The concept of Assets Under Management (AUM) in mutual funds is similar to market capitalization in stock markets.

Assets Under Management (AUM) is a critical metric in the financial sector, particularly for mutual funds. It represents the total market value of all the assets that a fund manages on behalf of its investors. Understanding AUM is essential for both investors and fund managers, as it reflects the fund’s size, performance, and management efficiency.

What is AUM in Mutual Funds?

In the context of mutual funds, AUM refers to the aggregate market value of all investments held within the fund, including stocks, bonds, and other securities. This value fluctuates regularly due to market conditions and investor activities.

AUM serves as an indicator of a fund’s popularity and its ability to attract and retain investors, as higher AUM often signifies greater investor trust and fund stability.

Calculation of AUM in Mutual Funds

Calculating AUM is straightforward. It involves multiplying the total number of shares or units held by investors by the current market price per share or unit.

Formula: AUM = (Total Units or Shares Held) × (Market Price Per Unit or Share)

Example: If a mutual fund has 2,00,000 shares outstanding, and each share is priced at ₹40, the AUM would be calculated as follows:

AUM = 2,00,000 shares × ₹40 per share = ₹8,000,000

This calculation is dynamic and can change daily based on the performance of the underlying assets and investor transactions.

Importance of AUM in Mutual Funds

- Indicator of Fund Size: AUM provides a clear picture of the fund’s scale and operational capacity. A larger AUM signals strong investor confidence, showing that many are willing to invest in the fund.

- Revenue Generation: Fund managers usually charge fees based on AUM, so a higher AUM can boost revenue, helping cover operational costs and potentially increasing investor returns.

- Performance Assessment: While AUM is an important metric, it should not be the sole criterion for evaluating a fund’s performance. Factors such as the fund manager’s expertise, investment strategy, and historical returns are equally crucial.

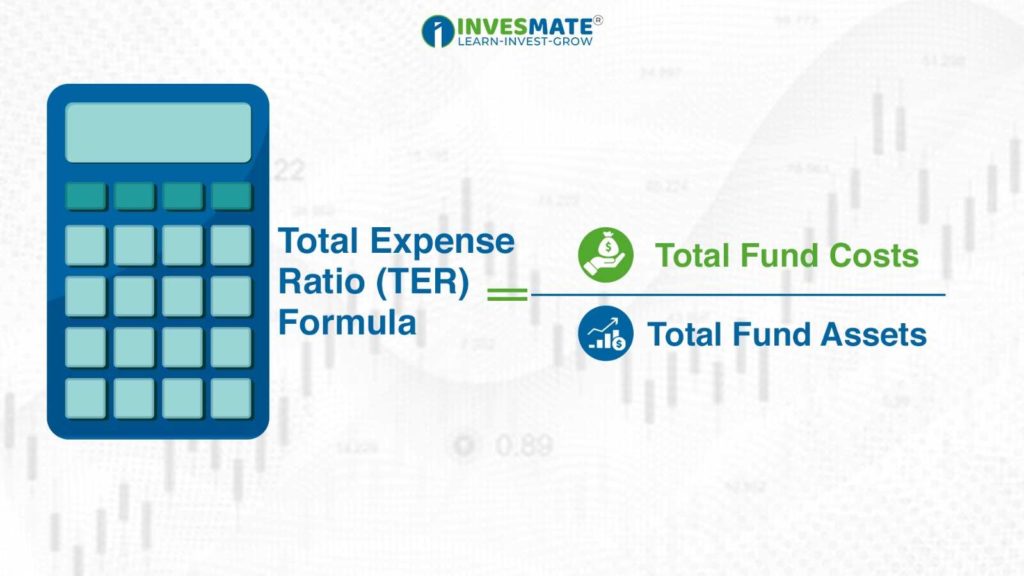

Relation Between AUM and Expense Ratio

Concept : The expense ratio is the annual fee that all funds or ETFs charge their shareholders, expressed as a percentage of the fund’s average assets under management.

Key Takeaway : Generally, funds with higher AUM can offer lower expense ratios because their fixed costs are distributed over a larger asset pool. This can make them more attractive to investors, as lower fees can lead to better net returns over time.

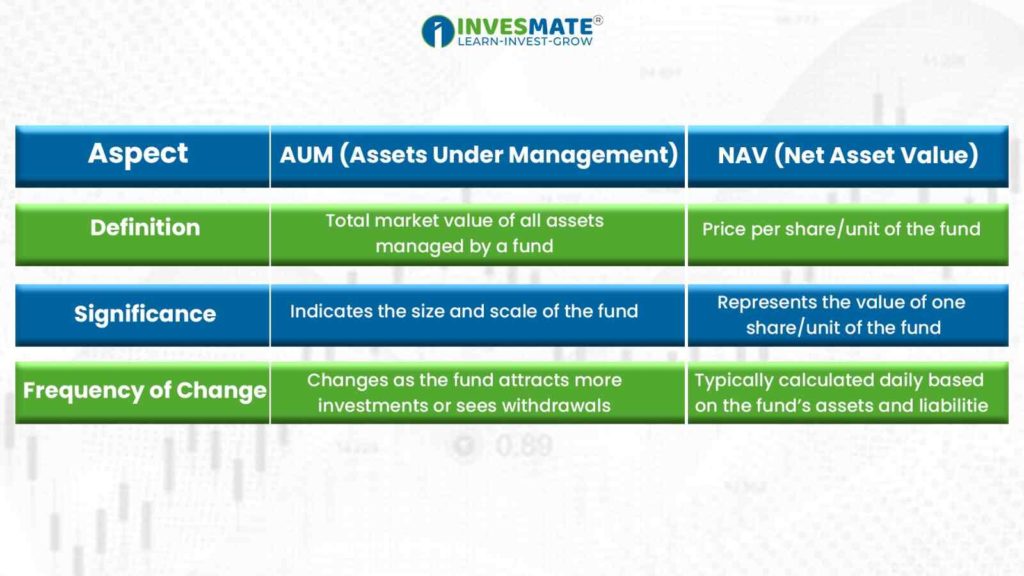

Difference Between AUM and NAV

While AUM and Net Asset Value (NAV) are related, they are distinct concepts:

Understanding both metrics is essential for investors to assess the fund’s overall health and performance effectively.

Conclusion: AUM shows a mutual fund’s size and capacity, indicating its popularity and potential revenue. However, investors should also consider other performance indicators before making decisions.

FAQs

Higher AUMs suggest better investment inflows, quality, and management expertise of a fund. Therefore, Higher AUM is good.

AUM is the total value of assets managed by a financial institution, whereas market cap is the total value of a company’s shares (stock price multiplied by the number of shares).

AUM covers all client investments, including stocks, bonds, real estate, mutual funds, cash, and accrued earnings like interest and dividends.

HDFC Balanced Advantage Fund has the largest AUM among all equity and equity-oriented mutual funds.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Leave a Reply