Earlier on this month on December 1st the Reserve Bank of India announced the launch of the digital rupee or the e-rupee. It is a Central Bank Digital Currency or CBDC that is going to be an electronic version of the rupee. It is going to be meant for retail transactions.

This article will help you to understand the whole process of digital currency and complete information about all the facts about digital currency.

What is CBDC?

- Central bank digital currencies (CBDC) are digital tokens issued by a central bank.CBDC is generally defined as a digital liability of a central bank that is widely available to the general public.

- Fiat money is a government-issued currency that is not backed by a physical commodity like gold or silver. It is considered a form of legal tenderthat can be used to exchange goods and

TYPE OF CBDC

CBDC can be classified into two broad types, viz. general purpose or Retail (CBDC-R) and Wholesale (CBDC-W).

- Retail CBDC (e₹-R) would be potentially available for use by all, viz., private sector, non financial consumers and businesses, while Wholesale CBDC (e₹-W) is designed for restricted access to select financial institutions.

- While Wholesale CBDC is intended for the settlement of interbank transfers and related wholesale transactions, Retail CBDC is an electronic version of cash primarily meant for retail transactions.

Who issues CBDC ??

As the name suggests, a CBDC is issued and regulated by a nation’s monetary authority or central bank.

In India It Is RBI (Reserve Bank of India)

IN US The Federal Reserve Board

Where does it differ from UPI? What is the key difference?

#UPI

- CBDC, or e-rupee is the equivalent of fiat currency in digital form, while UPI is a platform to facilitate banking transactions.

- Any UPI transaction involves the intermediation of the bank. So, when we use a UPI app, our bank account gets debited and money gets transferred to the recipient’s bank. In paper currency, we can draw a certain amount from the bank, keep it in our wallet and spend it at a shop or anywhere.

- Similarly in CBDC, we can draw the digital currency and keep it in our wallet in our mobile. When we make a payment at a shop or to another individual, it will move from our wallet to their wallet. There is no routing or intermediation of the bank.

- CBDC can enable the movement of money directly between two private entities, individuals or businesses, similar to cash. While in UPI, the movement is only between two bank accounts.

Co-Relation with Crypto Currency

Although we can call it a form of cryptocurrency, but it has some differences with the so-called cryptocurrency. According to the Blockchain Council, a group of Blockchain experts:

- The CBDCs operate on authorised (private) blockchains, whereas cryptocurrencies operate on permissionless (public) blockchains.

- Anonymity is a benefit for crypto currency users. CBDC customer’s identities will be linked to an existing bank account as well as a similar quantity of personal information.

- A central bank (RBI) determines the regulations for CBDC networks. The authority in crypto networks is given to the user base, which makes choices through consensus.

Why does the government want to digitize money?

#Digitize

- The main goal of CBDCs is to provide businesses and consumers with privacy, transferability, convenience, accessibility, and financial security

- The idea of launching the digital rupee had been in the pipeline for some time. It is expected to help in managing the costs of printing paper cash and coins.

- Additionally, it is expected to help in bringing in innovation in the field of cross-border payments.

How and when its operation will start?

- First and foremost, it is not a fully-fledged launch. It is going to be a pilot project and the digital rupee is going to be initially rolled out in Bhubaneswar, Bengaluru, Mumbai and New Delhi.

- Total of four banks are going to be involved in launching the pilot project. The banks are IDFC First Bank, State Bank of India, Yes Bank and ICICI Bank.

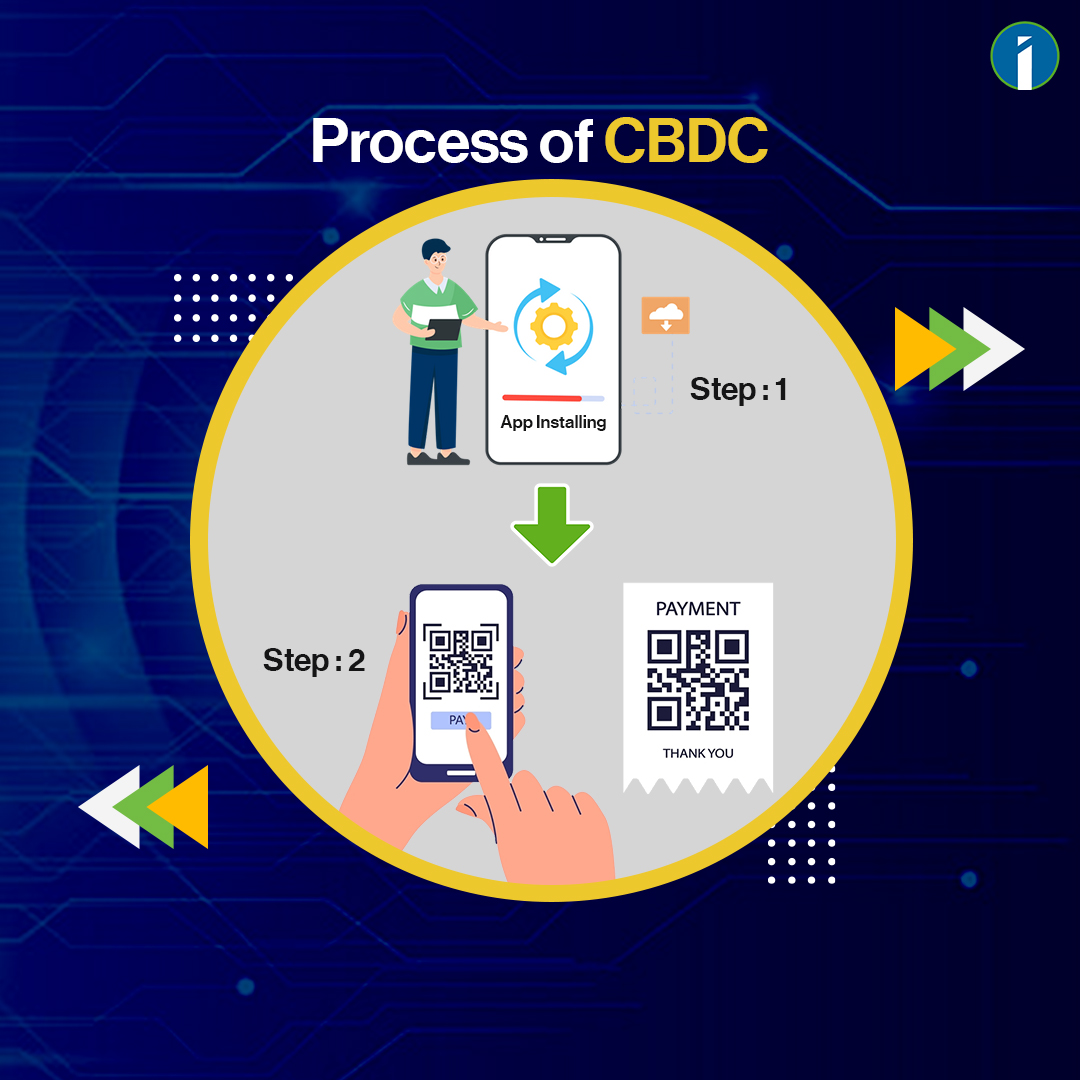

How will this going to work?

#E-Rupee_Work?

- Those who wish to transact in e-Rupee are going to be provided with a digital wallet by the participating banks. The wallet can be installed on mobile devices. Users can make transactions with other people or with merchants through the use of QR codes.

- Now that the pilot project has been launched, it is going to help the banks in getting an idea of the strength in the process involved with the creation of the digital rupee. Additionally, it would help in figuring out the robustness of the entire pipeline starting from creation, distribution and then transactions.

where digital currency is already being used?

Here are countries that have already launched their own digital currencies and some of them are on the way.

Countries where CBDCs have been launched:

- • The Sand Dollar was issued by the Central Bank of the Bahamas in October 2020. It was the first nationwide CBDC in the world.

- Nigeria became the first country in Africa to launch a CBDC in October.

- Countries in the Eastern Caribbean Union created their own form of digital currency meant to help speed transactions and serve people without bank accounts. The seven countries involved are Antigua and Barbuda, Dominica, Grenada, Montserrat, St. Kitts and Nevis, Saint Lucia, and St. Vincent and the Grenadines.

Countries that are testing CBDCs in pilot projects:

- Sweden

- China

- Jamaica

- Taiwan

- Europe

Stay tuned to Invesmate for more such explainers on some of the hot topics of the day.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Excellent. Thank you for sharing 🙂

Very much useful information. Thanks for sharing.

Wow.. thanks for the information