Imagine you’re investing in iconic Skyscrapers, Shopping Malls, and Luxury Hotels without millions or the need for a Property Management team. Isn’t it cool?

Yes it is possible, through the extraordinary accessibility, liquidity, and attractive returns of Real Estate Investment Trusts (REITs).

Let’s take a closer look at how REITs can enhance your portfolio and bring real estate benefits within your reach.

What are Real Estate Investment Trust (REITs) ?

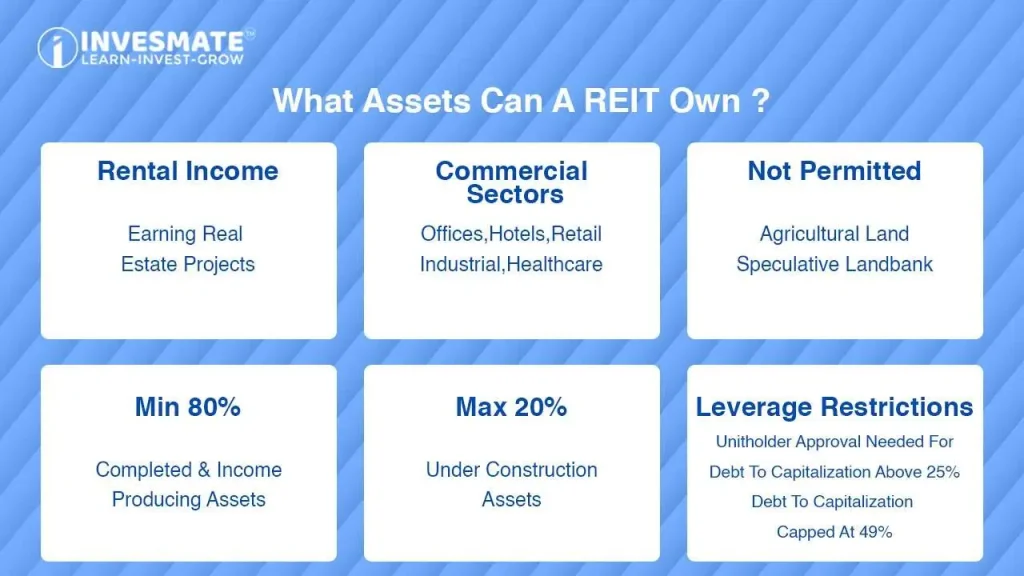

Real Estate Investment Trusts (REITs) in India allow individuals to invest in income-generating real estate without direct ownership. Introduced by SEBI in 2007 and updated in 2014, REITs enable investment in properties like malls, apartments and data centers.

Types of Real Estate Investment Trust (REITs)

- Equity REITs: Equity REITs own and manage income-producing real estate. Revenue comes from leasing space and collecting rents on the properties, which are then distributed as dividends to shareholders.

- Mortgage REITs (mREITs): Mortgage REITs lend money to real estate owners and operators or acquire mortgage-backed securities. Their earnings come from the interest on these financial assets. Interest rate fluctuation makes mREITs risky. Rising interest rates can reduce profits.

- Hybrid REITs: These REITs combine the investment strategies of both equity REITs and mortgage REITs. Hybrid REITs generate rental and interest income both.

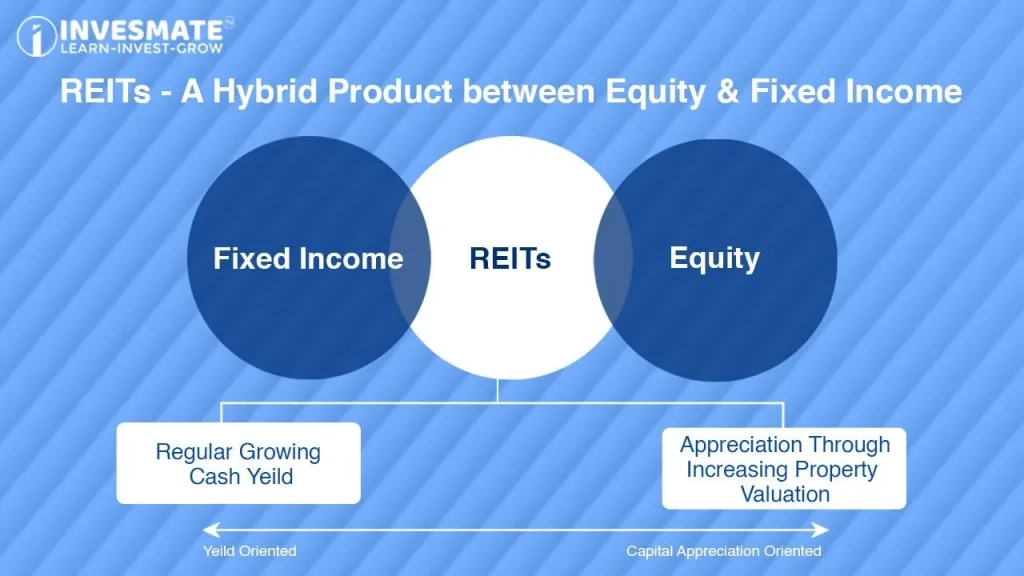

REITs generate income in two ways,

I) Regular Income through Dividend/Interest and

II) Income through Capital Gain

MSM REITs: Micro, Small, and Medium REITs

In 2023, India introduced MSM REITs, enabling small retail investors to enter the market with lower investment amounts. Launched by SEBI, these REITs require a minimum asset size of INR 25 crores, much lower than the INR 500 crore needed for traditional REITs.

This change increases competition, reduces costs, and allows more investors to participate in real estate, boosting liquidity in the sector and its related industries.

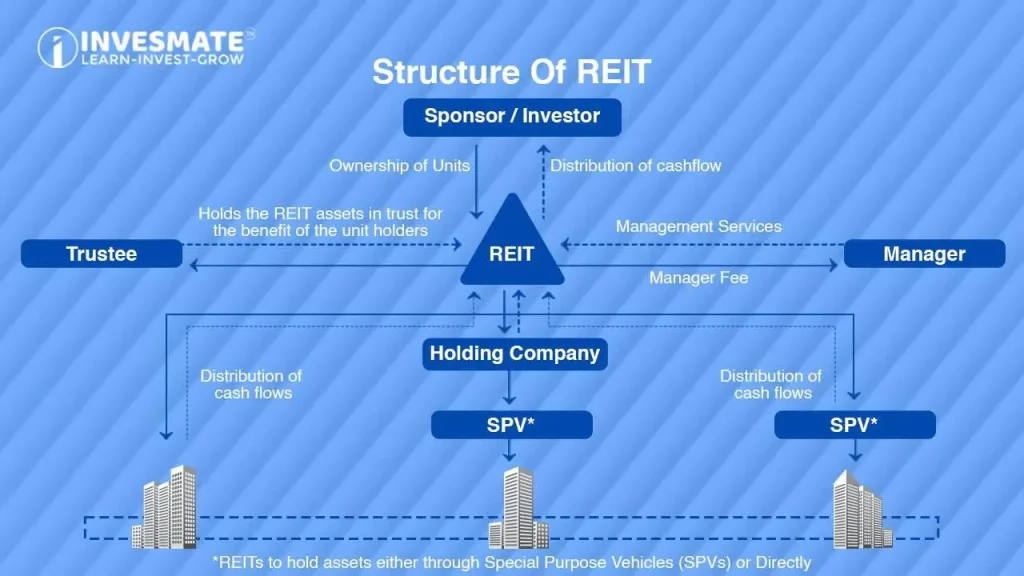

Key Stakeholders and Structure of REITs in India

- Sponsor: Sets up the REIT and appoints the trustee.

- Trustee: Manages the assets on behalf of investors.

- Manager: Handles the REIT’s operations.

- Valuer: Ensures transparent financial and technical asset valuation.

How to Invest in Real Estate Investment Trusts?

- SEBI mandates REITs to be listed on stock exchanges and raise funds through an Initial Public Offering (IPO).

- An individual may buy shares in a REIT, which is listed on major stock exchanges, just like any other public stock. Investors may also purchase shares in a REIT mutual fund or exchange-traded fund (ETF).

Who can Invest in REITs?

- Any investor (Domestic / Foreign / Retail / Institutional) can buy REIT units in India;

- The minimum subscription amount is in the range of ₹10,000 to ₹ 15,000/- and the trading lot is 1 unit. (revised w.e.f. July 30, 2021) Previously it was ₹50,000 & 100 units, respectively;

- Investors can purchase REIT units through a Demat account, similar to how they would purchase equity shares;

- REITs are suitable for those who want to take price benefits / returns from Real Estate.

Advantages of Investing in REITs

- Liquidity: REITs are typically traded on major stock exchanges, making them easy to buy and sell.

- Diversification: REITs provide access to the real estate market, which can diversify an investment portfolio.

- Regular Income: REITs pay out most of their income as dividends, ensuring consistent income for investors.

- Professional Management: REITs are managed by experienced professionals who handle the complexities of property management and real estate transactions.

How to own units of REITs?

Investors can own units of REITs in following manner:

- By subscribing to issue in Initial Public Issue (IPO) or Followon Issue of a REITs,

- By purchasing units of REITs from Stock Exchange, where they are listed,

- Procedures for the bidding, application, payment, and Allotment of REITs Units in Public Issue (IPO or Follow-on Issue)

- Price of Units shall be determined through Book building process,

- Investors are required to participate in the Issue only through the ASBA process.

List of REITs in India

New REITs: 360 ONE Real Estate Investment Trust (REIT), registered with SEBI on April 12, 2024 (IN/REIT/22-23/0005), has perpetual validity, making it a long-term investment vehicle for real estate assets in India.

Conclusion

REITs can be a valuable addition to an investment portfolio, offering regular income, diversification, and exposure to the real estate market without the need for direct property ownership. However, like all investments, they come with risks that need to be carefully considered.

FAQs

As the name suggests, this rule requires real estate trusts to distribute 90% of their taxable income to current shareholders.

Investing in REITs diversifies your portfolio beyond traditional stocks and bonds, offering strong dividends and potential for long-term capital appreciation.

A REIT investment is open-ended and can last indefinitely until the shareholder chooses to sell their shares.

Investing in REITs for the long term is beneficial, providing stable dividends and capital appreciation without property management hassle.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Leave a Reply