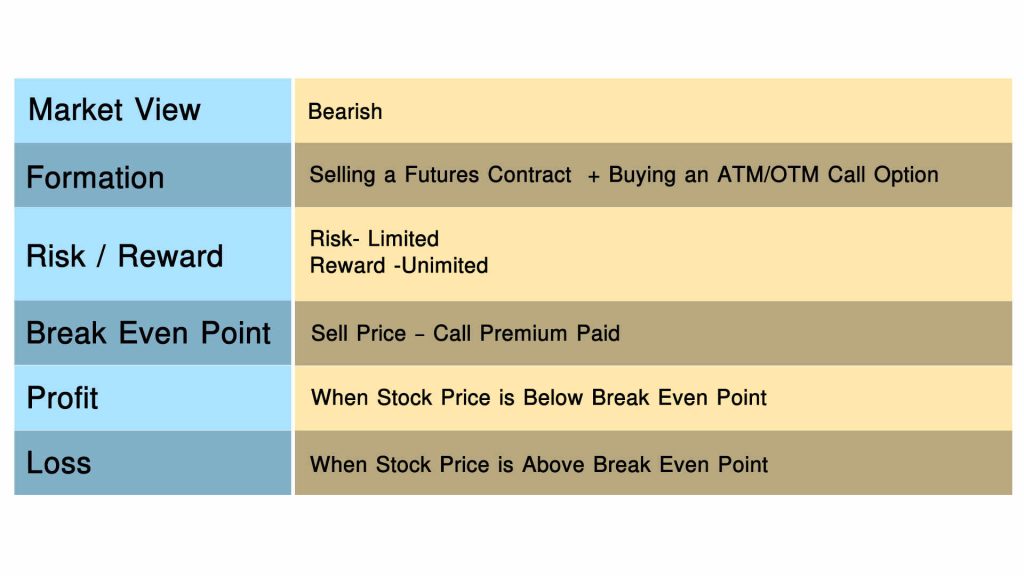

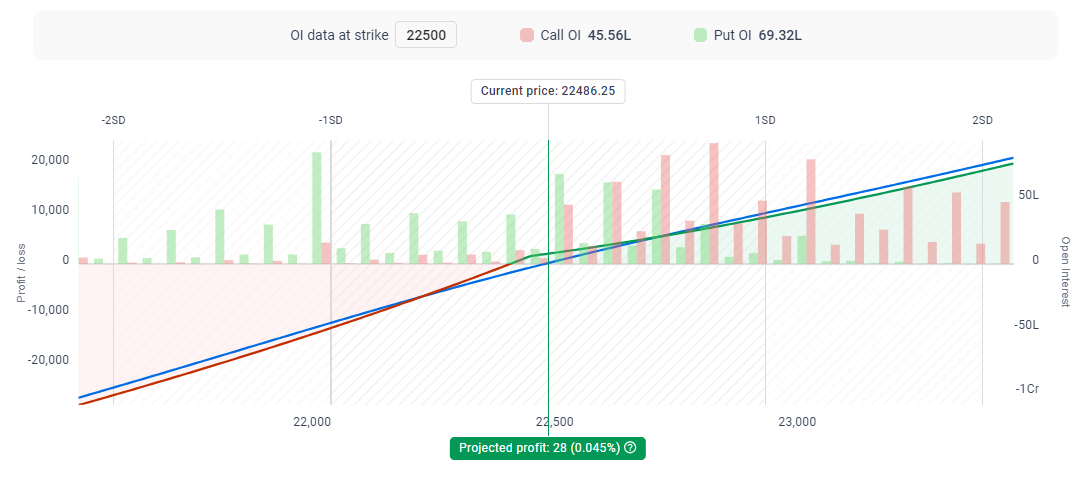

▸Long Call:

A Long Call is an options trading strategy where an investor purchases a call option on a stock or other Underlying Asset. This strategy allows the investor to buy the Underlying Asset at a predetermined price, known as the strike price, before the option’s expiration date.

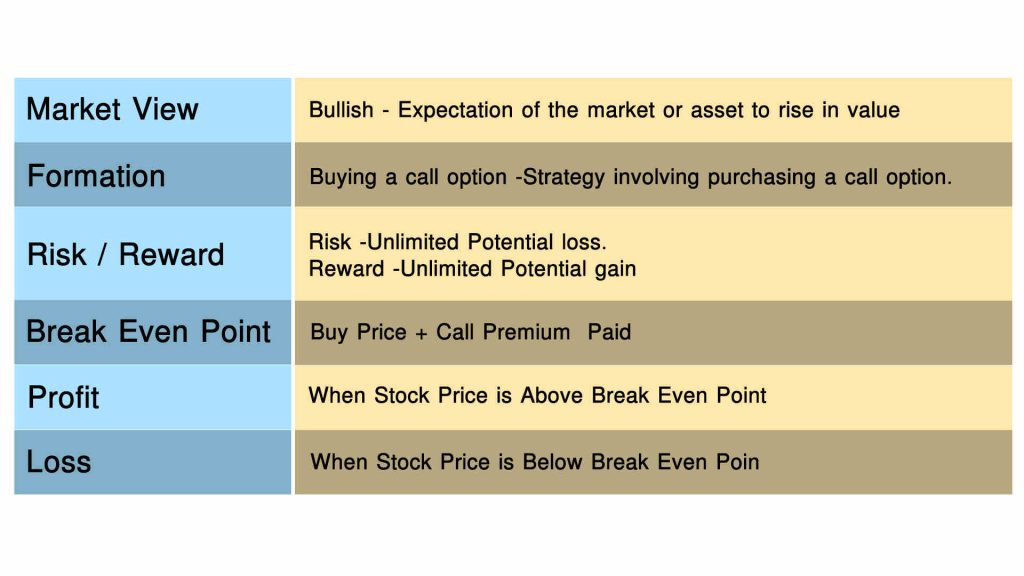

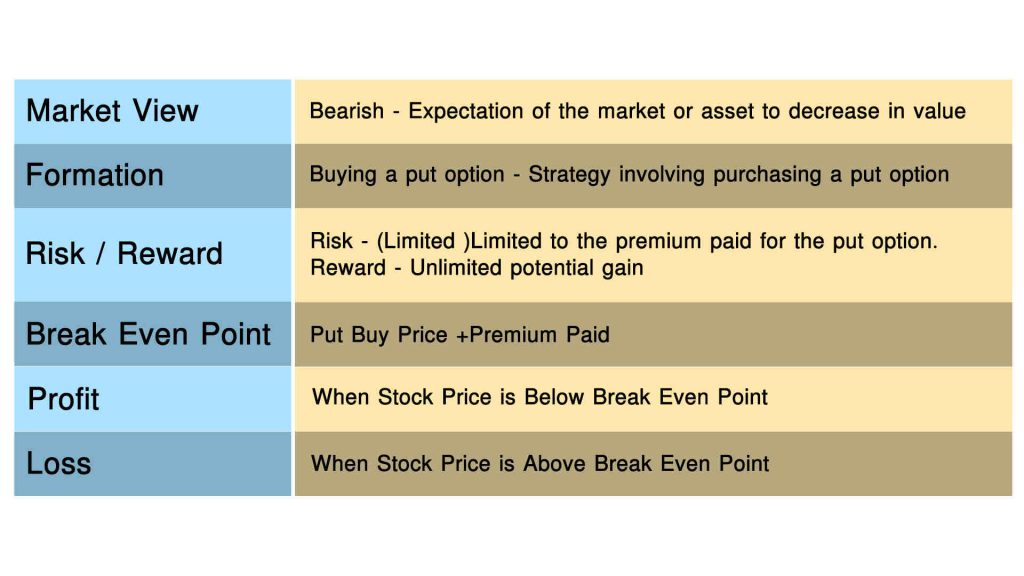

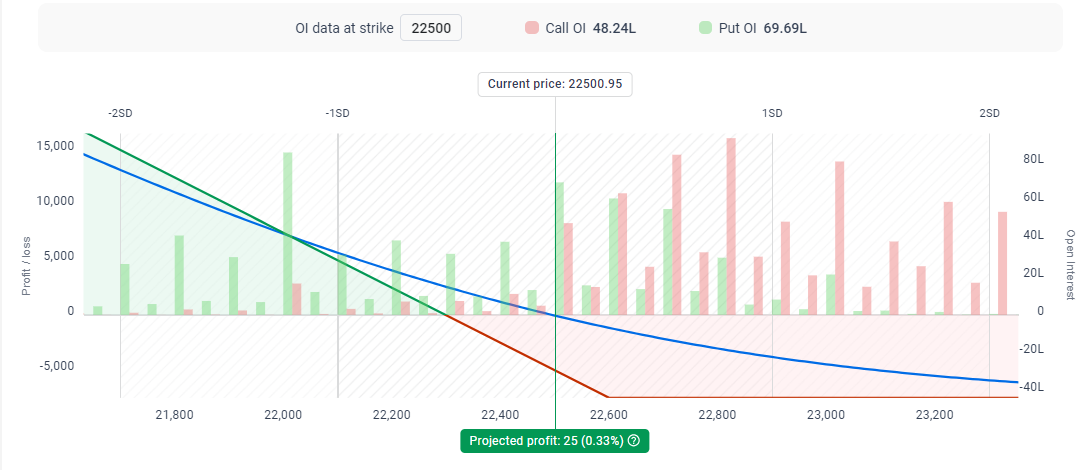

▸Long Put:

A Long Put is when an Investor buys a put option, expecting the price of the Underlying Asset to fall.

If you are willing to learn and read more about Option Trading, then you can join INVESMATE’s Option Trading Course.

Some advanced option Strategy :

▸Long Straddle

A Long Straddle is an Option Trading strategy where an Investor simultaneously purchases a Call Option and a Put Option with the Same Strike Price and Expiration Date on the same Underlying Asset.

▸Short Straddle

A Short Straddle is an Options Trading Strategy where an Investor simultaneously Sells a Call Option and a Put Option with the Same Strike price and Expiration Date on the Same Underlying Asset.

▸Long Strangle

A Long Strangle is an Option Trading Strategy where an Investor simultaneously Purchases a Call Option and a Put Option with Different Strike Prices but the Same Expiration Date on the Same Underlying Asset.

▸Short Strangle

A Short Strangle is an Options Trading Strategy where an Investor simultaneously Sells a Call Option and a Put Option with Different Strike Prices but the Same Expiration Date on the Same Underlying Asset.

▸Bull call Spread

A Bull Call Spread is an Options Trading Strategy that involves Buying a Call Option while simultaneously Selling another Call Option with a higher Strike Price, both having the Same Expiration Date and Underlying Asset.

▸Bull Put Spread

A Bull Put Spread is an Options Trading Strategy that involves Selling a Put Option while simultaneously Buying another Put Option with a Lower Strike Price, both having the Same Expiration Date and Underlying Asset.

▸Bear Call Spread

Bear call Spread strategy can be used when the sentiment of an index or share appears to be uncertain or bearish. Since the market view is bearish, the call option is sold here and the lower price call option is bought to protect this sell position. It helps you to make profit from a moderate decline in the stock or index’s value while limiting your potential losses.

▸Bear Put Spread

A Bear Put Spread is an Options Trading Strategy that involves Buying a Put Option while simultaneously Selling another Put Option with a Lower Strike Price, both having the Same Expiration Date and Underlying Asset.

▸Iron Condor

An Iron Condor is a multi-leg options strategy used by traders to profit from low volatility in the underlying asset. It involves four options contracts: two short options (one call and one put) with a higher strike price and two long options (one call and one put) with a lower strike price. The goal is to generate profit from the premiums received while limiting potential losses. The strategy profits when the underlying asset’s price remains within a specified range until expiration.

▸Butterfly Strategy

The Butterfly Strategy is an options trading strategy that involves buying and selling options with three different strike prices. It’s designed to profit from minimal movement in the price of the underlying asset.

Options Trading Tips For Complete Beginners :

• Avoid Low Liquidity Options:

When selecting options, pay attention to liquidity. Avoid options with low trading volume, as they may have wider bid-ask spreads and be harder to execute. Verify the volume at specific strike prices before making a decision.

• Different Strategies:

Market Conditions: Adapt your strategies based on market conditions.

For example:

In a bullish market, consider buying call options.

In a bearish market, consider buying put options.

Diverse Approaches: Explore various options trading approaches, such as covered calls, protective puts, and straddles.

Start with Paper Trading: Consider starting with Paper Trading or Virtual Trading platforms offered by brokerage firms. This allows you to practice trading options without risking real money, helping you gain experience and confidence.

▪ Remember that options trading involves risks, and there’s no guarantee of profits. Take your time to learn and practice, and gradually build your skills and confidence as a trader.

FAQs

You can get started trading options by opening an Demat account, choosing to buy or sell puts or calls, and choosing an appropriate strike price and timeframe.

Options trading can be risky, sometimes riskier than trading stocks. But if you learn about it, you can also find ways to reduce risk.

Earning Rs 1000 per day in the share market might seem ambitious, but it is achievable with the right strategies, knowledge, and discipline.

To become successful, options traders must practise with discipline.

Basic strategies for beginners include buying calls, buying puts, selling covered calls, and buying protective puts.

There is no option strategy that guarantees zero loss.

You can start small with a capital of less than Rs 2 lakhs too. However, as you start small, you need to be a careful trader so that you can cut down on the possibility of losses and enhance the return potential of your trades. Use these simple yet effective rules to trade in options with little money.

Call and put options form the basis of trading in options, enabling a trader to take bets on movement in the markets or hedge their risks efficiently. Having a firm grasp of the options can serve to construct profitable trading strategies. A great blog for beginners!