Investing in US stocks from India is an excellent way to diversify your portfolio and gain exposure to some of the world’s largest and most influential companies.

Here’s a detailed guide summarizing how to invest in US stocks from India, including direct and indirect methods, costs involved, and key considerations.

Direct Investments

1. Opening an Overseas Trading Account with a Domestic Broker

- Process: Many Indian brokers have partnerships with US brokers, allowing you to trade US stocks. You’ll need to provide documentation for identity verification and might face certain restrictions based on the brokerage.

- Considerations: Be aware of higher costs due to brokerage fees and currency conversion charges. Verify the types of investments and the number of trades you can make.

2. Opening an Overseas Trading Account with a Foreign Broker

- Process: You can also open an account directly with a foreign broker like Charles Schwab, Ameritrade, or Interactive Brokers. These brokers typically offer more flexibility and potentially lower fees.

- Considerations: Understand all associated fees, including account maintenance, transaction costs, and currency conversion charges.

Indirect Investments

You can invest in U.S. stocks indirectly without opening an overseas trading account. The simple options are:

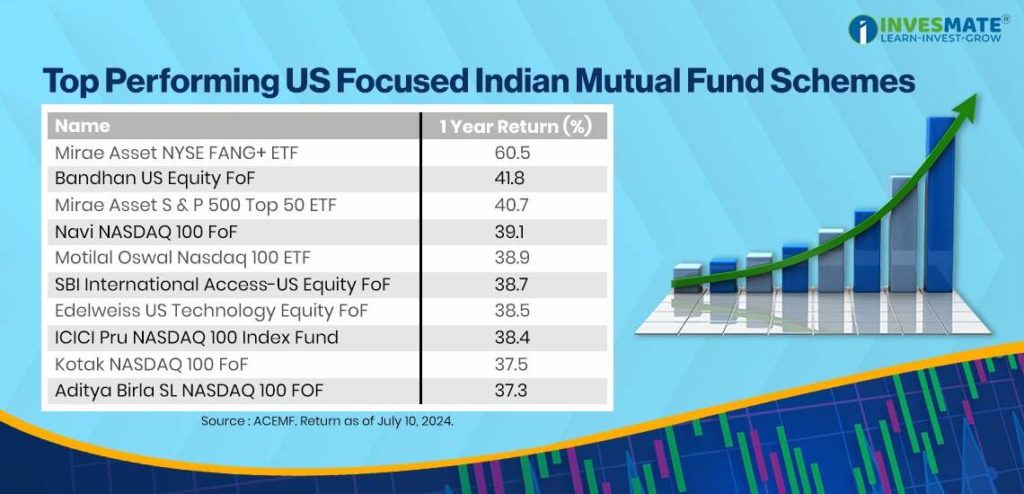

1. Mutual Funds: Invest in Indian mutual funds that hold U.S. stocks, avoiding the need for a foreign account Opening. For Example – DSP US Flexible Equity Fund.

2. ETFs: Gain exposure to U.S. markets through ETFs. You can buy U.S. ETFs via a broker or invest in Indian ETFs that track international indices. For Example Motilal Oswal Nasdaq 100 ETF.

3. Investing Through Modern Apps: Some start-ups and financial platforms offer apps that make investing in U.S. stocks easier, though they may restrict intraday trading due to regulations. For example New age apps – IND money

What Are the Various Costs Associated with Investing in US Stocks?

Tax Collected at Source (TCS): A 5% TCS is applicable on remittances above ₹7 lakh under the RBI’s Liberalized Remittance Scheme (LRS). This amount can be claimed as a refund when filing an income tax return.

Capital Gains & Dividend Tax:

- US Taxes: Dividends are taxed at 25% in the US for Indian residents. Under the DTAA, you can claim tax credit in India to avoid double taxation.

- Indian Taxes: No capital gains tax in the US, but you must pay tax on capital gains in India.

Bank Charges: Fees for currency conversion and fund transfers, including a potential one-time setup charge.

Brokerage Fees: Fees charged by brokers for buying and selling shares.

Foreign Exchange Rate: The exchange rate at the time of purchase or withdrawal affects the investment cost and returns.

It is very important to know the above points before investing in US Stocks from India. However, it is necessary to thoroughly research the Associated Risks and Regulations before investing.

FAQs

Indians can invest in US stocks through mutual funds, ETFs, and direct or indirect methods.

Under the Reserve Bank of India’s Liberalized Remittance Scheme (LRS), Indian residents can invest up to $250,000 (around ₹1.9 crore) annually in U.S. stocks without needing special permission.

Yes, you can trade top U.S. stocks on the NSE IFSC Exchange, located in Gujarat’s GIFT City, starting from March 3, 2022.

To open a global investing account, you’ll need a government-issued ID, a local tax ID, and proof of address. For Indian investors, PAN and Aadhaar are required.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Leave a Reply