In this article, you’re going to explore:

A beginning of a separate segment as a new horizon of humanityThe National Stock Exchange (NSE) finally gets the approval from the Securities and Exchange Board of India (SEBI) to launch Social Stock Exchanges (SSEs) as a new segment.

How did the journey begin: Nirmala Sitharaman's proposal in FY 19-20?

This concept was first presented by Union Finance Minister Smt. Nirmala Sitharaman in her speech on the Union Budget for the financial year 2019-2020 and proposed under the regulatory ambit of SEBI.

When there are already many non-government charitable bodies successfully running in India, the introduction of such an initiative is obviously a question here! In this context, the Union Finance Minister has clarified her vision of shrinking the gap between the capital market and mass social enterprises by making the fund collection process more apparent.

There are mainly two problems that arise when it comes to raising funds.

First, organizations dealing with such social endeavours lack enough exposure and therefore fail to collect enough funds.

And second, sometimes the donors are quite doubtful about their money, wondering whether it is being used rightfully or not.

To resolve this ambiguity and bring more awareness towards social welfare, instead of running SSE as another bourse Smt. Sitharaman proposed to start it as a different segment within the NSE platform itself in the form of equity, ZCZP, and mutual funds.

👉What is Social Stock Exchange (SSE)?

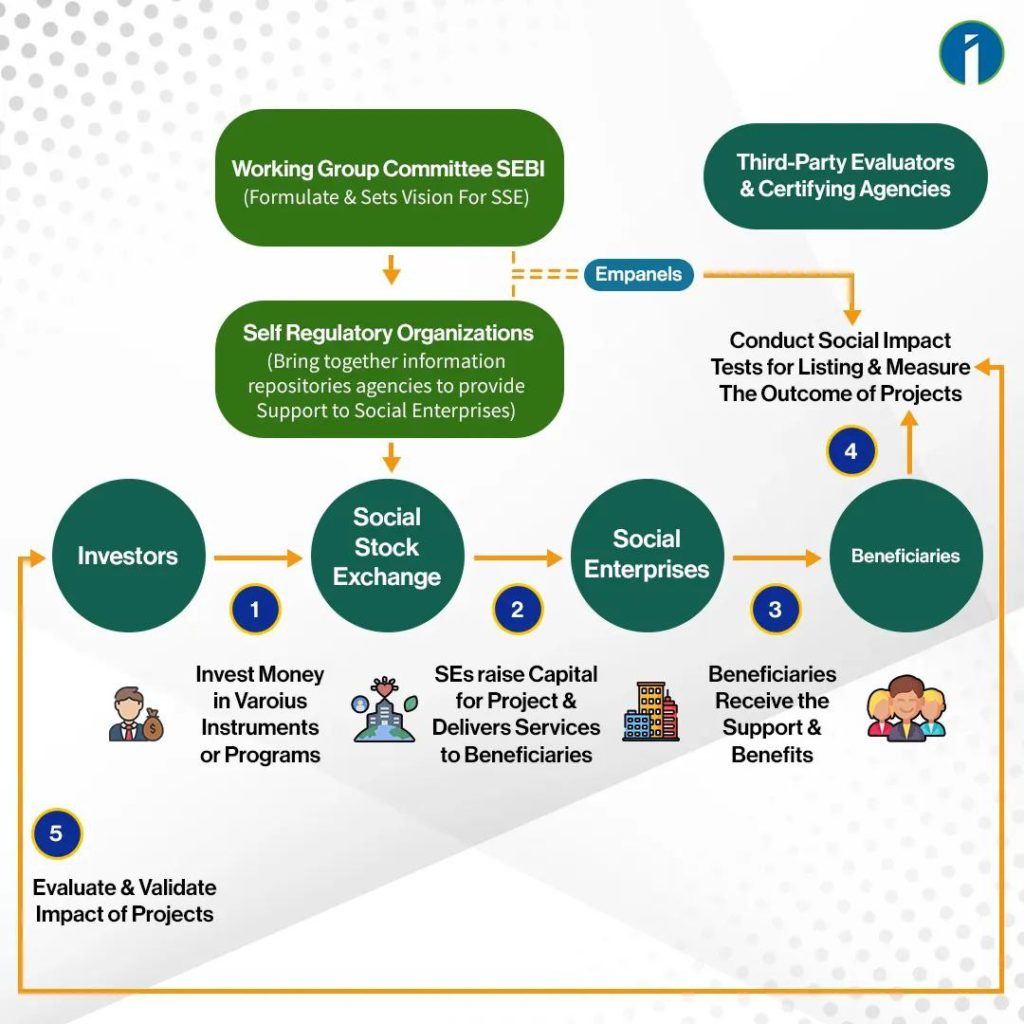

The Social Stock Exchange (SSE) is a distinct section within the established Stock Exchanges that enables Social Enterprises to raise funds from the public using the stock exchange mechanism. The SSE functions as an intermediary between Social Enterprises and fund providers, aiding them in identifying those organizations that are generating measurable social impact and reporting on that impact. Non-profit organizations (NPOs) that satisfy the registration requirements may register on the SSE and commit to making continual disclosures regarding their social impact. These NPOs may or may not elect to raise funds through the SSE, but they must continue to make disclosures, including those on social impact, to the stock exchanges.

Participants of the social stock exchange

👉 Key Benefits of Social Stock Exchange

Enhanced Market Accessibility

Establishing a Social Stock Exchange (SSE) will create a standardized and organized platform where Social Enterprises can interact with potential investors/donors, and where financial activities are regulated to ensure transparency and responsibility.

The collaboration between investor and investee

Transparency between both parties can be enhanced through the use of a Social Stock Exchange (SSE). The flexibility of investments and the availability of capital on an SSE creates a larger range of options for both investors and recipients, which makes it easier for those with similar goals and objectives to come together and work towards a common purpose. This facilitates a smooth connection between investors and investees with compatible missions and visions.

The system solely focused on performance

The SSE will keep track of the performance of the companies listed on it, encouraging a philanthropic culture that prioritizes measurable social impact and outcomes.

The SSE’s cost-effective solutions

The SSE offers a cost-effective solution for issuers and investors/donors as it charges minimal fees for registration and listing, resulting in zero listing and admission costs. This approach helps to reduce the financial burden for both parties involved.

New opportunity for social enterprises

This has proven to be a life-changing opportunity for non-governmental social enterprises which could alleviate some of the pressure on the Central and State governments to achieve sustainable development goals. The Social Stock Exchange (SSE) is a platform that offers an alternative avenue for social enterprises to raise funds. By utilizing SSE, both new and existing social enterprises can be encouraged to pursue their objectives and goals.

SSE in other Countries:

Socially responsible enterprises (SSE) have been established in several countries including Singapore, the United Kingdom, and Canada. These nations permit companies working in industries such as healthcare, ecology, and transportation to generate funds for high-risk ventures.

What is a Social Enterprise in the context of a Social Stock Exchange?

Social Stock Exchange identifies the following two forms of social enterprises that are engaging in the activity of creating positive social impact and that meet the primacy of their social intent.

- Not-for-profit organization

- For-profit social enterprise

To establish the dominance of social purpose, any organization – whether it is a non-profit or for-profit social enterprise – must fulfil the three criteria specified in Regulation 292E(2) of the ICDR Regulations. These criteria dictate that the organization must engage in the activities listed under Regulation 292E(2)(a) and focus on serving marginalized or disadvantaged populations or regions that have not seen significant progress in the development priorities of central or state governments.

Additionally, to be recognized as a social enterprise, the organization must prove that at least 67% of its eligible activities are directed towards the target population. This can be demonstrated through either of the following means:

- A minimum of 67% of the revenue generated by the company in the past three years should have come from providing eligible activities to the target population.

Or

- The company must have spent at least 67% of its total expenses in the past three years on providing eligible activities to the target population.

Or

- The target population, who have received eligible activities from the company, should make up at least 67% of the total customer base and/or beneficiaries in the past three years.

However, organizations such as corporate foundations, political or religious entities, professional or trade associations, infrastructure companies, and housing companies (except affordable housing) are not qualified to be recognized as social enterprises.

What is a For-Profit Social Enterprise in the context of a Social Stock Exchange?

A social enterprise that operates for profit is an organization that fulfils the requirements to be recognized as a social enterprise and falls under any of the following categories:

- A company established under the Companies Act, 2013, that is engaged in profit-making activities but does not encompass a company established under section 8 of the Companies Act, 2013 (18 of 2013).

- A legal entity that conducts business for profit.

What is a Not-for-Profit Organization in the context of the Social Stock Exchange?

A non-profit organization refers to a social enterprise that satisfies specific conditions and falls into one of these categories:

- A public trust that is registered as a charitable organization under the relevant state’s statute.

- A charitable society that is registered under the Societies Registration Act of 1860 (21 of 1860).

- A corporation established under section 8 of the Companies Act of 2013 (18 of 2013).

- Any other entity designated by SEBI.

What is Zero Coupon Zero Principal Instruments? How does it help Not for Profit Organizations?

Zero-coupon bonds are a type of bond that does not offer any interest payments throughout the duration of the bond’s life. Instead, investors can purchase these bonds at a significant discount to their face value, which represents the amount that the investor will receive once the bond reaches its maturity date. Non-profit organisations may have the option to list directly by issuing zero-coupon or zero-principal bonds as a means of financing.

Are For-profit organisations eligible to issue Zero Coupon Zero Principal Instruments for raising funds?

Organisations that operate with the primary aim of making profits are prohibited from issuing financial instruments with zero coupons and zero principal as a means of raising capital. Only non-profit organisations that are registered with a Social Stock Exchange are authorised to issue such instruments.

Last but not the least, how can an institutional investor as well as a retailer take part in such a remarkable endeavour?

Retail investors can only invest in securities offered by for-profit social enterprises (SSEs) under the Main Board. In all other cases, only institutional investors and non-institutional investors can invest in securities issued by SSEs.

Conclusion

We must say that this is an admirable initiative taken by SEBI to shrink the gap between the capital market and mass social enterprises. Here, we have gained important knowledge about all the terms used in SSE.

With that being said, we are all eagerly waiting for the SSE to launch in the market, and then we can decide where to invest accordingly.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

এই ব্লগটি একটি সামাজিক স্টক এক্সচেঞ্জের ধারণা এবং আরও টেকসই এবং ন্যায়সঙ্গত বিশ্ব তৈরির জন্য এটির সম্ভাব্যতা সম্পর্কে আরও শিখতে আগ্রহী প্রত্যেকের জন্য একটি অসামান্য সম্পদ।

এই ব্লগের বিষয়বস্তু তথ্যপূর্ণ এবং আকর্ষক উভয়ই। লেখকরা জটিল বিষয়গুলিকে ভেঙে ফেলার এবং তাদের বোঝার সহজ উপায়ে ব্যাখ্যা করার একটি দুর্দান্ত কাজ করেন, এমনকি যারা অর্থ বা অর্থনীতিতে পটভূমি নেই তাদের জন্যও। উপরন্তু, ব্লগটি সামাজিক স্টক এক্সচেঞ্জের সাথে সম্পর্কিত বিস্তৃত বিষয়গুলি কভার করে, যার মধ্যে রয়েছে সামাজিক উদ্যোগে বিনিয়োগের সুবিধা, অর্থনীতিতে সামাজিক স্টক এক্সচেঞ্জের প্রভাব এবং ক্ষেত্রের সর্বশেষ উন্নয়নগুলি।

This blog is an outstanding resource for anyone interested in learning more about the concept of a social stock exchange and the potential it holds for creating a more sustainable and equitable world.

The content on this blog is both informative and engaging. The writers do an excellent job of breaking down complex topics and explaining them in a way that is easy to understand, even for those without a background in finance or economics. Additionally, the blog covers a wide range of topics related to social stock exchanges, including the benefits of investing in social enterprises, the impact of social stock exchanges on the economy, and the latest developments in the field.