AUM (Assets Under Management) of ESG Mutual fund have seen a sharp growth in last 2 years from Rs 2800 Cr in Oct ’20 to Rs 10800 in Oct’ 22, which is 3.85 X growth in terms of figures.

ESG fund is completely a new trend of investing and it has become a key topic of discussion at the analysts and investors table now a day.

This article will provide you a clear picture about ESG mutual funds, whether it is worth of investing for you or not?

WHAT IS ESG?

ESG stands for Environmental, Social, and Governance. Environmental, Social and Governance factors have gained increasing attention over the past few years.

ENVRONMENTAL AWARNESS

- Publishes a carbon or sustainability report.

- Limits harmful polluations and chemicals.

- Seeks to lower greenhouse gas emissions and CO2 footprint.

- Uses renewable energy sources.

- Reduces waste.

SOCIAL AWARNESS

- Operates an ethical supply chain.

- Avoids overseas labor that may have.

- Questionable workplace safety or employ child labor.

- Supports LGBTQ+ rights and encourages all forms of diversity.

- Have policies to protect against sexual misconduct.

- Pays fair (living) wages.

- Embraces diversity on board of directors.

- Embraces corporate transparency.

- Someone other than the CEO is chair of the board.

- Staggers board elections.

What is ESG Fund?

ESG funds are investments that consider environmental, social, and governance factors when making investment decisions. ESG funds aim to generate financial returns while also making a positive impact on society and the environment.

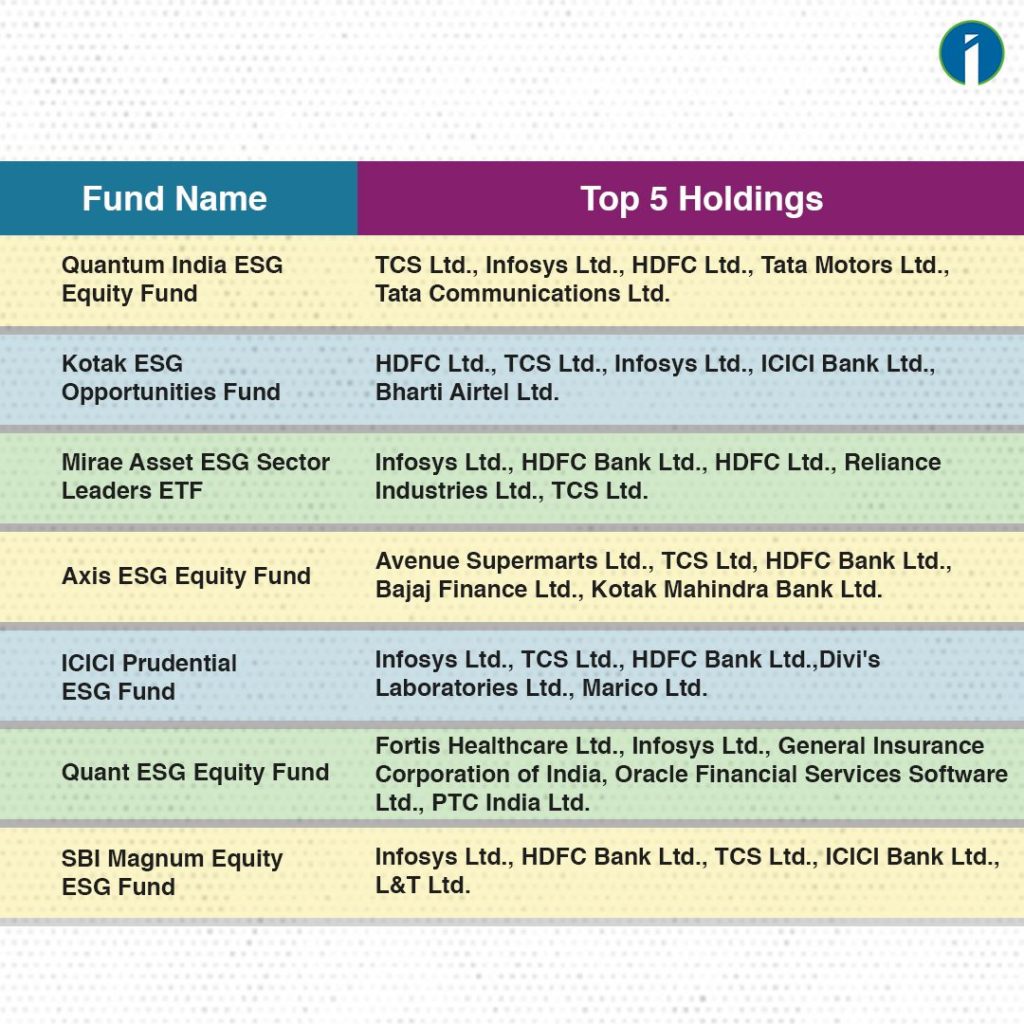

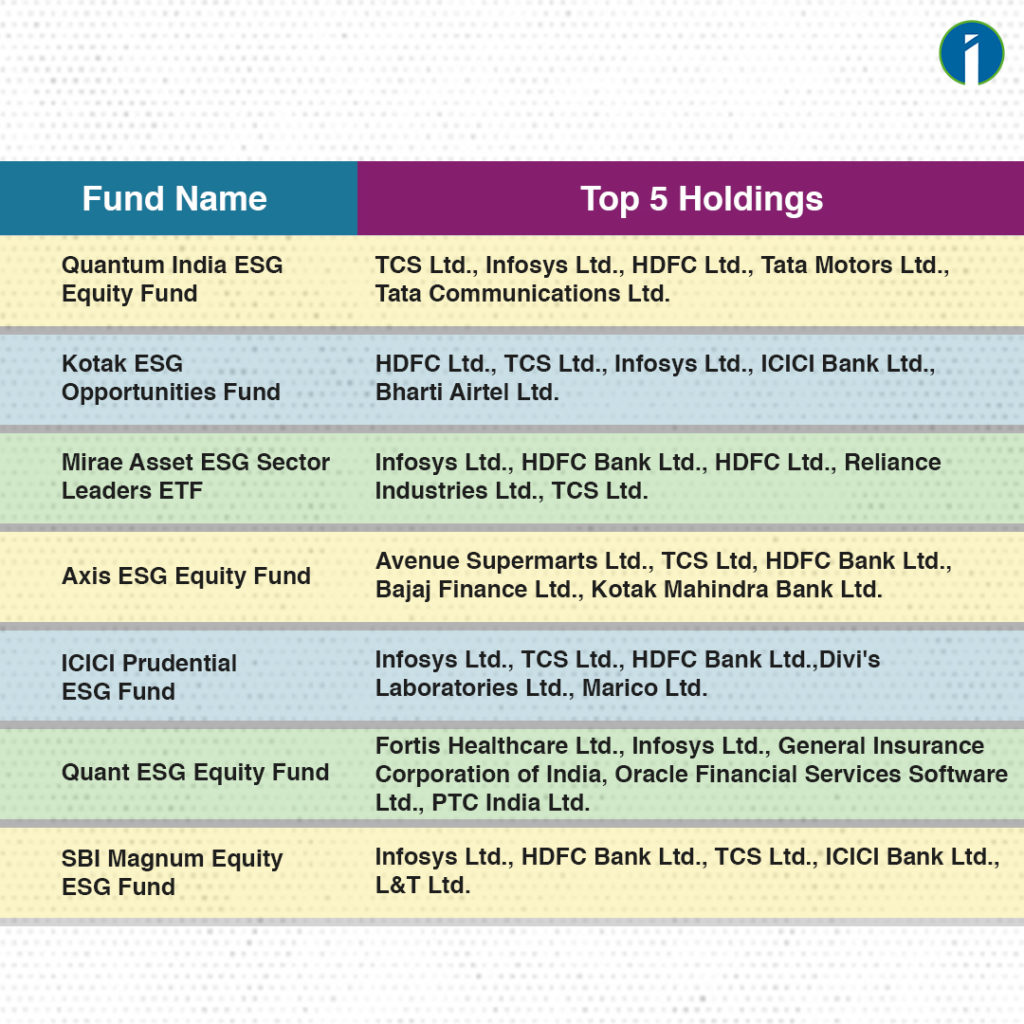

- Mutual fund houses like SBI, Kotak, Mirae, ICICI hold some common stocks, these are Infosys ltd, TCS ltd, HDFC Bank etc.

ESG Investment Parameters

- These funds usually don’t put money into companies that do controversial things, like tobacco or weapon maker etc.

- These funds try to promote sustainable business practices and help companies do good things for society.

Asset Classes of ESG Funds

Many ESG funds are available to invest in a wide variety of assets, including stocks, bonds and real estate.

HISTORY OF ESG FUNDS

Over the last few years, the Indian investment market has seen the entry of quite a few ESG funds. Avendus launched India’s first ESG-based fund in 2019. Around the same time, Quantum Asset Management Company launched its first open-ended ESG fund- Quantum India ESG Equity Fund. Then many more come on the market like Axis, Kotak, SBI etc.

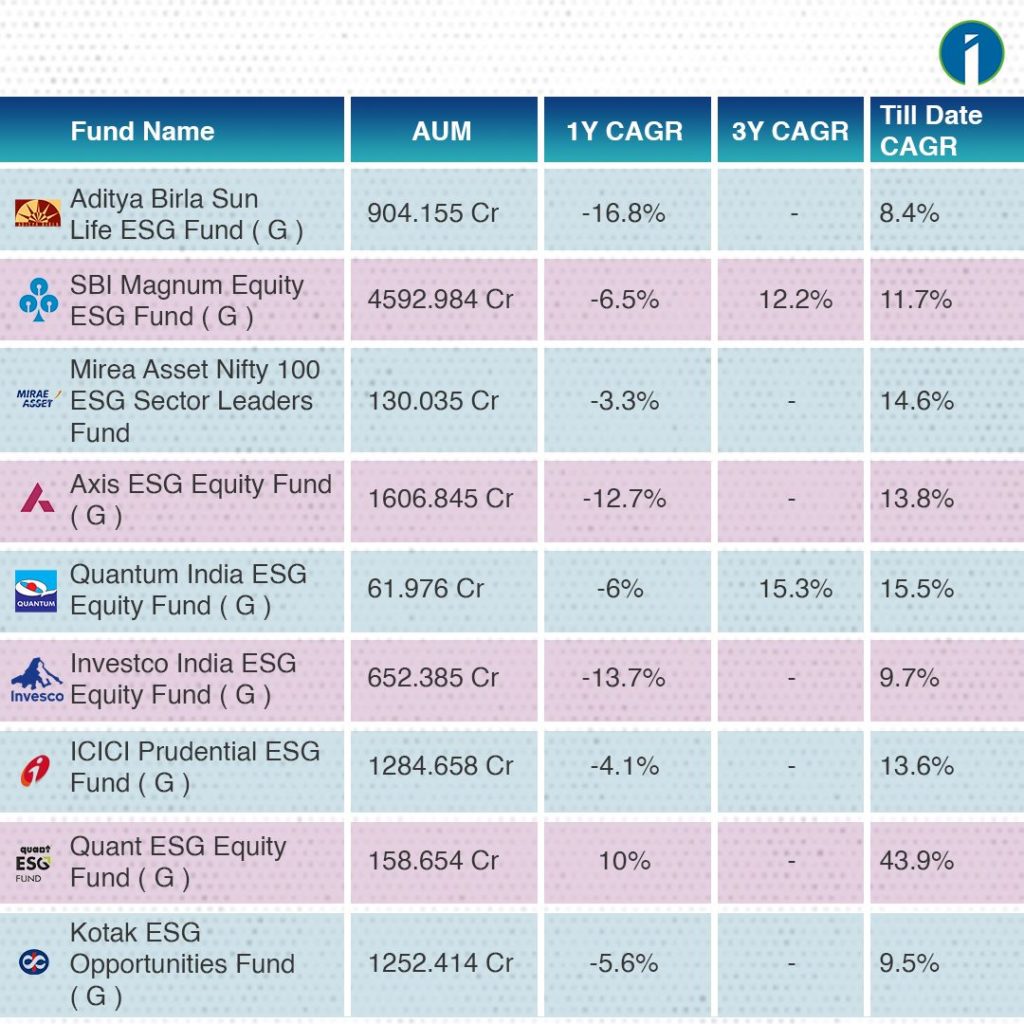

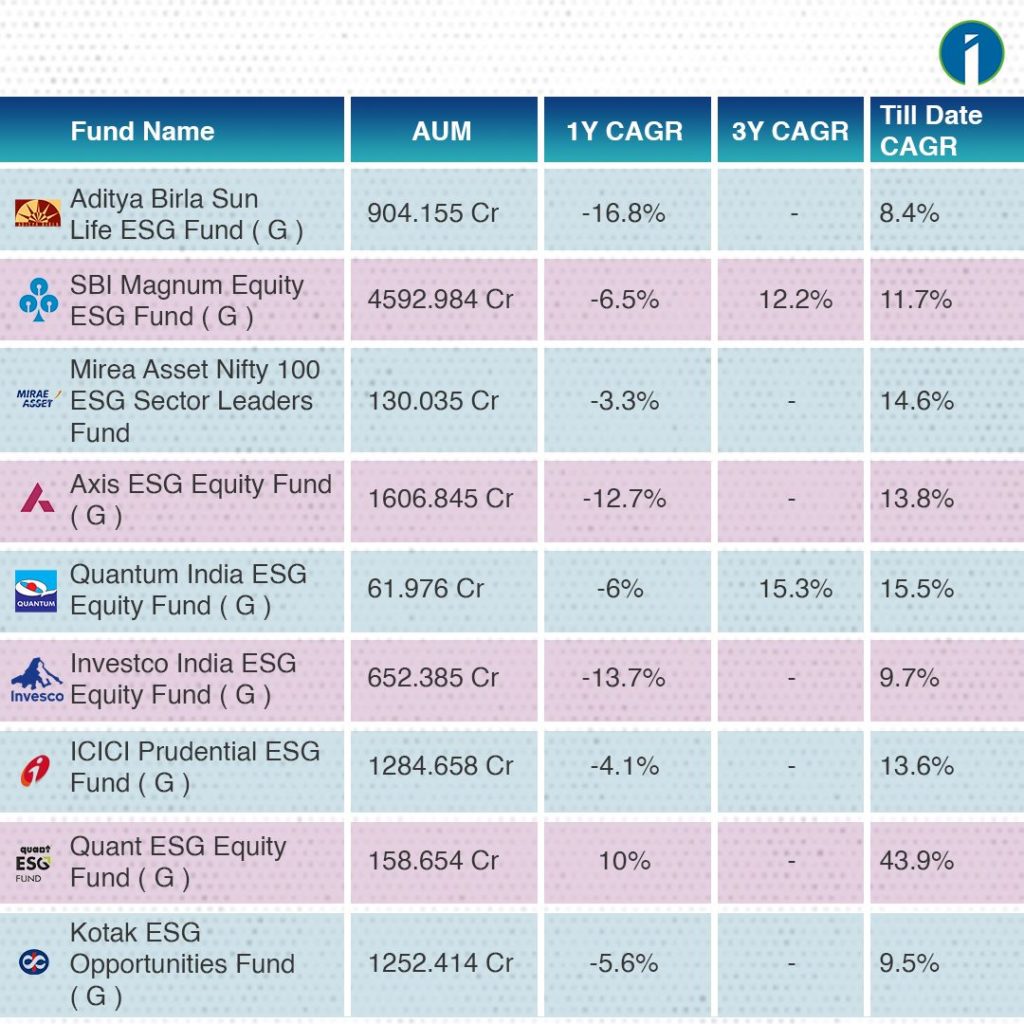

TOP ESG Mutual funds in India with their Returns

#ESGmutualFund

Stocks of ESG Funds

DIFFERENCES & SIMILARITIES WITH TRADITIONAL MUTUAL FUNDS

- Traditional mutual funds are usually run to make the most money without considering ESG factors. It means traditional mutual funds may invest in companies that are bad for the environment or society.

- On the other hand, ESG mutual funds try to make money while also doing good things for the world.

- There are lots of similarities with traditional long-term equity mutual funds in terms of holding stocks.

TAX BENEFIT & LOCK-IN PERIOD

Tax benefits of ESG Funds are yet to be defined, whereas ELSS has given tax benefit.

- There is no lock-in period in ESG Funds like any ELSS funds.

ADVANTAGES & DISADVANTAGES OF ESG MUTUAL FUNDS

Advantages

- ESG investments may deliver outperformance, especially during bearish markets due to its value investing style.

- Companies with sustainable plans to make carbon free global environment, may be better prepared to meet long-term investment goals.

Disadvantages

- Ratings are not standardized & companies can get a passing grade even when you disagree with their policies.

- ESG funds have high fees, which can eat into returns over time.

- ESG can also lead to less diversification. Investors may have miss good financial companies due to its ESG parameter consideration.

Experts View on ESG Fund

Mr. Chirag Mehta, CIO of Quantum Mutual AMC has also been big on ESG investing. He said, last year has been difficult for the ESG theme globally and for our fund as well, due to war and global energy crisis. But if you look at the performance since inception, the Quantum ESG Fund is still beating the indices.

The AUM of the Indian MF Industry has grown from ₹ 7.60 trillion as on December 31, 2012 to ₹39.89 trillion as on December 31, 2022 more than 5 fold increase in a span of 10 years.

- The total numbers of accounts (or folios as per mutual fund parlance) as on December 31, 2022 stood at 14.11 Cr.

- India, the world’s fifth largest economy, has 23 ESG funds, compared to over 500 in the United States and Britain, 182 in Japan, and 119 in China.

- In July’22, equity mutual fund inflows reached a record high of $22,583 Cr. ($3.04 billion).

TOP ESG Mutual funds in India with their Returns

#ESGmutualFund

Quantum Mutual Fund house has also been big on ESG investing. CIO of the Company, Mr. Chirag Mehta said that, last year has been difficult for the ESG theme globally and for our fund as well, due to war and global energy crisis. But if you look at the performance since inception, the Quantum ESG Fund is still beating the indices.

In this article, we have discussed about ESG Funds and a brief on Indian mutual funds. Now what do you think about ESG Funds’ prospects in upcoming years? Write us in the comment box.

In this article, we have discussed about ESG Funds and a brief on Indian mutual funds. Now what do you think about ESG Funds’ prospects in upcoming years? Write us in the comment box.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Thank you for sharing this in-depth analysis on ESG.

Thanks, its new to me

ESG funds seem to have good return possibility.

This is the new era of investment beyond conventional investment…. Very helpful information.

Very helpful content. Thank you for explaining.

Great blog on ESG!

Very Interesting Blog.