In This Blog You Are Going To Explore

👉Brief overview of lithium reserves in Jammu and Kashmir’s Reasi.

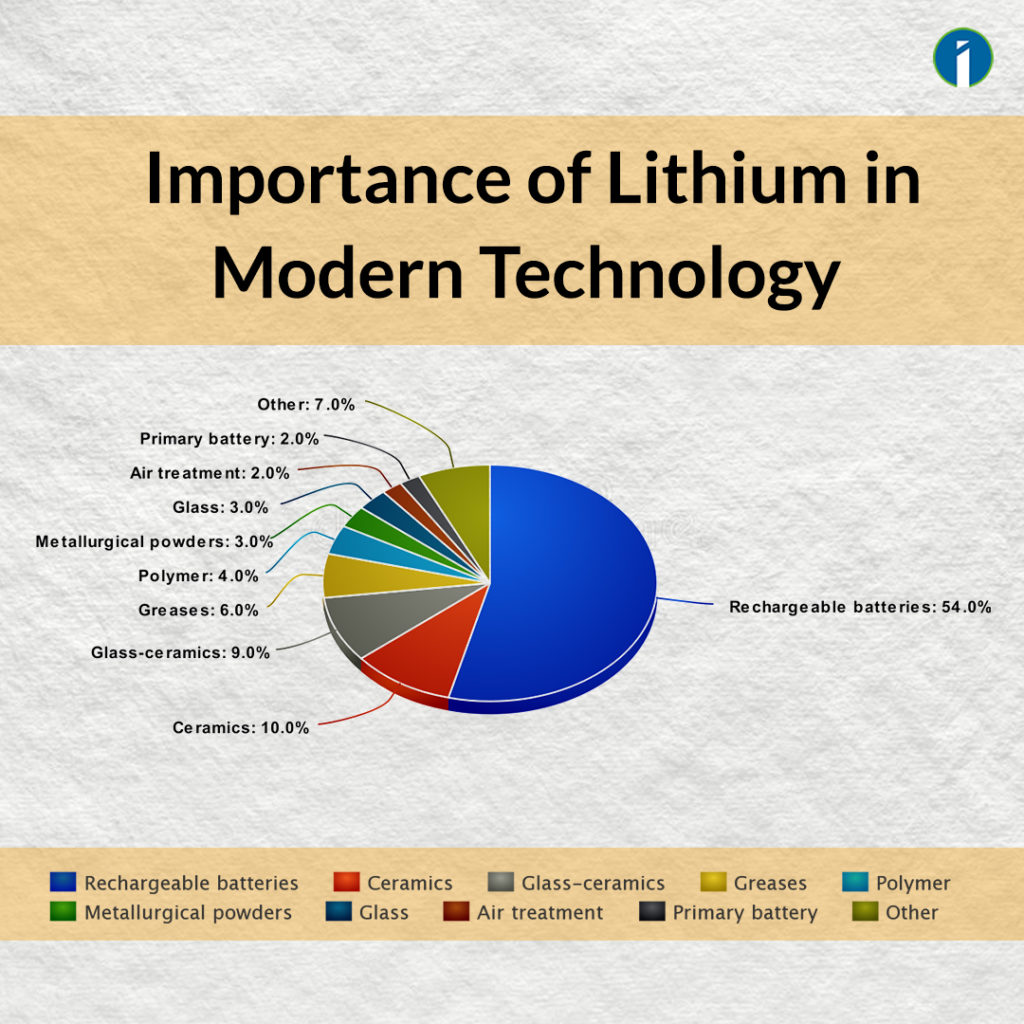

👉 Importance of lithium in modern technology.

👉 Global industry highlights.

👉 Indian lithium industry.

👉 Impact of the news on indian stock market.

👉Last but not least, retail investors’ opportunities in top-tier companies, as well as proxy investing?

Indian Lithium Reserve Discovery Unlocks Exciting Opportunities for Retail Investors in the Stock Market.

Investing in India’s Lithium Boom: Retail Investors Set to Reap Rewards in the Stock Market.

Brief Overview of lithium reserves in Jammu and Kashmir Reasi

A life-changing moment for India’s advancement as the 5.9 million ton deposit of lithium has been found in Salal -Haimana region of Reasi district situated on the bank of river Chenab of the Indian Union Territory of Jammu and Kashmir. The operation took place under the close supervision of the Geological Survey of India (GSI). While the ever-rising demand for the latest electronic gadgets is seen everywhere from the educational sector to high-quality electric transportation, lithium is considered one of the critical resources that have the potential to meet all the provincial necessities of this country. And needless to say, for the tremendous importance of this shiny and grey metal, it is often called “White gold” in electric mobility industries.

As per the source, the found reserve of lithium is 500 parts per million plus grading, which is way better than the normal grades, as confirmed by the Indian mining ministry on February 9, 2023. In his vision, this new discovery has the capability to beat, if not all three, then at least the third-positioned lithium producer country, China, in the near future.

Let’s dive deep and understand what the government’s future vision for this project is, what its effect will be on India’s lithium industry, and how it can help stock market investors in these sectors.

Importance of Lithium in modern technology

The craze of Lithium is nothing “over the top” for its unique properties and qualities. It is one of those highly sustainable metals which are extremely light in weight, long-lasting, capable of storing a maximum of energy for a longer period of time and a good reactive alkaline. So in the modern world, where safe and sustainable products are our concern, lithium has the potential to fit into any new-age industry, from electronic goods to electric vehicles.

Because of its high energy storage capacity per kg, it is widely used in making EV batteries, personal desktops, phones, tablets, etc. Not only that, but it is also a brilliant option for automatic electric vehicle manufacturing companies because of its lesser mass and high energy density. From transportation, steel, air conditioners, and aluminium to medical compounds as well as aviation, lithium has made a huge contribution to these industries so far.

Lithium carbonate, an inorganic compound of lithium, has a tendency to reduce thermal expansion by increasing its strength; for that reason, back in 2010, lithium was the 31%-contributing component in making ceramics and glasses. But after a sudden surge of EV and lithium-ion batteries, the amount of used lithium has decreased significantly, which ensures that other sectors have sufficient lithium supplies.

While talking about the global contribution, it will be unjust if we don’t talk about the world’s most populous country, China. As per the above chart, we can see China is holding the #3 position with its 7.9% of the world’s lithium reserves. But that is only one side of the story.

Global Industry Highlights

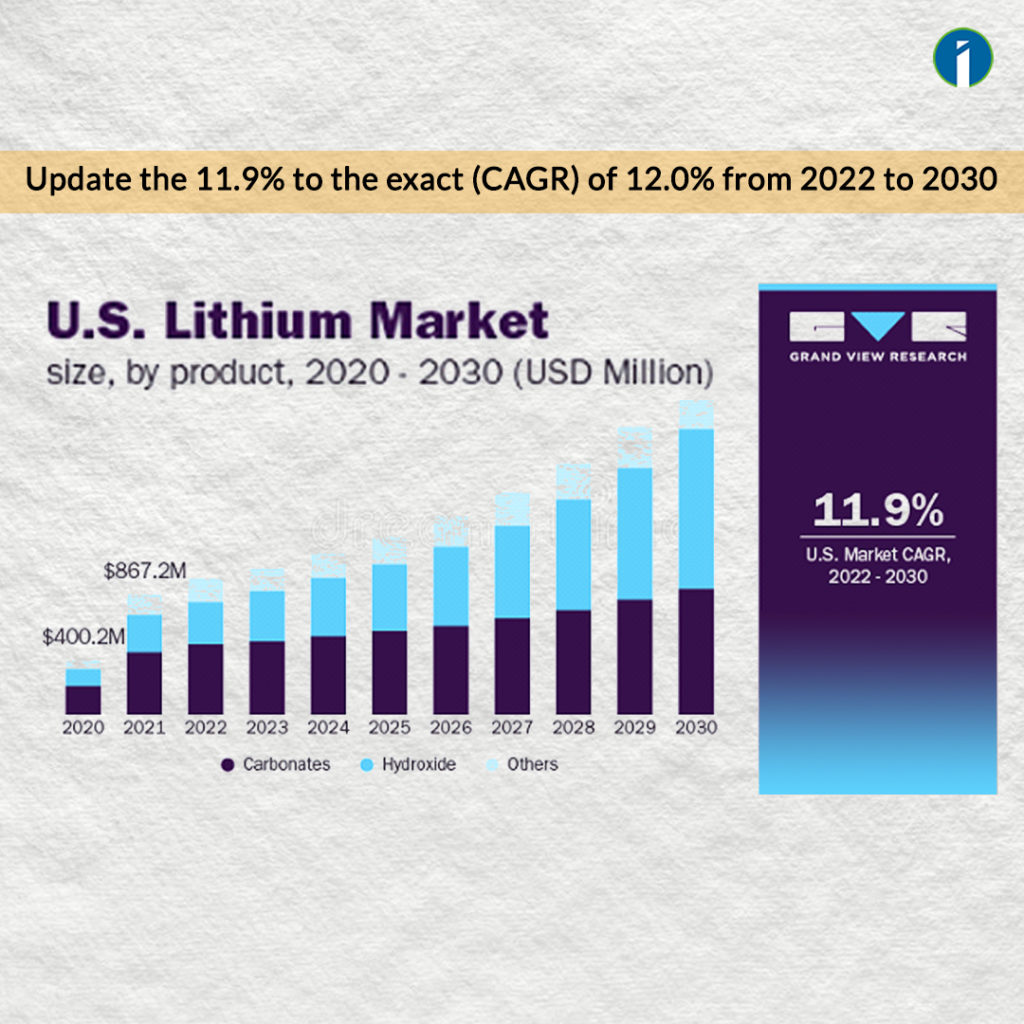

As per the documents shared by the International Lithium Association, the current lithium supply is constrained to 24% of the total global demand, whereas the assumption is that this could hit the 79-80% slab within the year 2028-2030, which is around $15.45 billion with a 12.0% CAGR (according to a 157-page published report with the name “Global Lithium Industry Forecast 2022-2028”))

This is a graphical forecast of the likely brisk demand for lithium in the coming years.

While looking at the global picture, the first name that shows up is Tesla. For being one of the top and most renowned EV producers, their need for safe and good quality lithium batteries is essential, and to stay at the top, they are going to require 2700 GWh of lithium batteries each year. For that reason, they already had a long-term contract with one of China’s leading enterprise lithium-producing companies, Ganfeng Lithium.

A few other global lithium-ion battery importer companies are Panasonic, Samsung, LG, etc., which are also going to teem in terms of the usage of lithium-ion batteries from telecom to technology—you name it—in the coming eras.

When other countries have completed their brilliant and strategic plans for the future, India’s concern about the same becomes relevant.

Why does India require its own lithium reserves? And how will this contribute to the expansion of the Indian lithium battery industries and proxy investing?

Growth of the Indian lithium industry

By now there are no second thoughts about the usefulness of this recently founded whitish-grey treasure in Reasi, India. There are numerous reasons for India to have its own lithium deposits, not just in EV.

With the emergence of further job opportunities in the top IT hub spots like Bangalore, Hyderabad, Mumbai, New Delhi, etc., the requirements for electric mobility are going to increase at a rapid rate in the coming time in both private and public transportation.

So far, India was one of the top lithium importers from abroad, and China was the source of more than 90% of India’s total imported lithium-ion batteries in the year 2020–2021 (which was around Rs 8,811 crore), as per the stated official government reports. In this context, the recent discovery of white gold has given a ray of hope among the Indian direct and ancillary industry entrepreneurs, which is acknowledging this country’s capability of producing its own lithium-ion batteries instead of being dependent on others, therefore strengthening India’s mining rank on the global platform.

As we know, being a riverine country, India has always been abundant in its several river bodies, thus providing unending water supplies. So unlike other countries, the discovery of this new resource in our country can be a boon for us since there will be a requirement for a huge water supply at every stage of its further procedures.

Also, as we discussed earlier, China, despite being a large exporter of lithium, is always facing a threat in terms of its quality. In these circumstances, India has a slight vision to surpass China in the near future with both quantity and quality parameters, as per Mr Amit Sharma, the J.K. mining secretary’s statement.

The good news is that, in addition to the government’s resolutions, several large industries are banding together to carry on this endeavor by establishing numerous lithium manufacturing plants across India. Reliance, the No. 1 telecom company, has already made a contract with Ambri for establishing a Gigafactory. Mahindra, JSW, and Suzuki are the few other names that are also planning to take part in this rally.

Effect of this news on the Indian stock market

Top 5 Lithium Battery manufacturers in 2023: Opportunities for Retail investors

Reliance - EV

recently focusing more on sodium-ion battery manufacturing since the company believes sodium-ion batteries are cheaper and safer in the EV revolution. As a result, Reliance Industries has acquired Faradion, a UK startup producing sodium-ion batteries.

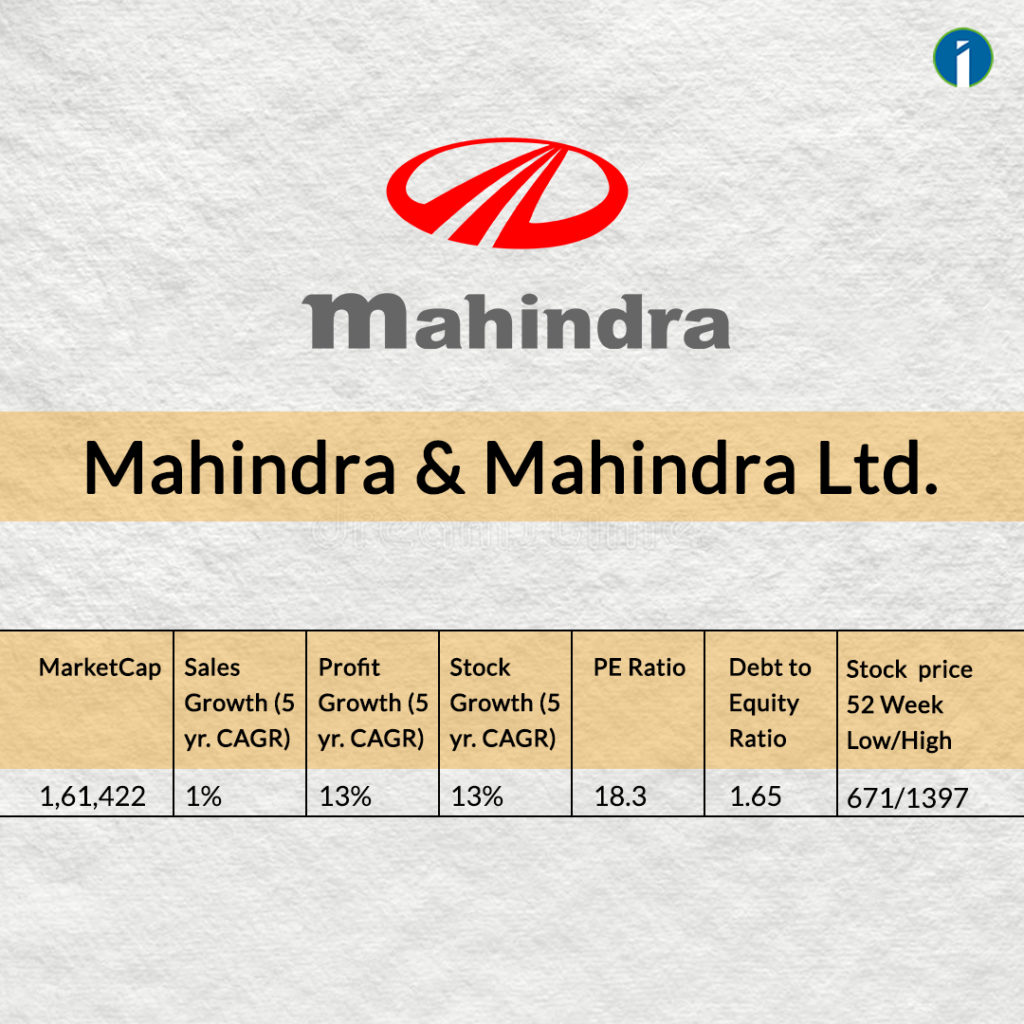

Mahindra - EV

Like Tesla and any other top-tier EV companies, Mahindra – one of the greatest car manufacturer companies in India is also setting its foot on the EV race. The news of their E-rickshaw concept is already making headlines, along with their auto-rickshaw Treo concept. The company’s vision is to fully embrace lithium-ion batteries in its products. With that being said, it is stated that the company has submitted their bids under India’s $2.4 billion battery scheme for the same, where Reliance and Hyundai’s names are also on this list.

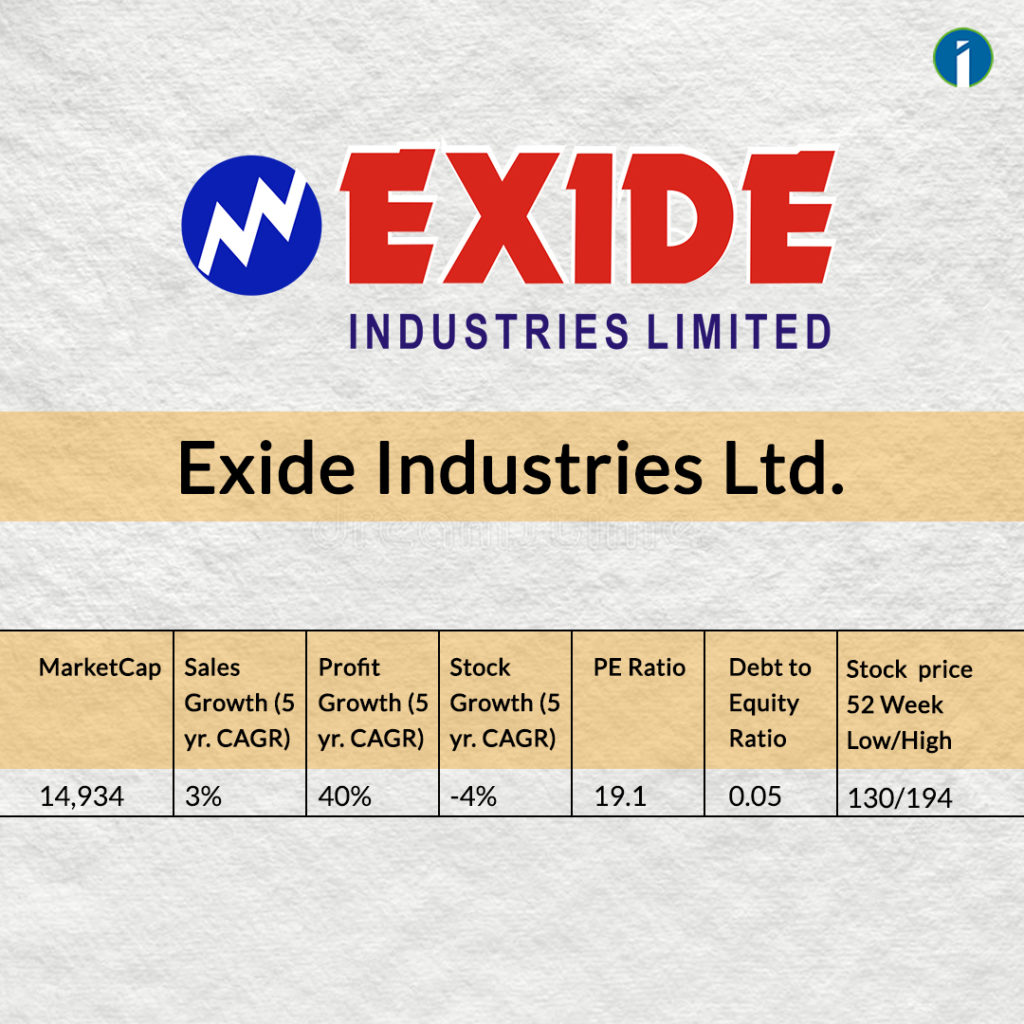

Exide -EV

In India, Exide has been the biggest domestic lithium battery-selling company since 2018, forming a 75:25 JV with Leclanche SA. The JV was established with a plan in mind to assemble lithium batteries within our country itself in the financial year of ’21, but later they started an integration approach for manufacturing cells in India.

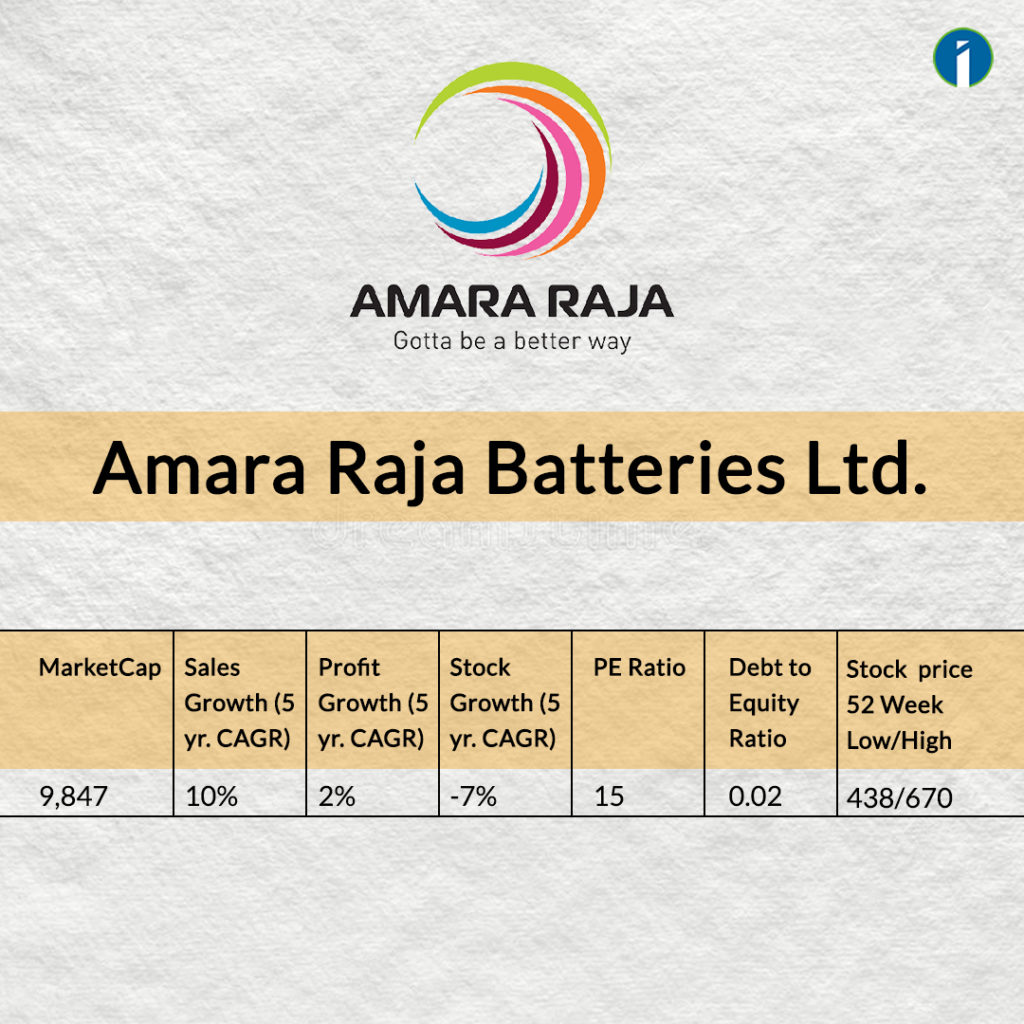

Amara Raja Batteries Ltd.

Among the top conglomerates comprising businesses, Amara Raja is one of the largest lead acid battery manufacturing companies that supplies an extended amount of battery storage appliances for both automotive and industrial companies. It is great ideation on the part of Amaron, the power brand of Amara Raja, to shift their focus from lead batteries to lithium-ion batteries, considering the recent full-fledged market for electric vehicles. They’re also setting up a gigafactory in Telangana to work on the same thing on a larger scale.

According to our research, these are all the companies that have the potential to become big in such scenarios, but what about the ancillary industries in terms of proxy investing that are also ready to boom along with these opportunities?

Here are the two main ancillary industries that, in our vision, have the potential to flourish in the near future.

Tata Chemicals Ltd

TCL is a leading Indian multinational company that manufactures a wide range of products, from chemicals to fertilisers and consumer products. It is the world’s third soda ash production company, with a capacity of 3670 KT.

Talking about soda ash or sodium carbonate is one of the main inorganic compounds which is used to extract metals like aluminium and lithium for its further usage. While soda ash is responsible for 56% of the revenue of Tata Chemicals, it is no wonder that after the advancement of EVs, the progress possibility of this ancillary company is also going to increase.

Gujarat FluoroChemicals

Last but not least on our list is GFL, a leading fluorochemicals manufacturing company established in 1987 that produces a wide range of products, including refrigerants, fluoropolymers, and chemicals, mainly for industries focused on aluminium and steel. But by setting up the subsidies, they’re also working on lithium chemical cells. So there’s an assumption that with the large global presence of Gujarat FluoroChemicals, the chemical shares of it will be playing an important role in upcoming years of EVs, and this could be the right time for retail investors as there has been a recent price correction on this stock.

In conclusion, the potential of lithium to meet global demand is enormous. With enough reserves to meet the growing demand and new technologies emerging, the production of lithium can lead to a more sustainable future. As the world continues to shift towards eco-friendly and sustainable energy sources, lithium will play a crucial role in powering the transition in every sector, be it the stock market or any other field of modern life.

এই তথ্য শুধুমাত্র শিক্ষামূলক উদ্দেশ্যে প্রদান করা হয়েছে। একে কোনোভাবেই Investment Advice বা Recommendation হিসেবে গণ্য করা উচিত নয়। আমরা একটি SEBI-registered Organization, এবং আমাদের মূল লক্ষ্য হলো বিনিয়োগ সম্পর্কিত Concepts-এর সাধারণ জ্ঞান ও বোঝাপড়া বৃদ্ধি করা।

প্রত্যেক পাঠক/দর্শককে অনুরোধ করা হচ্ছে, যেকোনো Investment Decision নেওয়ার আগে নিজস্ব Research এবং Analysis করুন। Investment সর্বদা হওয়া উচিত ব্যক্তিগত Conviction-এর ভিত্তিতে, অন্যের মতামত থেকে নয়। অতএব, প্রদত্ত তথ্যের ওপর ভিত্তি করে নেওয়া কোনো ধরনের Investment Decision-এর জন্য আমরা কোনোভাবেই Liability বা Responsibility গ্রহণ করি না।

Thank you for sharing this in-depth analysis.

Great News…..

It’s a great 👍 information

Extremely knowledgeable content. ♥️♥️

Hats off to your analysis 🙏🙏