What is Candlestick ?

A candlestick is a way of displaying information about an asset’s price movement. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly.

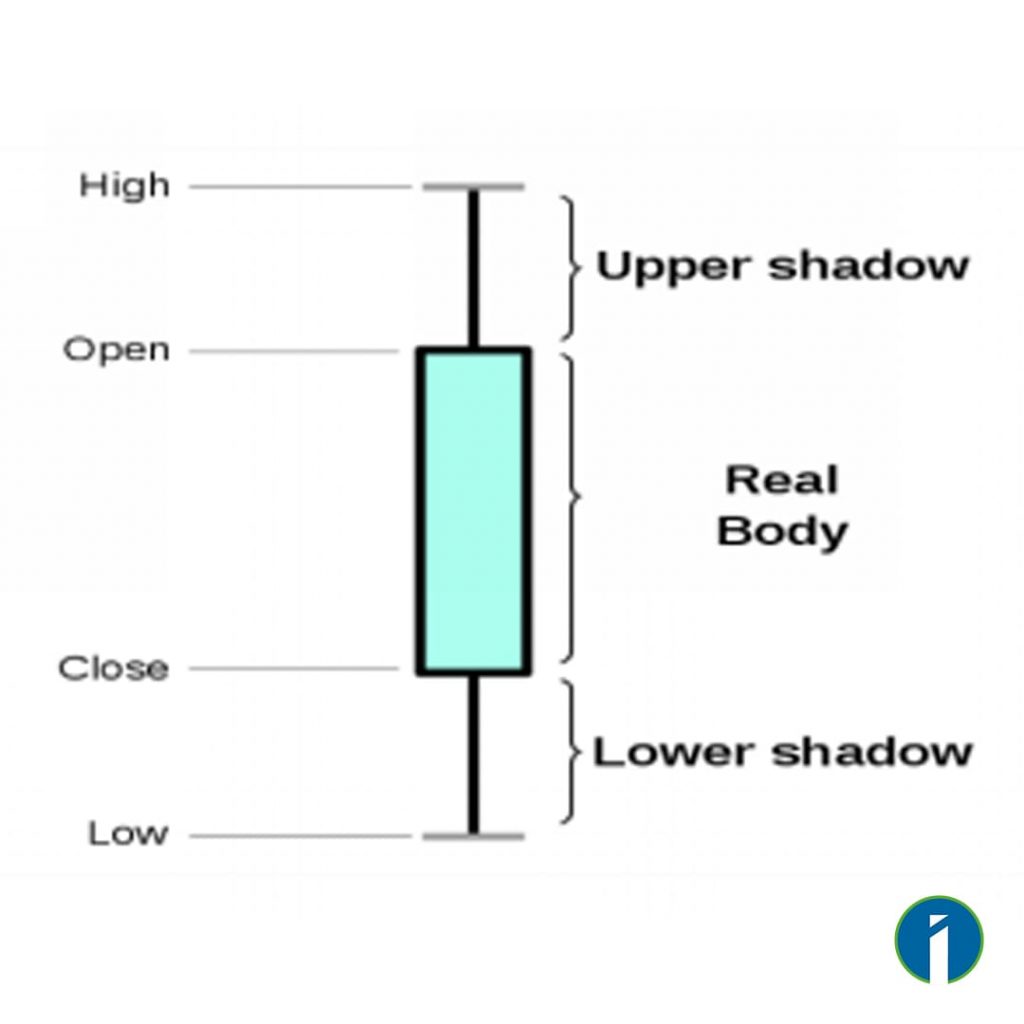

Candlestick has three basic features:

The body, which represents the open-to-close range.

The Wick, or Shadow, which reveals the High and Low of Price for a specific period or day.

The colour, which reveals the direction of market movement- a green (or white) body indicates a price increase, while a red (or black) body shows a price decrease.

Candlestick Structure :

Each candlestick on the chart represents the price movement of an asset over a specific period of time, such as 1 minute, 5 minutes, 1 hour, 1 day, 1 Week etc.Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels.

Origin :

Japanese candlestick chart patterns, the earliest charting technique, originated in the 1700s to forecast rice prices. These charts revolutionized technical analysis, providing insights into market sentiment and future price movements.

Components of a Candlestick:

Open: The price at which the asset opened during the given time frame.

Close: The price at which the asset closed during the given time frame.

High: The highest price reached during the given time frame.

Low: The lowest price reached during the given time frame.

The candlestick’s shadows show the day’s high and low and how they compare to the open and close. A candlestick’s shape varies based on the relationship between the day’s high, low, opening and closing prices.

Candlesticks can be classified into two types based on the price movement they represent:

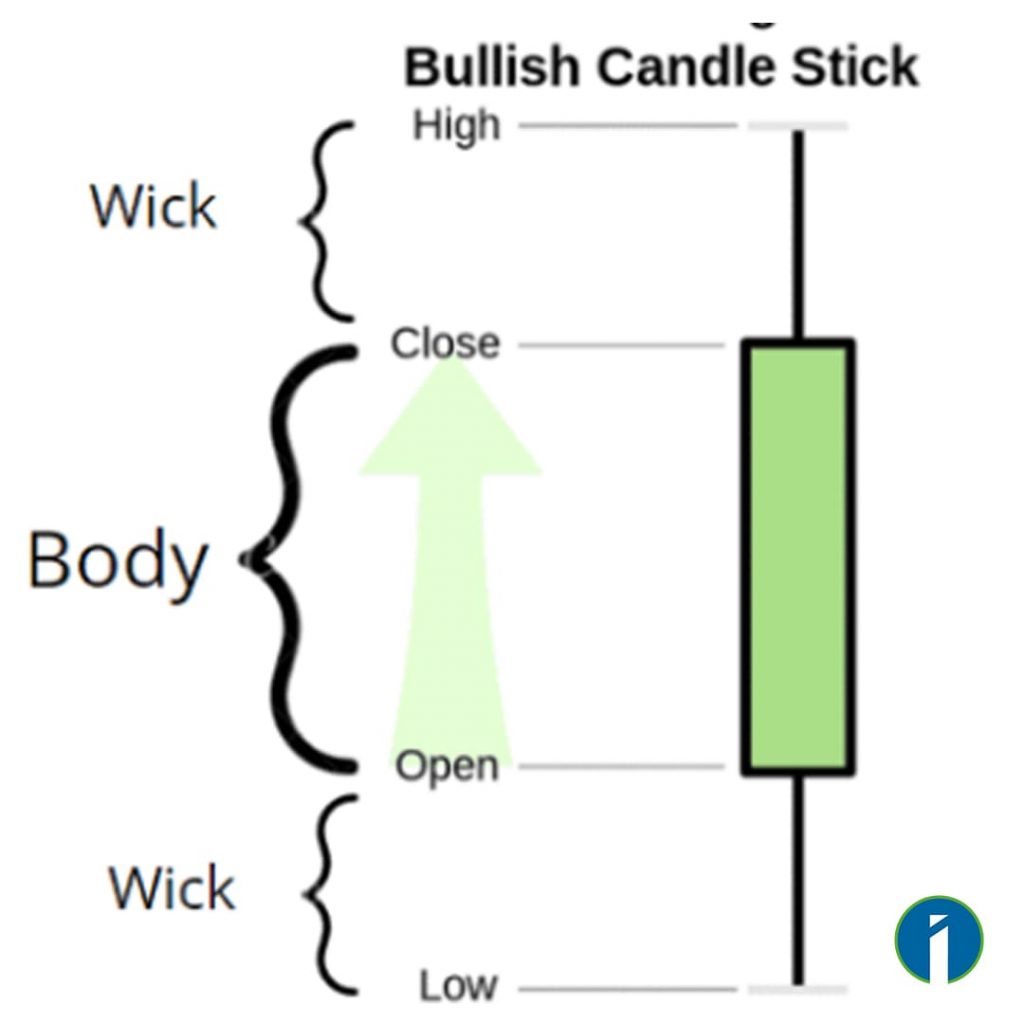

Bullish Candlestick:

If the closing price is higher than the opening price, the candlestick is typically colored green or white. It indicates that buyers were in control during that period, pushing the price up.

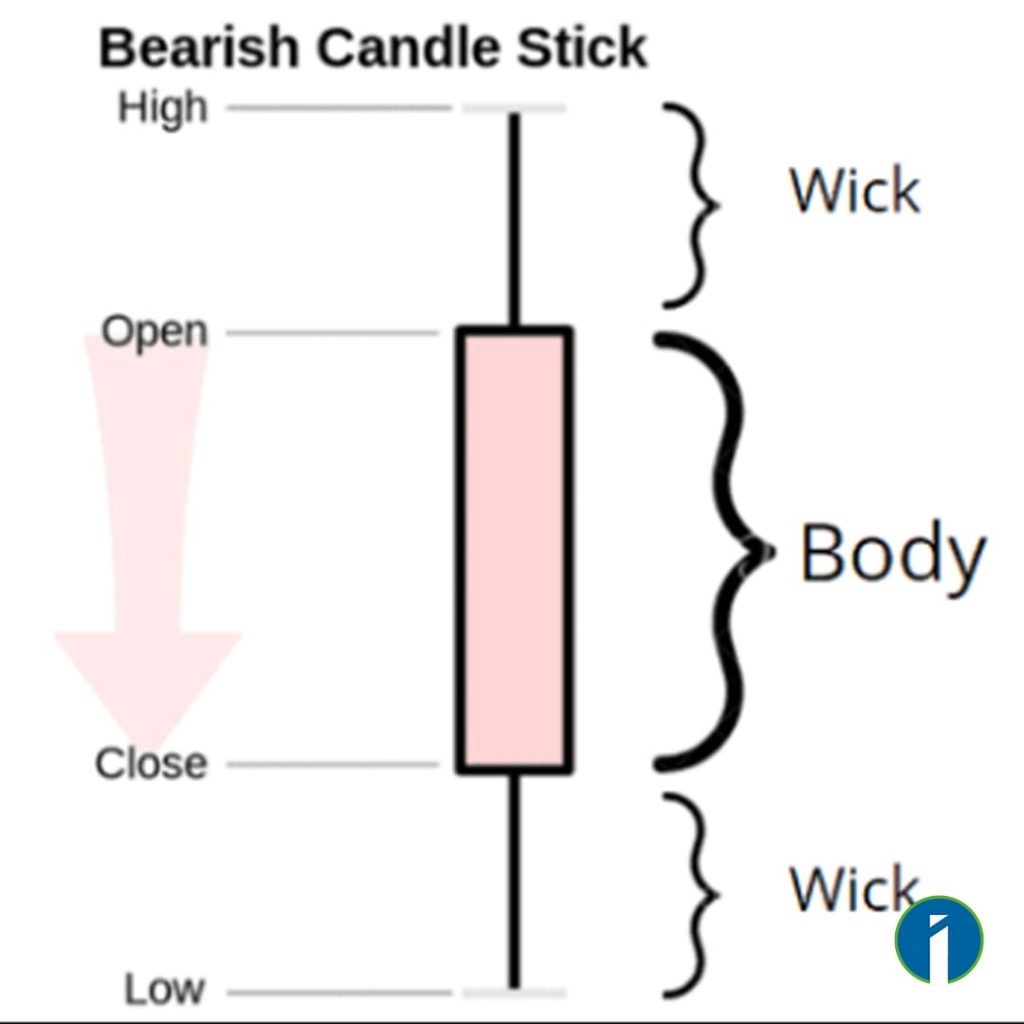

Bearish Candlestick:

If the closing price is lower than the opening price, the candlestick is typically colored red or black. It indicates that sellers were in control during that period, pushing the price down.

Types of Candlestick Pattern :

There are two types of candlestick patterns, categorized into single candlestick patterns and multiple candlestick patterns, along with their bullish or bearish implications.

Single Candlestick Patterns:

A single candlestick pattern is formed by just one candle using the open, close, high, and low prices of a single trading period.

> Types of Bullish Single Candlestick Patterns:

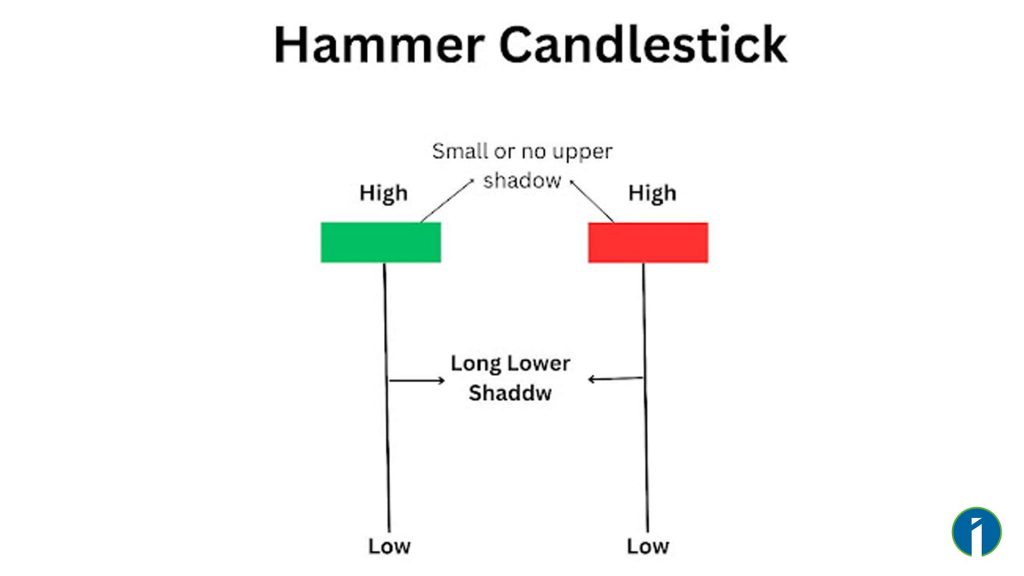

Hammer Candlestick:

Indicates potential bullish reversal, especially at the bottom of a downtrend.

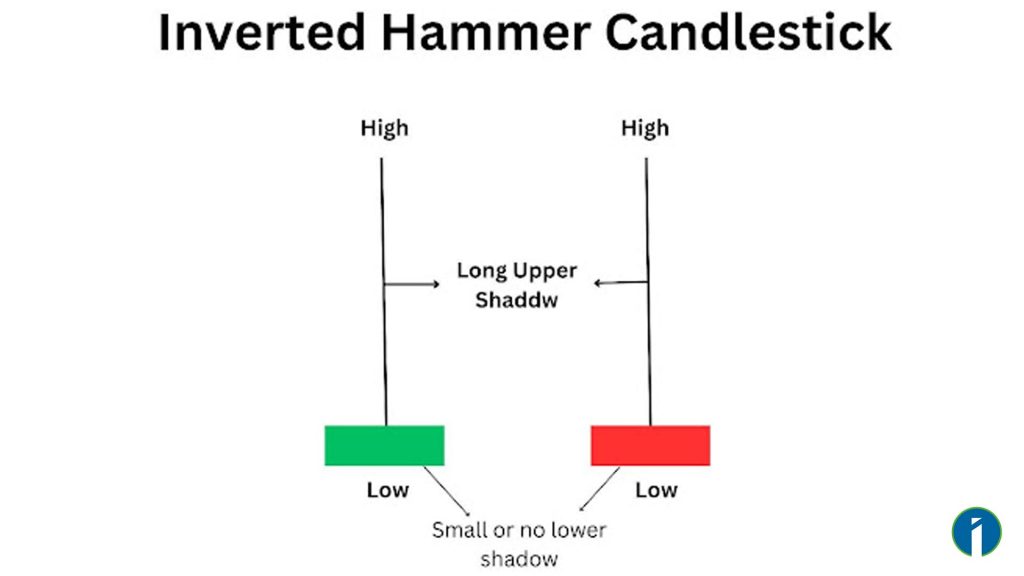

Inverted Hammer Candlestick:

Similar to Hammer, indicates potential bullish reversal.

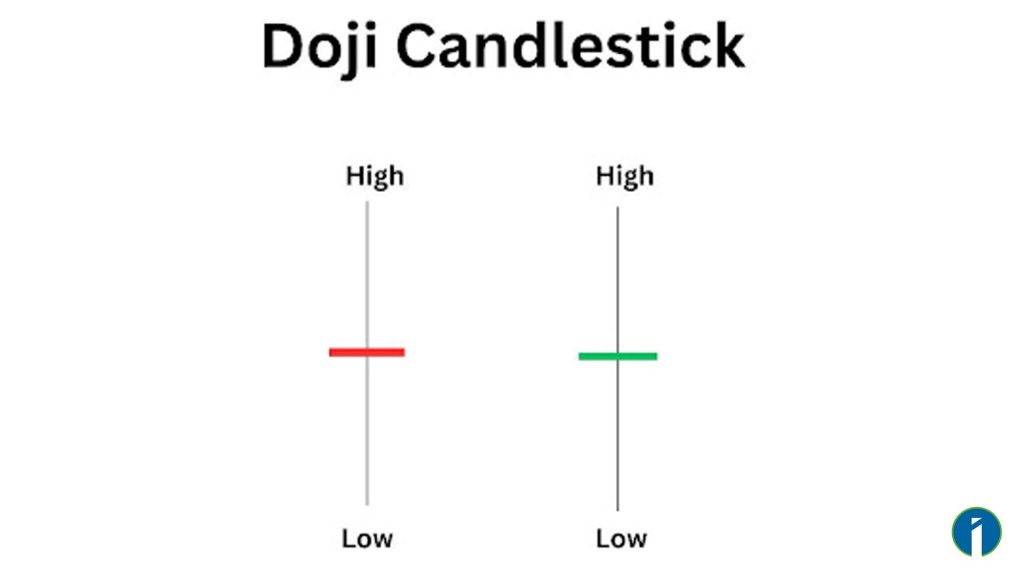

Doji Candlestick:

Represents market indecision with equal opening and closing prices.

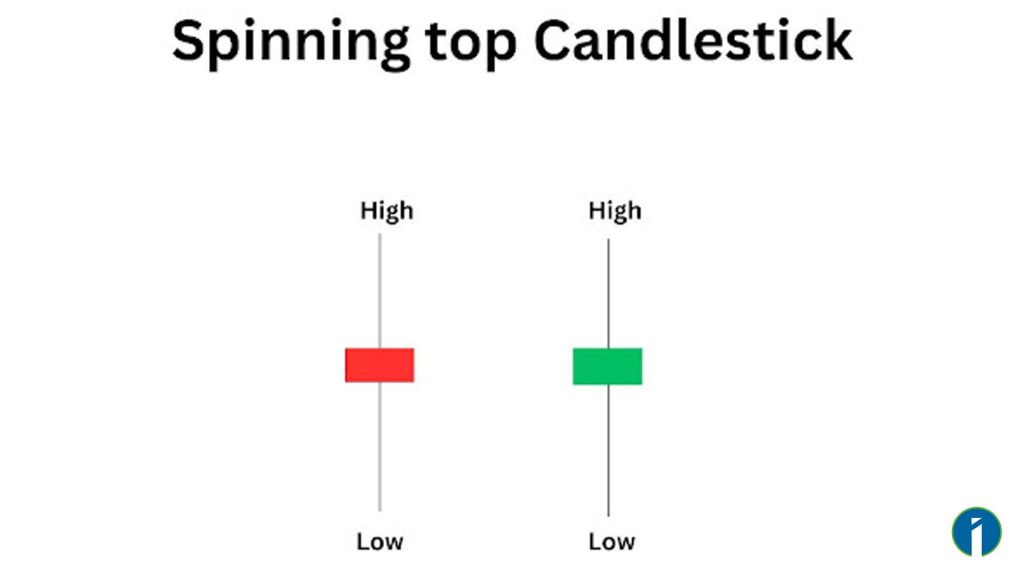

Spinning Top Candlestick:

Shows indecision with small bodies and long upper and lower shadows.

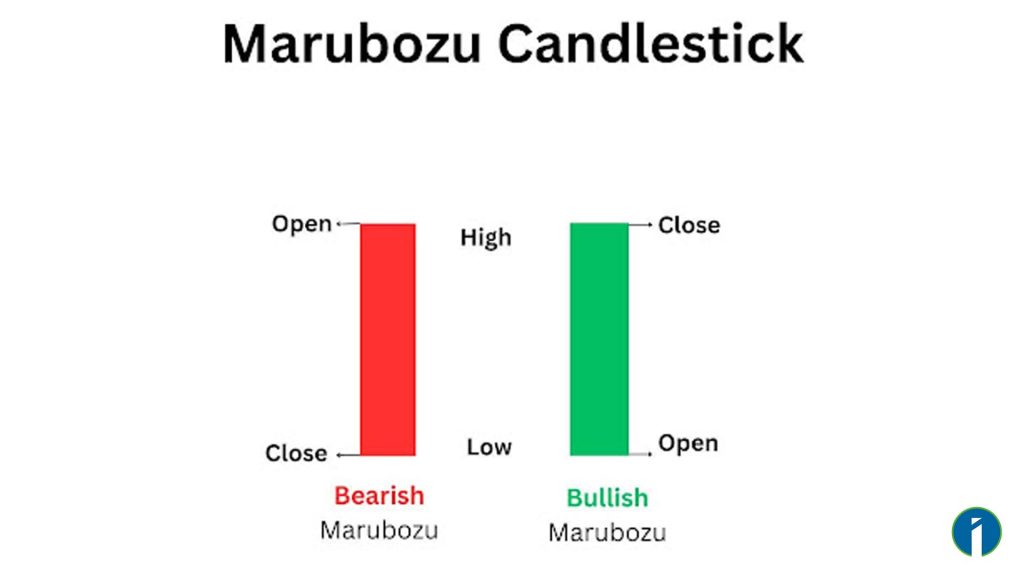

Marubozu Candlestick:

Indicates strong bullish or bearish sentiment based on its color and lack of shadows.

> Types of Bearish Single Candlestick Patterns :

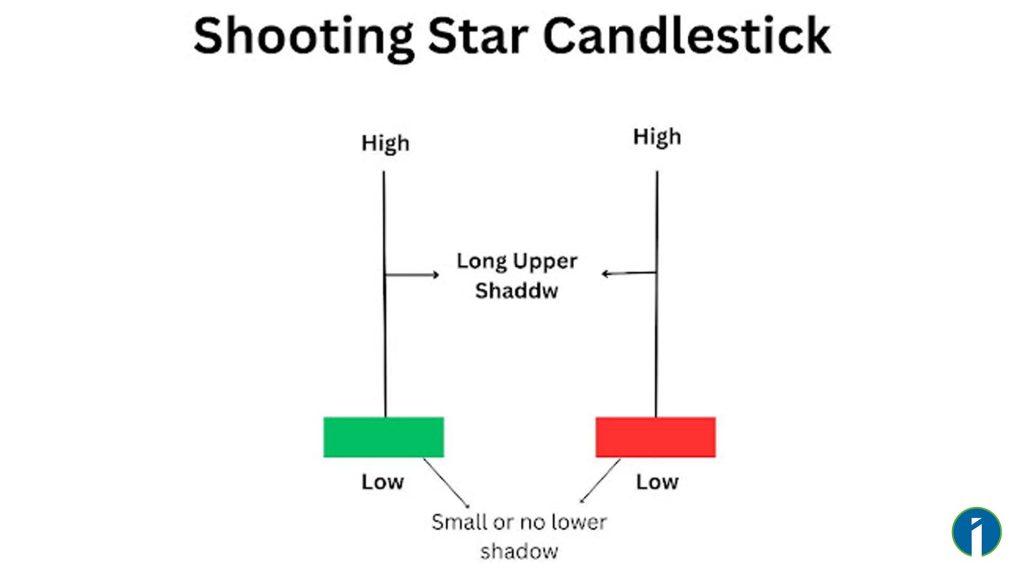

Shooting Star Candlestick:

Suggests potential bearish reversal, especially at the top of an uptrend.

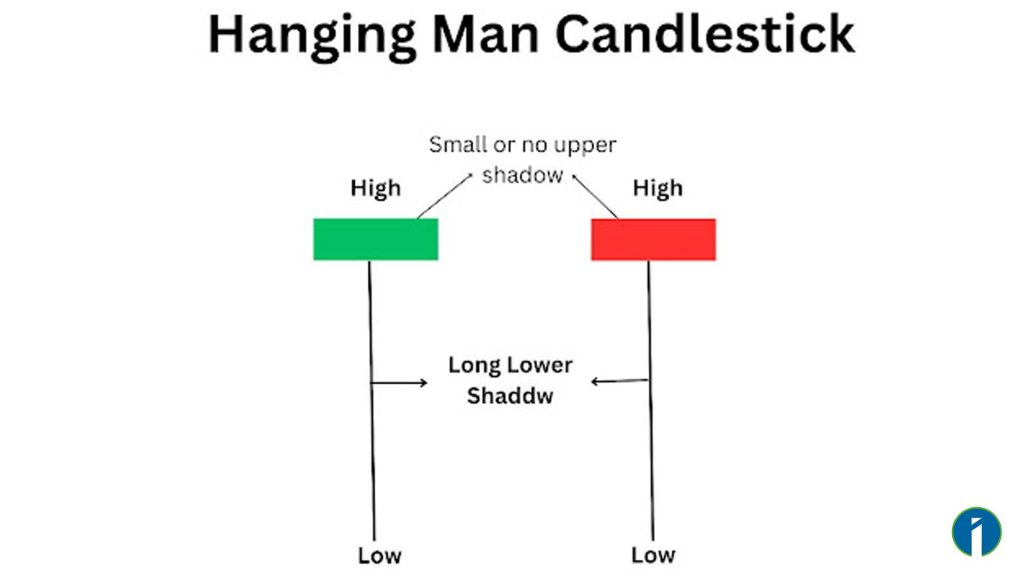

Hanging Man Candlestick:

Similar to Shooting Star but signals potential bearish reversal.

Multiple Candlestick Patterns:

A double candlestick pattern is formed by two consecutive candlesticks using their open, close, high, and low prices over two consecutive trading periods. These patterns often indicate potential reversals or continuation of trends in the stock market.

> Types of Bullish Multiple Candlestick Patterns :

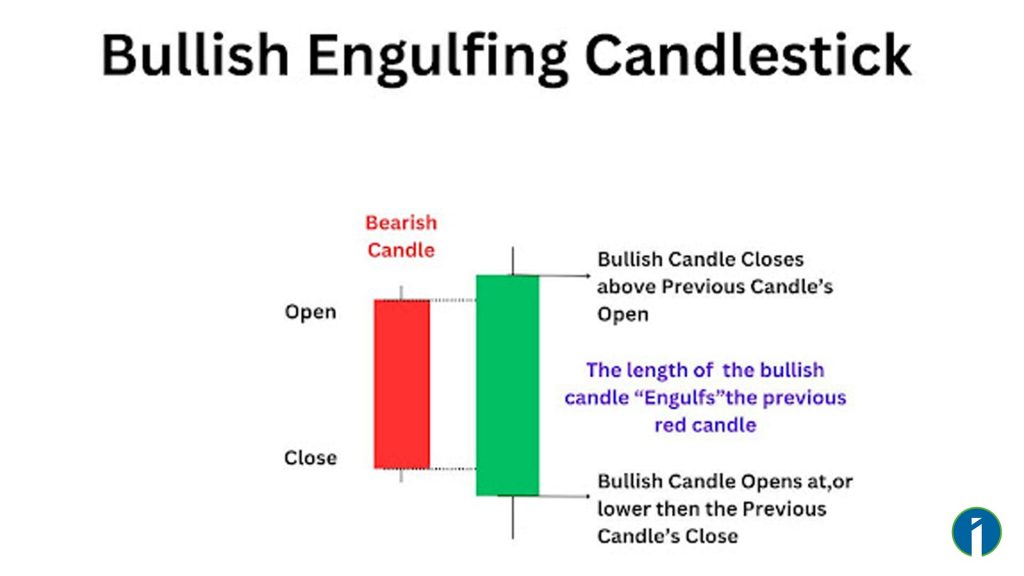

Engulfing Pattern:

Signifies a reversal where the second candle completely engulfs the first.

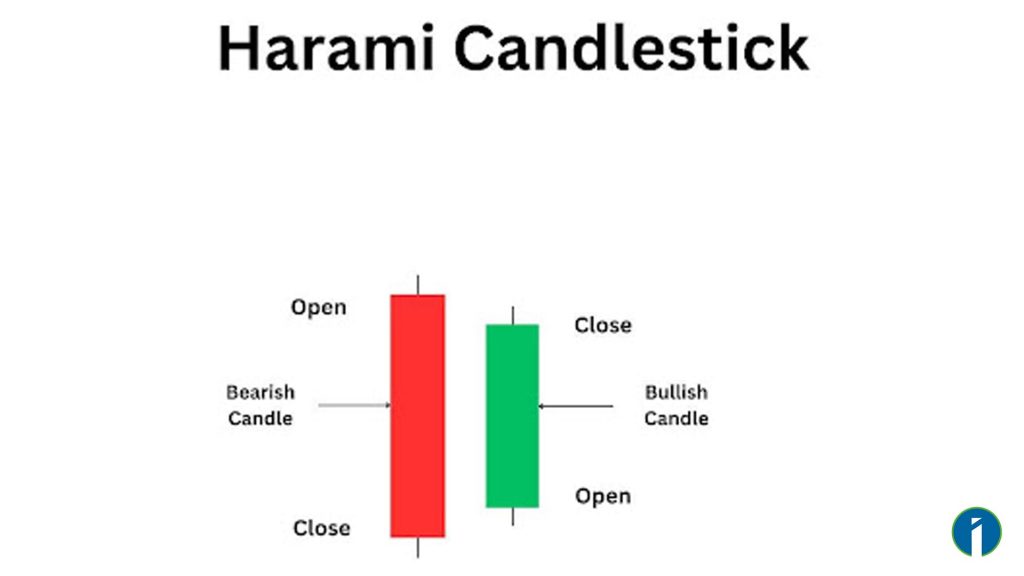

Harami Candlestick Pattern:

Consists of two candles, the second being contained within the first, signaling a potential reversal.

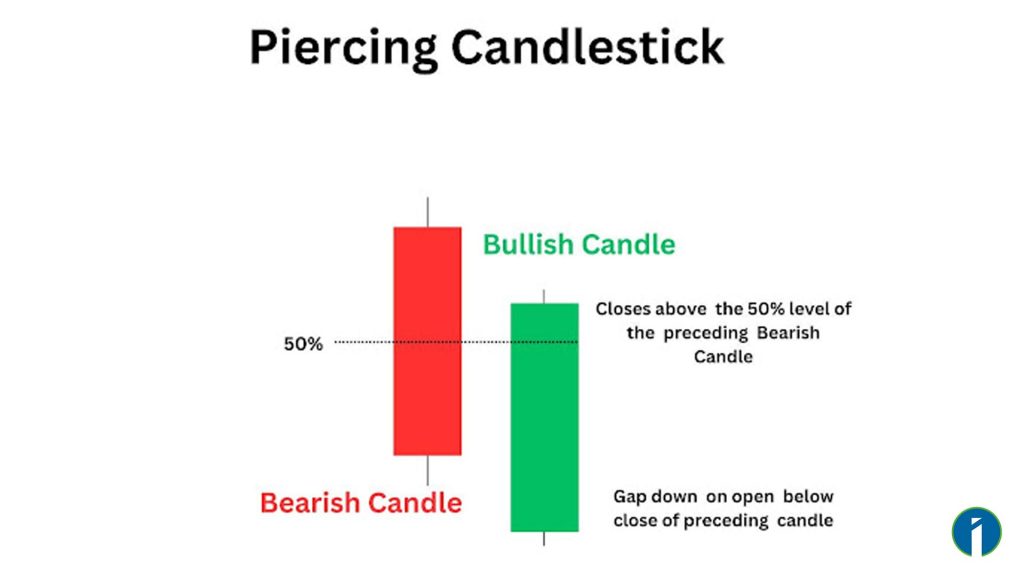

Piercing Candlestick Pattern:

Shows potential bullish reversal after a downtrend.

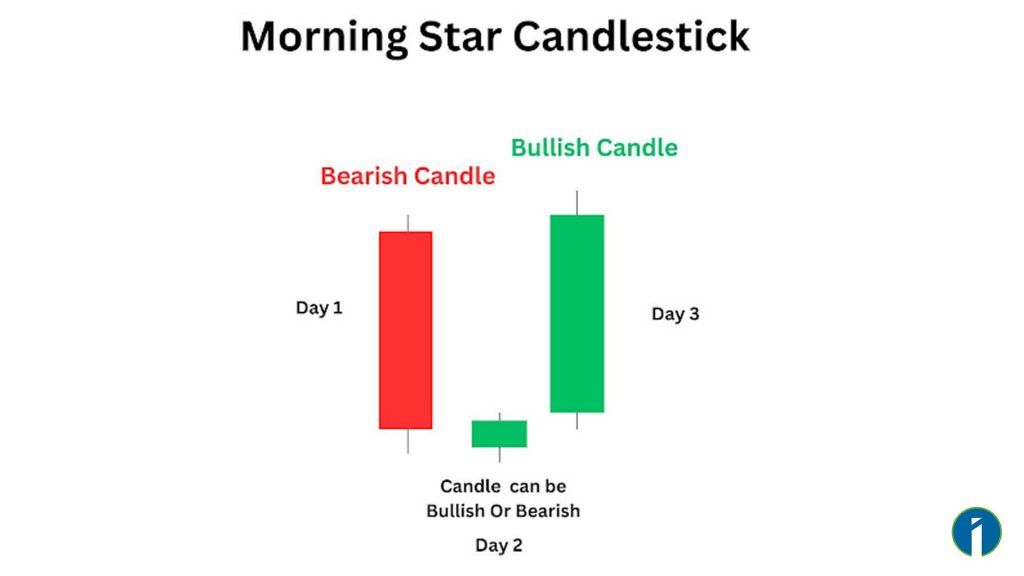

Morning Star Pattern :

A bullish reversal pattern formed by three candles.

> Types of Bearish Multiple Candlestick Patterns :

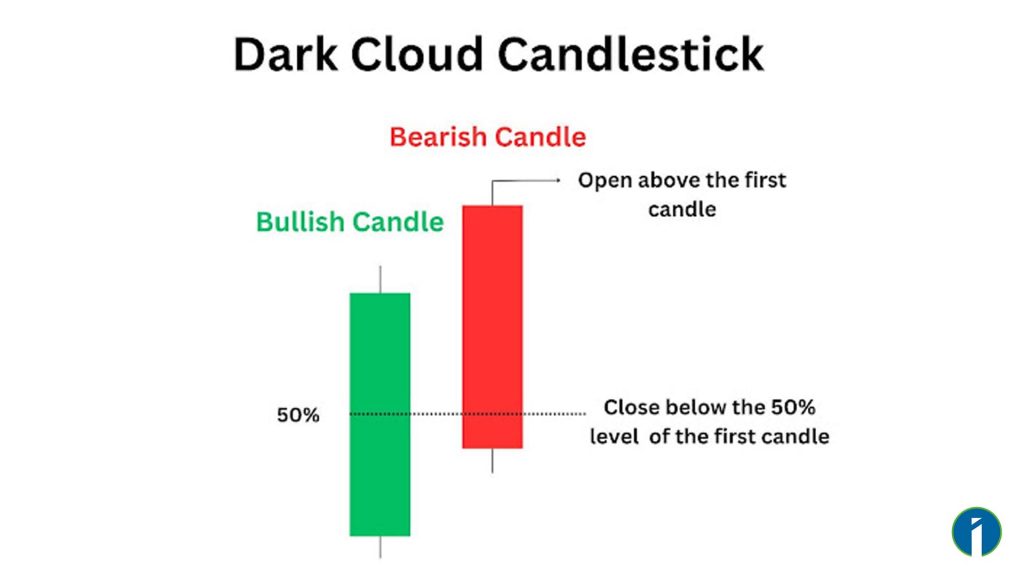

Dark Cloud Candlestick Pattern :

Indicates potential bearish reversal after an uptrend.

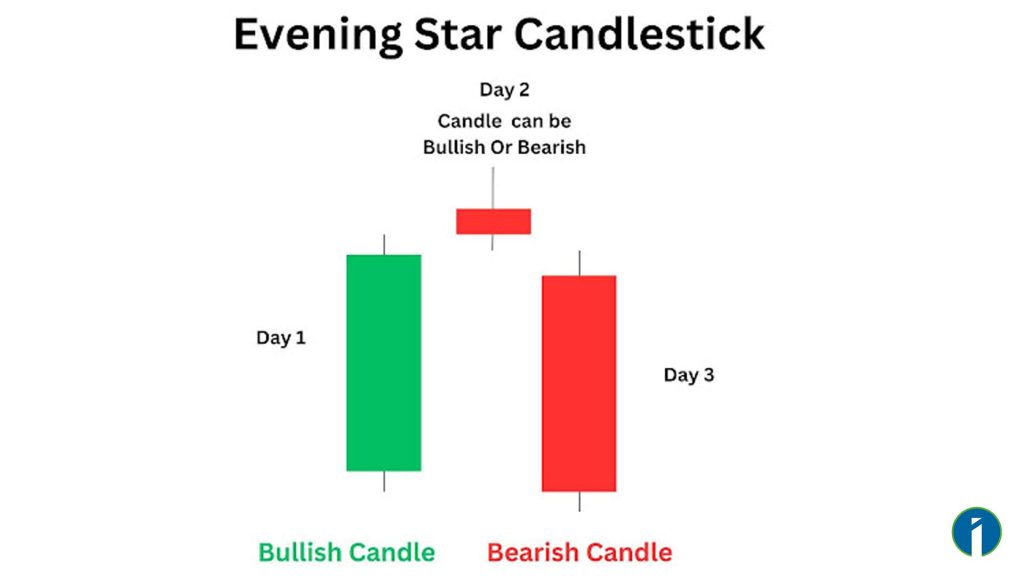

Evening Star Pattern :

The bearish counterpart of the Morning Star, formed by three candles.These patterns provide valuable insights into market sentiment and potential price movements.

Conclusion:

Understanding candlestick charts can be a valuable skill for traders and investors to analyze market sentiment and make informed decisions. It’s important to combine candlestick analysis with other technical and fundamental analysis techniques for a comprehensive understanding of market dynamics.

FAQs

The Shooting star, Hammer, bullish and bearish engulfing pattern are best among other candlestick patterns for trading.

Candlestick patterns are visual representations of price movements in financial markets, formed by the open, high, low, and close prices of an asset over a specific time period.

Candlestick patterns provide insight into market sentiment and potential future price movements, aiding traders in making informed decisions.

Candlestick patterns can be applied to various markets such as stocks, forex, commodities, and cryptocurrencies, but their effectiveness may vary.

Some candlestick patterns, like bullish/bearish engulfing or hammer/inverted hammer, are considered reversal signals, indicating potential changes in market direction.

The length of wicks represents the price range during the trading period. Long wicks suggest high volatility, while short wicks indicate relatively stable price action.

Most powerful candlestick patterns are bullish and bearish reversal pattern, and bullish and bearish continuation pattern.

Candlestick Patterns are separated into two categories, bullish and bearish. Bullish patterns indicate that the price is likely to rise, while bearish patterns indicate that the price is likely to fall. No pattern works all the time, as candlestick patterns represent tendencies in price movement.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Pingback: NSE and BSE Stock Series: Meaning, Difference & their Categories