Vijay Kedia is a prominent Indian investor known for his stock-picking acumen and investment philosophy. Vijay Kishanlal Kedia born in Kolkata. He has been involved in the market since he was 19 years old.

With over three decades of experience in the Indian stock market, Kedia has earned a reputation for identifying multi-bagger stocks and generating significant wealth through his investments. His journey from rags to riches is an inspiring tale for every aspiring investor.

Today we will know about his life and investment philosophy and we will discuss in detail what inspiration we can take from his success journey.

Career Of Vijay Kedia :

“The Desire to become a Millionaire overnight is the root cause of failures in The Stock Market.”

– Vijay Kedia.

Vijay Kedia realized his passion for stock market when he was 14 and joined the stock market when he turned 19. After few years he left his hometown Kolkata and came to Mumbai to try his luck.

Early Stage :

Vijay Kedia, known for his bold investment style, faced setbacks early in his career, including a significant loss in Hindustan Motors shares. Despite these challenges he was strict to his goals.

In 1988, Kedia’s keen analysis of industry reports led him to invest his entire savings of 35,000 rupees in Punjab Tractor, marking his first major success as the stock surged 5-7 times.

His next breakthrough came with ACC, purchased at 300 rupees and sold at 3,000 rupees, allowing him to buy his first house in Mumbai. These experiences shaped Kedia’s investment philosophy, emphasizing research and calculated risk-taking.

Year 2000 – 2010 :

In 2004 and 2005 he identified and invested in three such shares (Atul auto, Aegis logistics, Cera sanitaryware) which appreciated more than 100 times in next 10 to 12 years.

Year 2010 – 2020:

In early 2012, he correctly predicted that India was at the beginning of a structural bull run. In 2016 Kedia was featured at #13 in Business World list of Successful Investors In India. In 2017 “Money Life Advisory” launched an “Ask Vijay Kedia microsite” on him.

In 2017 Vijay Kedia’s portfolio stocks rose up to 170%. In 2018, he was invited to speak at London Business School. In November 2018, he was invited to speak at TEDx.

Investment Philosophy

Vijay Kedia’s investment approach revolves around the acronym “SMILE,” which stands for Small in size, Medium in experience, Large in aspiration, and Extra-large in market potential.

This strategy reflects his preference for investing in small and mid-cap companies with significant growth potential.

Let’s break down each component of the SMILE investment method:

1. Small in size:

Kedia focuses on small-sized companies that often fly under the radar of institutional investors and analysts. These companies typically have lower market capitalization but possess the potential for exponential growth.

2. Medium in experience:

While Kedia invests in small-sized companies, he looks for management teams with a decent level of experience and expertise. He believes that capable management is crucial for driving the company’s growth and navigating through challenges effectively. Therefore, he assesses the track record and competency of the management team before making investment decisions.

3. Large in aspiration:

One of the key criteria for Kedia’s investment is the company’s ambitious vision and aspirations for growth. Companies with a strong growth mindset and a clear strategy to capitalize on market opportunities are more likely to catch Kedia’s attention.

4. Extra-large in market potential:

Lastly, Kedia looks for companies operating in sectors with significant market potential. He focuses on industries poised for rapid growth and disruption, such as technology, healthcare, and consumer goods. By investing in companies with extra-large market potential, Kedia aims to ride the wave of sectoral growth and maximize returns for his investments.

Overall, Vijay Kedia’s SMILE investment method underscores his emphasis on identifying small and mid-cap companies with strong growth prospects and capable management teams. He is known for his ability to identify multi-bagger stocks early on and hold onto them for significant gains.

“Three qualities of a good investor; Knowledge, Courage, & Patience.” – Vijay Kedia.

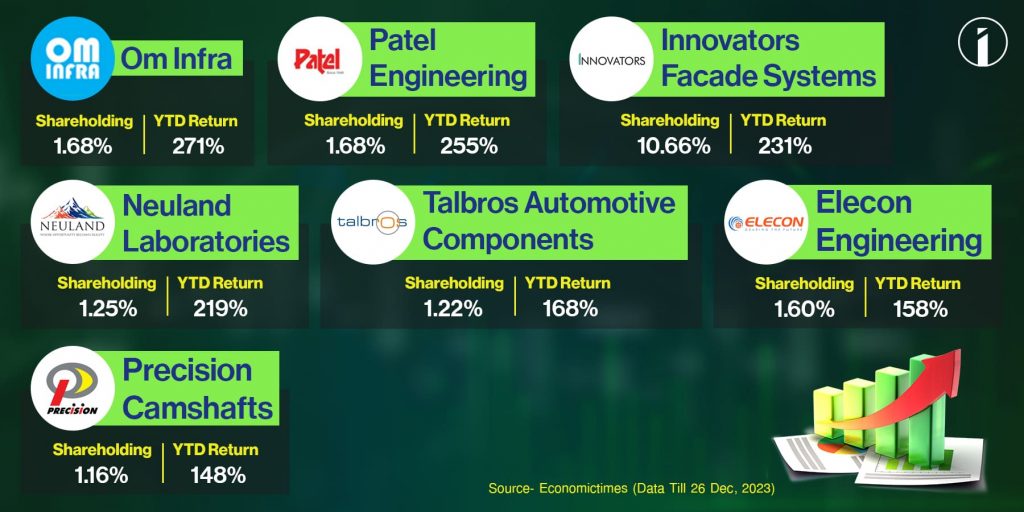

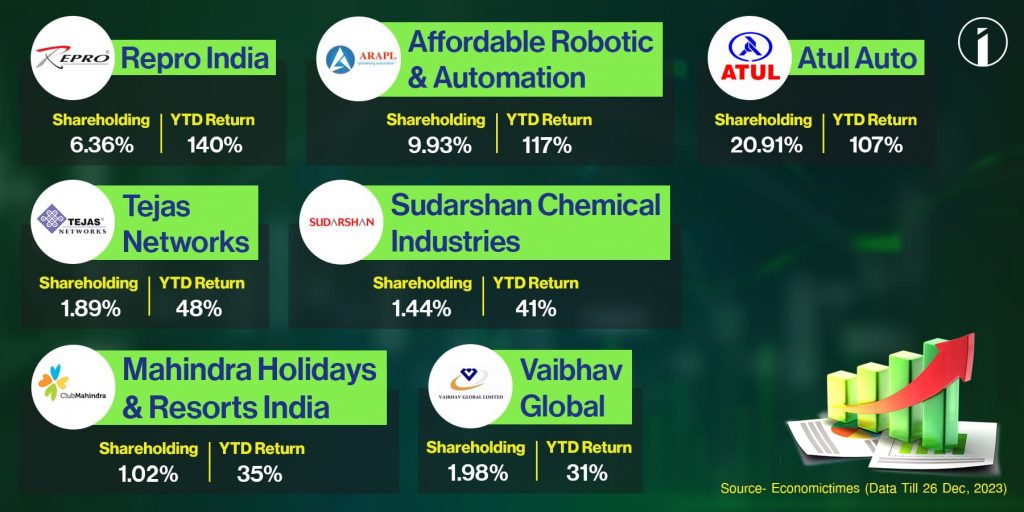

Portfolio Of Vijay Kedia :

As per the latest corporate shareholdings filed, Vijay Kishanlal Kedia publicly holds 14 stocks with a net worth of over Rs. 1,375.7 Cr.

In a world where success is often equated with wealth, Vijay Kedia stands out as a beacon of integrity and wisdom. His journey from humble beginnings to investment stardom is a testament to the power of perseverance, discipline, and astute decision-making. As we reflect on his life and achievements, let us draw inspiration from his story and strive to emulate his success in our own investment journeys.

FAQs

Vijay Kedia is an Indian investor, entrepreneur, and stock market expert known for his successful investments in the Indian stock market.

Vijay Kedia’s investment approach revolves around the acronym “SMILE,” which stands for Small in size, Medium in experience, Large in aspiration, and Extra-large in market potential.

Kedia has made successful investments in various sectors, including pharmaceuticals, textiles, and specialty chemicals. Notable investments include Sudarshan Chemicals, Cera Sanitaryware, and Atul Auto.

Vijay Kedia hasn’t authored any books on investing. However, he frequently shares his insights and investment principles through interviews, articles, and public appearances.

Kedia started his career in the stock market as a small investor and later ventured into full-time investing and trading. Over the years, he has gained recognition for his astute investment decisions and wealth creation.

Information about Vijay Kedia, his investment approach, and insights can be found through his interviews, articles, and public speeches.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

SaddamHaussib